Budget Surprises: Iraq's Annual Revenues and Expenditures Differ from Estimates!

09-06-2024

Overview

On June 3, 2024, Iraqi lawmakers swiftly approved the 2024 budget, which features increased figures compared to the previous year. The approval included the revenue and expenditure tables for the 2024 budget.

The approved budget for this year estimates non-oil revenues to be 57% higher and oil revenues to be 2.8% higher than last year. However, for the past two decades, the estimates from the Ministry of Finance and the Iraqi Parliament have not been accurate, and by the end of the year, they did not reconcile with actual oil and non-oil revenues.

An annual budget consists of the collection of revenues and their redistribution towards expenditures. The main principle of budgeting is to maintain a balance between revenues and expenditures by increasing revenue sources and reducing expenditures. However, in Iraq, this has been the opposite. Over the past two decades, for example, expenses have increased 29-fold, while revenues have increased only eight-and-a-half times.

According to the 2024 budget law, total expenditures are set at 211.8 trillion dinars, with total revenues at 147.8 trillion dinars, resulting in a deficit that is ten times larger than last year. Iraq’s increased spending and reliance on oil revenues have created an unprecedented consumer economy (Rentier State), with public salary expenditures rising from 2.1 trillion dinars to 47.2 trillion dinars over the past two decades. The sustainability of this consumption hinges on oil prices rather than the labor force and productivity levels of employees.

Additionally, the distribution of expenditures in the 2024 budget law does not accurately reflect the spending patterns of the Ministry of Finance over the past two decades across various institutions, ministries, and the Kurdistan Region. The amounts budgeted and spent are significantly different. Notably, the share allocated to the Kurdistan Region has frequently been reported at 17% and 12.64%. However, data from the past two decades shows that these figures were less than half of what was actually allocated. According to the Ministry of Finance, only 5.76% of total Iraqi expenditures were approved and sent to the Kurdistan Region.

Shockingly, expenditure on sectors such as health, education, agriculture, water resources, the environment, and even sports and youth in Iraq has been minimal. Over the past two decades, the combined budgets of the Ministries of Agriculture, Industry, and Water Resources accounted for just 2% of the country’s total expenditure, amounting to 28.8 trillion dinars. This year’s bill allocates only 1.57 percent of the total budget, assuming it is fully spent.

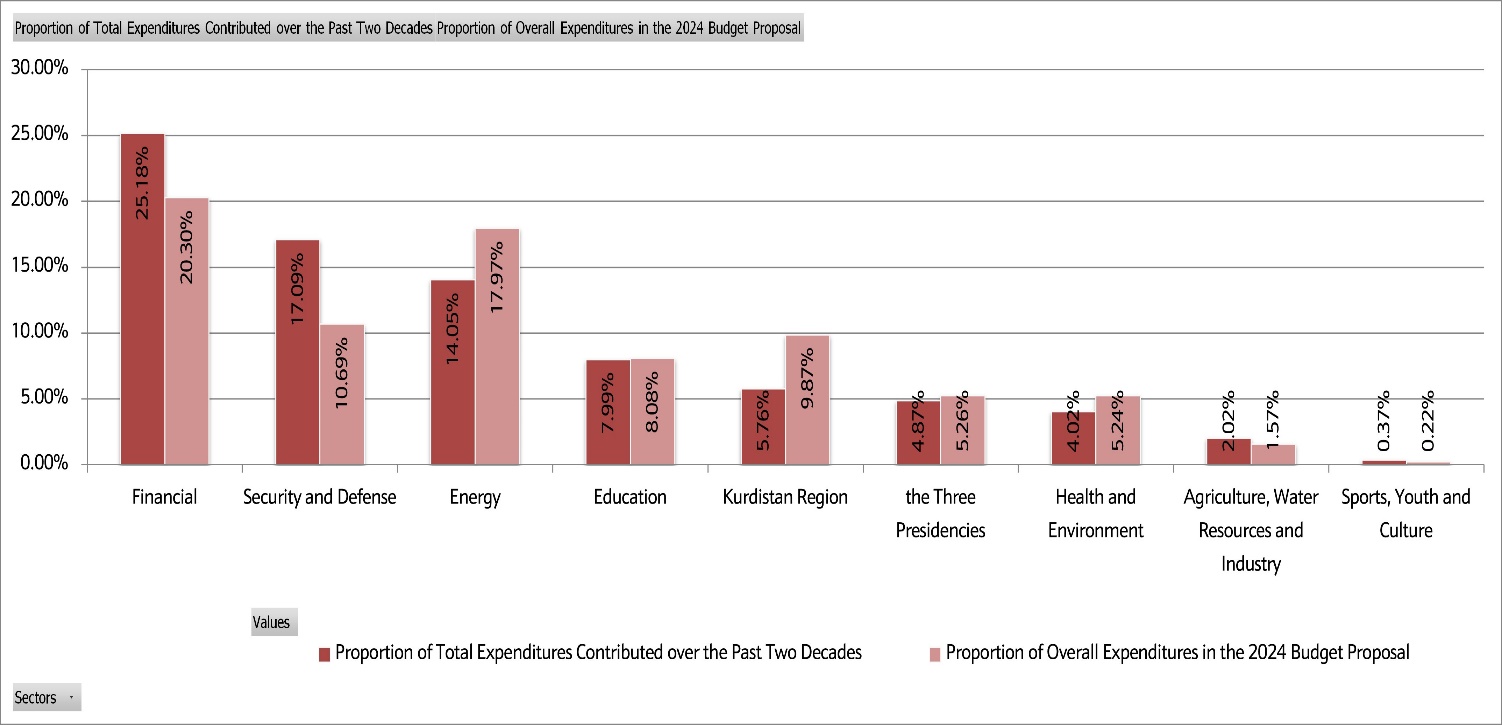

Expenditure Shares in the Last Two Decades Compared to the 2024 Budget Bill

Over the past two decades (2003-2023), seven sectors, three presidencies, and the Kurdistan Region accounted for 81.35% of total expenditures in the federal Iraqi state, and 79.25% in the approved 2024 budget law, though at significantly different rates.

The Ministry of Finance's highest expenditure rate during these two decades was 25.18%; however, this budget has reduced it to 20.3%, suggesting a reallocation to another sector. Similarly, the security sector, particularly the Ministries of Interior and Defense, accounted for 17% of expenditures in the past two decades but is allocated only 10.69% in this bill.

The third largest expenditure in Iraq was directed towards the energy sector, specifically the Ministry of Oil and Electricity, which accounted for 14.05% over the past two decades. However, in the approved bill, this allocation increased to 17.97%. This shift suggests that the reduction in expenditures for the Ministries of Finance and Interior has partly been redirected to these two ministries.

What is particularly noteworthy is the spending of the three Iraqi presidencies compared to infrastructure sectors such as health, education, environment, water resources, and industry. Over the past two decades, the three presidencies accounted for 4.87% of total expenditures, while the combined share of the ministries of agriculture, water resources, and industry was only 2.02%. More strikingly, the expenditure rate for these three institutions increased to 5.26% in the 2024 budget law, while the contribution from the aforementioned three ministries decreased to 1.57%. See Graph 1 below.

Over the past two decades, infrastructure sectors such as health and the environment accounted for 4.02% of expenditures, while the Ministries of Sports and Youth accounted for 0.37%. Despite Iraq currently experiencing a demographic dividend, with young people comprising one-third of the population, spending for these ministries has been reduced to 0.22% in the 2024 budget.

Over the past two decades, spending on infrastructure, basic services, and other institutions has remained consistent. Since the formation of Hashd al-Shaabi in Iraq in 2015, more than 1 trillion dinars has been allocated annually. However, the amount actually spent is not detailed in the Ministry of Finance's reports. According to the 2024 budget law, Hashd al-Shaabi has been allocated 4.3 trillion dinars. Additionally, the allocation for salaries this year has increased to 3.9 trillion dinars, up from 3.5 trillion dinars last year.

Graph 1: Distribution of Expenditures Across Seven Sectors, the Three Presidencies, and the Kurdistan Region, From 2003 to 2023 and in the 2024 Iraqi Budget Law

Source: Iraqi Ministry of Finance, Accounting Department, from May 15, 2024, to June 2, 2024.

Note 1: Expenditures for 2014 are not included in the data for all sectors, the three presidencies, and the Kurdistan Region for these two decades.

Note 2: The proportion of expenditures for the KRG would likely be lower than the total expenditures for all of Iraq if data were available for 2014, as expenditures for the KRG were reduced in February.

Note 3: Expenditures for the seven sectors, three presidencies, and the Kurdistan Region are subtracted from the total expenditures across all sectors, meaning they reflect the total spending in Iraq over these two decades, excluding 2014.

Note 4: The security sector in this report encompasses the Ministries of Interior and Defense. The budget allocations for these are derived from the 2024 budget law, which does not include expenditures from other institutions such as the National Security Council, Hashd al-Shaabi, the intelligence agency, and the Border Areas Board.

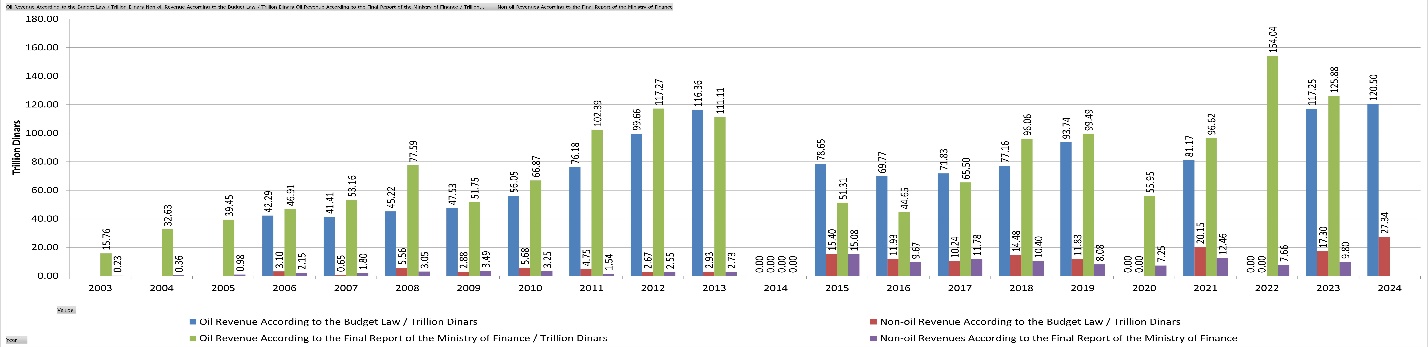

Oil and Non-Oil Revenues in the Budget Law and the Ministry of Finance Report

Over the past two decades, from 2003 to 2023, Iraq's Ministry of Finance published the final reports on both oil and non-oil revenues following budget approval. According to the budget, total oil revenues were projected to be 1,114 trillion dinars. In reality, however, actual oil revenues amounted to 1,206 trillion dinars. For non-oil revenues, the parliament anticipated earnings of 129.56 trillion dinars, but only 97 trillion dinars were collected.

Over the past two decades, there has been a significant imbalance between total expenditures and income, with expenditures tripling relative to revenues. According to the Iraqi Ministry of Finance, total expenditures were 4.6 trillion dinars in 2003, 119.1 trillion dinars in 2013, and 142.4 trillion dinars in 2023—an increase of 24 times in the first decade and 29 times in the second. In contrast, revenues were 16 trillion dinars in 2003, 113.8 trillion dinars in 2013, and 135.7 trillion dinars in 2023, growing sixfold in the first decade and eightfold over two decades.

Over the past two decades (2003-2023), high oil prices and easy access to oil revenues have significantly increased these revenues, from 15.7 trillion to 125 trillion dinars. Meanwhile, non-oil revenues grew from 225 billion to 9.7 trillion dinars, highlighting the Iraqi economy's heavy reliance on oil. According to the World Bank, oil revenues constitute 85 percent of the country's budget and 42 percent of its gross domestic product (GDP).

Over the past two decades, the increase in expenditures relative to revenues has been tempered by the consistent overflow of annual revenues, particularly driven by high oil prices. This pattern of spending has largely been influenced by the methods used for revenue collection. Persisting with this approach could lead to significant consequences in the context of the global energy transition and the goal of achieving net zero emissions. The ease of collecting and distributing revenues has also hindered the development of infrastructure for essential services such as water, electricity, healthcare, and education. Most critically, it has impeded the creation of jobs and the provision of a decent standard of living for Iraqis. This is evident in the unemployment rate, which reached 15.6% in 2023.

Graph 2: Oil and Non-Oil Revenues According to the Budget Law and Reports from the Iraqi Ministry of Finance, 2003-2024

Source: Iraqi Ministry of Finance

Note 1: There was no budget law from 2003 to 2005, and in 2014, 2020, and 2022, the government did not present the budget for parliamentary approval.

Conclusion

This year, the Iraqi parliament has approved the updated revenue tables from the Ministry of Finance and the Council of Ministers, presenting two significant challenges to the Iraqi economy. The first challenge is the increase in non-oil revenues to 27.3 trillion dinars, up from 17.3 trillion dinars in 2023; however, the Ministry of Finance collected only 9.7 trillion dinars. The second challenge involves increasing expenditures on the energy sector while reducing funding for agriculture, industry, and water resources.

Over the past five terms, the Iraqi parliament has struggled to restore balance to the annual budget, consistently increasing expenditures and tying revenues to production volumes, exports, and oil prices.

It is true that Iraq's reliance on oil has placed the political and economic system at risk on two occasions over the past two decades, particularly in 2014 and 2020. During these periods of fluctuating oil prices, the government was compelled to utilize its currency reserves and devalue its currency against the dollar to cover expenses.

Increased expenditures, particularly operational costs, which make up more than 80 percent of Iraq's total expenditures, will likely lead to three primary consequences: an increase in public debt that burdens future generations, a slowdown or weakening of economic growth, and a financial crisis.

Furthermore, the revenue estimates provided by the parliament in Iraq are often merely theoretical, as reflected in the budget law. In practice, the oil revenues reported by the Ministry of Oil and the non-oil revenues reported by state agencies to the Ministry of Finance often differ significantly.

Resources

وزارة المالية, جمهورية العراق،” Mof.gov.iq, mof.gov.iq/pages/MOFPublicReports.aspx. Accessed1 June 2024.

وزارة المالية, جمهورية العراق التقارير المالية العامة .” Mof.gov.iq, وزارة المالية mof.gov.iq/pages/ar/FinalAccounting.aspx. Accessed 03 May 2024

Supper admin panel (no date) Central Bank Of Iraq. Available at: https://www.cbiraq.org/SeriesChartBig.aspx?isVir=0 (Accessed: 02 June 2024).

وزارة المالية, جمهورية العراق. Retrieved May 30, 2024, from https://mof.gov.iq/pages/MOFPublicReports.aspx

وزارة المالية, جمهورية العراق. Retrieved May 30, 2024, from https://mof.gov.iq/pages/MOFPublicReports.aspx

وزارة المالية, جمهورية العراق. -. https://www.mof.gov.iq/pages/ar/FederalBudgetLaw.aspx

https://mof.gov.iq/pages/ar/BalanceArchive.aspxوزارة المالية, جمهورية العراق،