Overview

The Iraqi Ministry of Electricity has reiterated its intention to purchase gas from the KRG in the upcoming months. Dana Gas previously announced the completion of an additional 250 million cubic feet of gas production, slated for availability in the second quarter of this year. However, it remains uncertain whether this supply will be allocated for power plants within the Kurdistan Region or Iraq at large.

On April 2, 2024, the US ambassador engaged in discussions with the Iraqi oil minister, highlighting the preparations for Sudani's upcoming visit to Washington later this month. "We delved into Iraq's pursuit of energy independence, emphasizing the potential utilization of oil and gas resources from the KRG. This move could significantly contribute to Iraq's journey towards energy self-sufficiency, ultimately benefiting the Iraqi populace," stated the ambassador.

In early November of last year, the Iraqi government unveiled photographs and publications showcasing the rehabilitation and connection of the Khor Mor gas pipeline to the 620-megawatt Kirkuk (Taze) power plant.

Approximately nine months ago, on July 11, 2023, the Iraqi government, alongside the Sudani's cabinet, tasked the oil ministry with initiating negotiations with gas producers in the Kurdistan Region. They also greenlit a plan to procure Khor Mor gas. Despite this, the official announcement of a contract between Dana Gas and the Iraqi government for the sale of Khor Mor and Chamchamal gas to Baghdad is pending. Nevertheless, Iraq has been scaling back its gas imports, and the United States urges Iraq to utilize gas resources from the Kurdistan Region. In support of this endeavor, the United States has extended a $250 million loan to Dana Gas to facilitate the expansion of gas production operations.

The Iraqi Ministry of Electricity has recently extended its contract to import Iranian gas for an additional five years. However, there has been a reduction in the daily amount from 70 million cubic meters to 50 million cubic meters compared to the previous agreement.

All of this together underscores the importance of gas reserves and production levels in the Kurdistan Region, as well as US pressure and Iraqi efforts to invest and meet domestic gas needs. However, this report specifically focuses on the possibility of a tripartite agreement to sell Kurdistan Regional Government (KRG) gas to Iraq and the implications of signing such an agreement on the Kurdistan Regional Government's (KRG) oil and gas sector.

The Vital Role of Gas Reserves and Prospective Production in the Kurdistan Region

Natural gas is gaining increasing importance amid climate change and the restructuring of global energy frameworks, even during the transition from conventional to renewable energy sources. The Kurdistan Region emerges as a significant reservoir of this vital resource. A report prepared by Qamar Energy for the US Department of Energy indicates that with sustained investment, the region could potentially export to global markets within less than a decade.

The Khor Mor and Chamchamal gas fields boast proven reserves totaling 16 trillion cubic feet of gas, and reportedly the two fields contain an estimated 80 trillion cubic feet of gas, solidifying their status as among Iraq's and the world's largest developed gas fields. The contract for their development was inked in 2007, culminating in a 10-year gas sales agreement with the Kurdistan Regional Government on March 21, 2019.

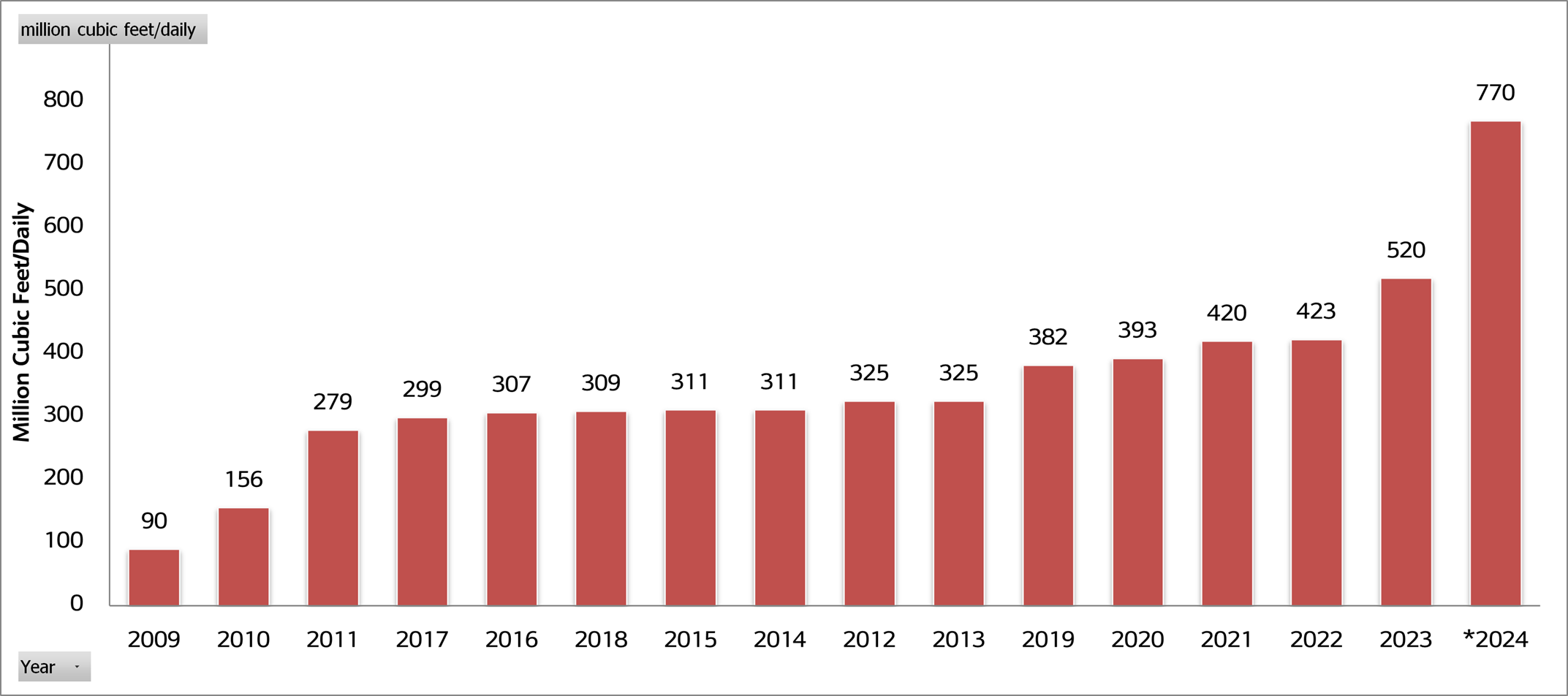

Since 2009, gas production from the Khor Mor field alone has soared from 30 million cubic feet to approximately 520 million cubic feet by 2023. Furthermore, the completion of a new well, boasting a capacity of 250 million cubic feet, is slated for full operational capability this year.

Also, regarding the natural gas reserves of the Kurdistan Region, particularly in the Chamchamal district, the latest report from the former director general of the Reservoirs and Fields Development Directorate indicates that gas reserves in the northern region of the country, especially in Sulaimani province within the Iraqi Kurdistan Region, are estimated to range from 20 to 40 trillion cubic feet (0.57-1.13 trillion cubic meters). This significant assessment contributes to the total national gas reserves, which are estimated at 3.74 trillion cubic meters for the entirety of Iraq.

Dana Gas, founded in 2005, entered into a partnership with Crescent Petroleum and signed a contract with the Kurdistan Regional Government in 2007 for the production and supply of gas to power plants. However, it wasn't until a 2017 lawsuit that Dana Gas saw its gas production rights in the Kurdistan Region renewed until 2049, along with compensation exceeding $1 billion. Without this legal intervention, recent years might have seen the Kurdistan Region assuming ownership of these reserves and leading developments in the gas sector.

Investment in this sector has surged from 90 MCF/day to 520 MCF/day, with projections indicating a further increase to 770 MCF/day, as illustrated in the graph below.

Now, the situation between Erbil and Baghdad is significantly altered from before. Erbil remained silent in recent days regarding the statement made by the spokesman of the Iraqi Ministry of Electricity. However, when the Iraqi Oil Ministry published photos of renewed pipelines connecting Khor Mor and Chamchamal, a day later, the Ministry of Natural Resources issued a statement "Dana Gas cannot transport gas from the Kurdistan Regional Government (KRG) fields to any other place without the approval of the Kurdistan Regional Government (KRG)."

Graph 1: Gas production levels in the Khor Mor and Chamchamal gas fields from 2009 to 2024.

Source: Dana Gas Annual and Third Quarter Report, 6-12-2023, MEES.

*It is anticipated that an additional 250 million cubic feet will be added to the total gas production in the Kurdistan Region during the second quarter of this year.

Baghdad's Shift towards Sourcing Gas from the KRG to Lessen Import Dependency during this Summer

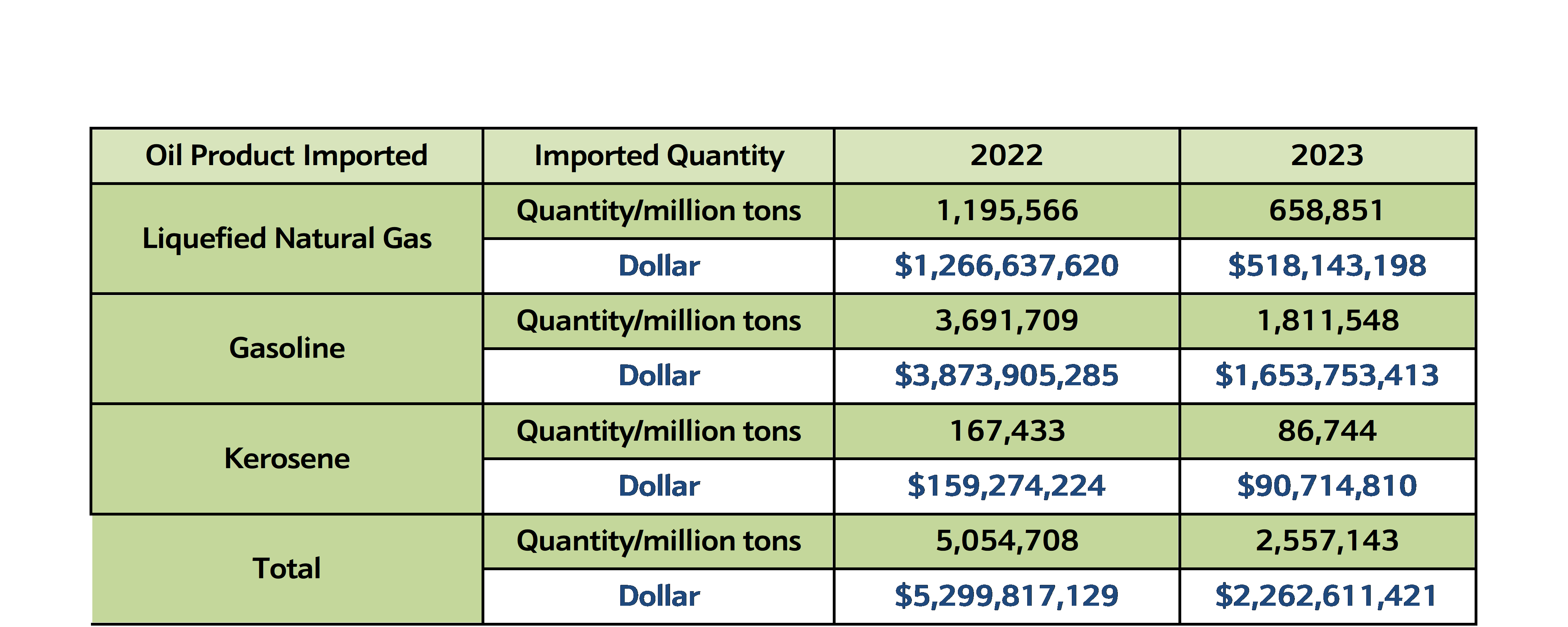

During this cabinet term, Iraq has notably decreased its imports of oil products, including imported gas. According to data from the Oil Ministry and SOMO (which may vary slightly in figures), Iraq's imports of oil products such as kerosene, gasoline, and gas were halved last year compared to 2022. Imports amounted to $5.2 billion in 2022 but dropped to $2.2 billion last year, with a significant decline attributed to reduced gas imports, as shown in the table below.

Furthermore, alongside this reduction, the latest report from the Oil Ministry reveals that Iraq's oil production has surged to nearly 5 million barrels per day, with gas production reaching 3,200 MCF/day, of which 38 percent is recklessly burned and wasted. In fact, the amount of gas burned and squandered is polluting Iraq's water, air, and soil, totaling 1,231 million cubic feet of gas per day. In economic terms, Iraq incurs a daily loss of $6.1 million and an annual loss of $2.2 billion due to the failure to capitalize on this untapped gas resource.

Iraq has pursued three different approaches to alleviate US pressure and seek alternatives to Iranian gas: investing in gas fields and oil fields that produce associated gas, agreeing to exchange gas purchases as it did with Turkmenistan in the past, and purchasing Khor Mor and Chamchamal gas from Dana Gas and the Kurdistan Region.

Currently, the Iraqi Oil Ministry is actively engaging in gas production contracts akin to those established with Total, Siemens, and Wheatherford. Additionally, it is fostering gas exchanges with Turkmenistan and renewing Iranian gas import contracts. However, its collaboration with Dana Gas and its partners transcends mere paperwork. Rather, the gas is readily available, and the United States has underscored its advantages. Notably, the United States has extended a loan of $250 million to Dana Gas to facilitate the expansion of gas production in the Kurdistan Region.

Dana Gas's total daily gas production in the Kurdistan Region is poised to escalate to 250 million cubic feet this quarter, surpassing by 150 million cubic feet the volume discussed for purchase by the Iraqi Ministry of Oil and Electricity for the Kirkuk power plant.

In the event that Baghdad procures only 100 million cubic feet of gas from Dana Gas, the remaining 150 million cubic feet can bolster the overall gas production capacity for the Kurdistan Regional Government (KRG) stations. Consequently, the tensions experienced during the initial stages of pipeline repair and connection should be quelled upon the signing of the agreement.

Table 1: Import Quantities of Liquefied Natural Gas, Gasoline, and Kerosene (2022-2023)

Source: Iraqi Oil Ministry, SOMO Company, April 1, 2024

Note: The data for 2023 differs from what is currently displayed on the website and what is attached to the file. This report relies on the website, as the data for 2022 is obtained from the same source.

Conclusion

Given the prevailing political and economic circumstances in the Kurdistan Region, Dana Gas and its partners are not solely focused on catering to domestic needs with the surplus they produce. According to Dana Gas's latest report, the Kurdistan Region still owes the two companies $103 million. This is despite the implementation of a new mechanism last year aimed at directly collecting funds from power plants to secure natural gas for these facilities, as well as efforts to complete projects aimed at achieving a daily production capacity of 1 billion cubic feet.

Furthermore, the Kurdistan Regional Government (KRG) has encountered challenges not only in compensating gas production companies for supplying electricity but also in settling outstanding debts. According to a report from the KRG's Finance Ministry presented to the Finance Committee of the Iraqi Parliament and the Iraqi Ministry of Finance, "The Kurdistan Regional Government (KRG) owes $436 million in wages to electricity generation companies until June 30, 2023."

Reports indicate that Dana Gas and its partners consistently update the Kurdistan Regional Government on their activities. Therefore, it is anticipated that the pipeline, along with US pressure on Iraq to either diminish imports of gas from Iran or seek alternative outlets, will align with the ongoing situation in the Kurdistan Region. This alignment is expected to provide a favorable environment for companies to sustain their operations in the future.

In conclusion, the ongoing challenges between Erbil and Baghdad regarding energy matters, particularly oil, as well as the operations of companies and the methods of oil exportation to the port of Ceyhan, persist. If a new agreement is reached without the involvement of the Kurdistan Region, it will draw attention to two contrasting outcomes regarding the stance of Baghdad institutions on the oil and gas situation in the Kurdistan Region. Despite previous internal divisions within the two main parties in the Kurdistan Region on this matter, it remains uncertain whether their disparities have lessened or intensified over time.

Firstly, Baghdad indirectly recognizes the oil and gas contracts of the Kurdistan Region, a stance it has refuted for the past decade. This acknowledgment comes through the recognition that the contract between Dana Gas and the Kurdistan Regional Government was established under existing law.

Secondly, Baghdad casts doubt on the rulings of the Federal Court, particularly the decision to nullify the Kurdistan Regional Government's oil and gas law, deeming it unconstitutional, because Iraq is dealing with a company whose contracts were formalized within the legal framework.