Erbil's Real Estate Boom: Over 50,000 New Apartments, Houses, and Villas Under Construction

24-03-2024

Overview

Despite facing economic challenges last year, the Kurdistan Region and its capital, Erbil, witnessed a remarkable surge in the housing sector. Over 52,000 new housing units, comprising apartments, houses, and villas, were initiated, signifying a significant boost in investment within the region's real estate market.

Recent data reveals that over the past two decades, Erbil has seen the completion of 131 residential projects, comprising apartments, houses, and villas, now actively traded in the real estate market. This impressive tally amounts to a total of 128,542 residential units of varying sizes.

The data unequivocally indicates a surge in housing construction in Erbil, with projections of over 50,000 units set for completion within the next three years. Of this total, an estimated 27,000 units, their keys are anticipated to be delivered to owners and investors this year alone.

This rapid acceleration in housing development is not confined to Erbil; it is a trend observed across the Kurdistan Region. In Sulaimani, for instance, the number of real estate investment projects currently underway has surged two to threefold compared to previous years, reflecting the region's robust growth and burgeoning housing market.

Amidst the uncertainty and rapid fluctuations in the global housing market, exacerbated by geopolitical instability and a slowdown in the global economy, both last year and this year have seen most countries' capital cities experiencing significant volatility. Prices have continued to plummet, influenced by factors such as heightened instability, elevated bank interest rates, inflationary pressures, and existing a significant gap between sellers and buyers

Moreover, upon a brief review of Erbil's real estate market, noticeable changes from the previous year emerge: varying declines in rental rates and apartment prices, short- and long-term installment sales, as well as decreased prepayment. Additionally, there has been an expansion in marketing efforts aimed at promoting the sale of residential units.

This sustained growth within the housing sector of the Kurdistan Region necessitates a differentiated approach. In this re[prt, we will hone in on the capital city of Erbil and explore its implications for the future, with a particular focus on presenting data on the ongoing construction projects shaping the city's landscape.

Persisting in the Construction of Apartments, Houses, and Villas in Erbil

The housing market in Erbil stands out among Iraqi provinces, earning its reputation as the hub of high-rise residential projects and towers. However, the city's residential landscape isn't solely defined by projects licensed by the Investment Board. Towers operate for a total of 16 hours a day, have received approval from various institutions including the Ministry of Municipalities.

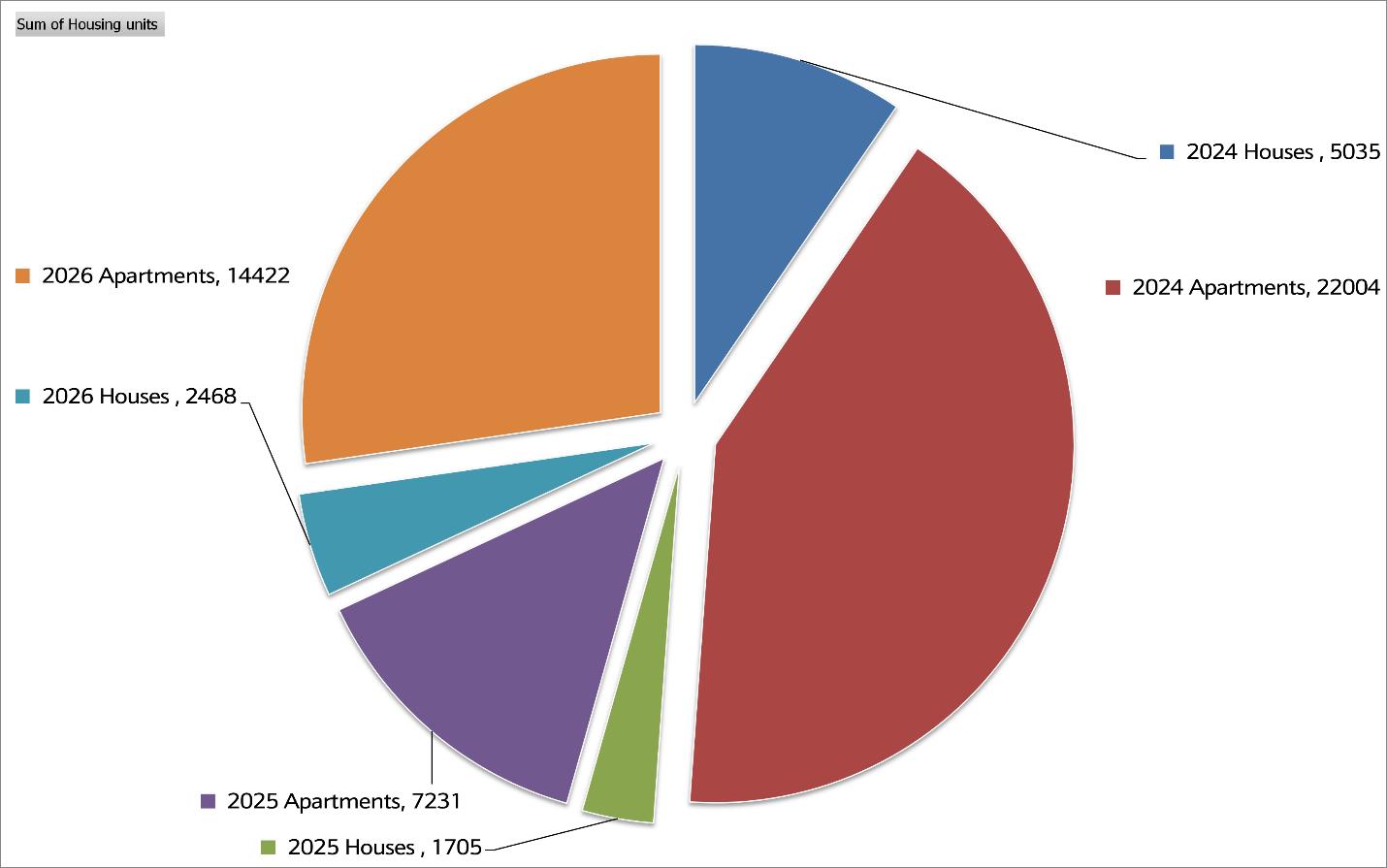

Based on gathered data, this year will see the construction of 5,035 houses and 22,004 apartments, resulting in a total of 27,039 new housing units entering Erbil's market, with some having been completed towards the end of last year.

Looking ahead, the forecast indicates that over the next two years, 25,843 new units will be completed, with 21,673 units being apartments, as illustrated in the graph below. This transition from horizontal to vertical development in the housing sector presents both opportunities and challenges for the future of Erbil's infrastructure.

Graph 1: Number of Residential Units (Apartments, Houses, and Villas) in Erbil for 2024, 2025, and 2026

Source: Baghi Shaqlawa Real Estate Company (13-1-2024) and Manar Real Estate Company (25-2-2024).

Note 1: While some projects comprise both houses and apartments, this list exclusively enumerates properties currently on the market and under construction. Notably, only villas are listed for the Pavilion project.

Note 2: Projects with a modest number of villas are categorized here as single-unit houses. It's also worth noting that some projects had commenced construction before 2023.

Erbil's New Residential Projects and Market Prospects

The count of housing units in Erbil extends beyond the 131 projects and 128 thousand units constructed within investment housing projects. It encompasses the vibrant neighborhoods and communities established by the residents themselves, including New Erbil, Andazyran, Bakhtiari, Sawaran, Havalan, among others.

Housing developments in Erbil are shifting towards apartments and villas, with an estimated 43,657 units, comprising 4 out of 5 total units, set to be completed in the next three years. This transition is attributed to social and demographic changes, as well as the increasing preference for apartment living, particularly among the younger generation, who constitute over 60% of the population.

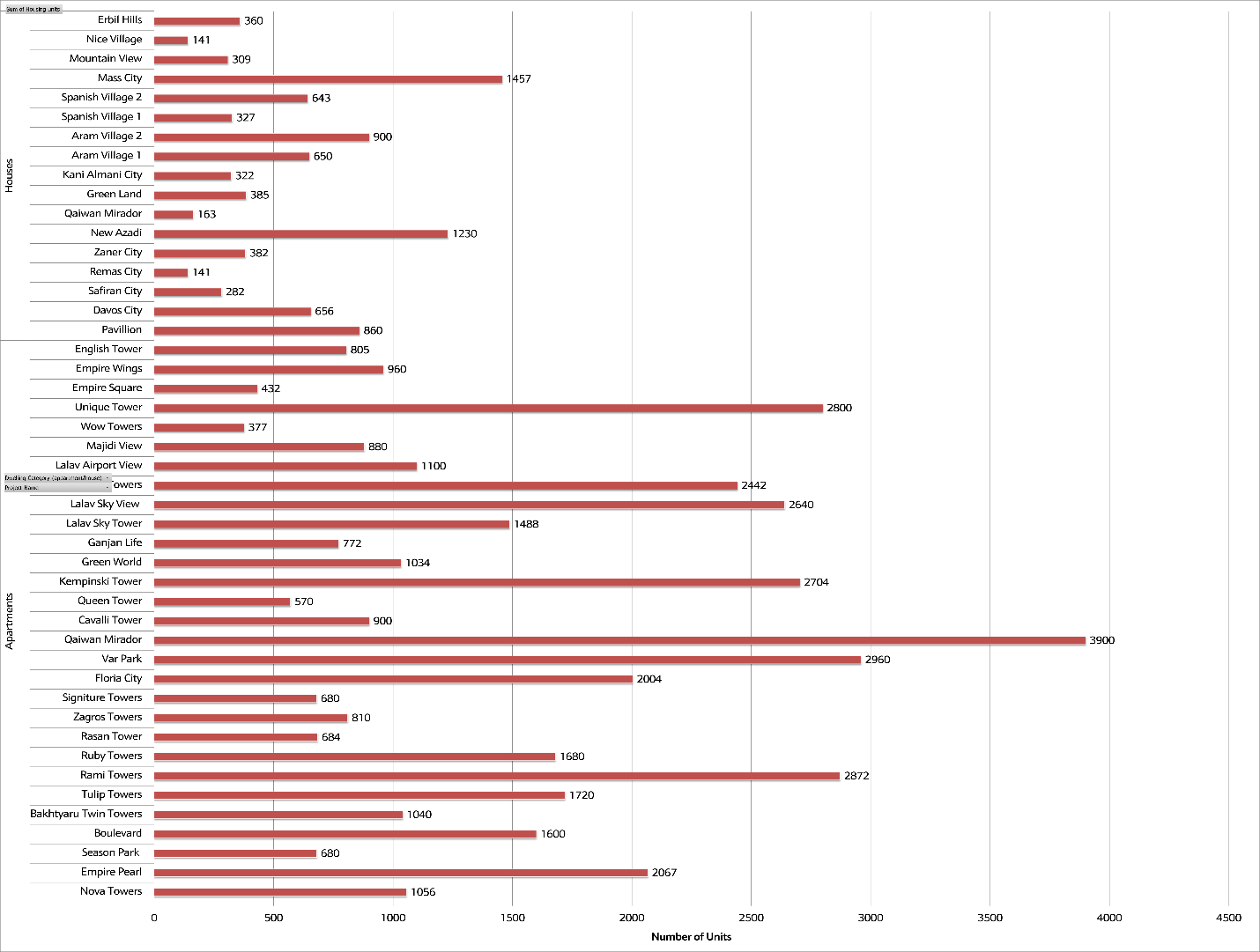

Graph 2: Names and Number of Units of Residential Projects in Erbil in 2024-2026.

Source: Baghi Shaqlawa Real Estate Company (13-1-2024) and Manar Real Estate Company (25-2-2024).

These new projects emerge amidst a significant decline in rents for apartments and houses, plummeting by 30% to 40% from 2021 to 2024. For instance, in 2021, the rent for a 150-square-meter apartment stood at $450, whereas now it ranges from $350 to $300. Additionally, cash transactions and sales have notably decreased, despite the overall decline in prices, except for projects still under construction by investors and marketed at company prices.

In prior years, the real estate market, both in Erbil, the Kurdistan Region, and globally, operated under the mantra "build and the buyer will come." However, today, there exists a significant gap between sellers and buyers. Sellers anticipate improvements in economic, political, and security conditions before committing, while buyers struggle to meet the demanding prices set by sellers. This phenomenon is prevalent across many markets worldwide.

Conversely, the decrease in rapid cash transactions has led to a shift towards long-term installment plans with low down payments for most ongoing projects. This trend contrasts with the past, where residential projects witnessed more real estate transactions compared to new developments. If this situation persists, it could result in a slowdown in projects and investments within the real estate sector. Those relying on local buyers and short- to long-term installment plans may experience a deceleration or even suspension of their operations.

Conclusion

The surge in apartment and house construction isn't exclusive to Erbil and the Kurdistan Region center but extends across Iraq. The delays in constructing housing units in the past have contributed to what we are currently witnessing. Consequently, the number of housing projects in Erbil pales in comparison to Baghdad, where over dozens of new projects are underway with investments exceeding $25 billion. The Sudani’s cabinet has pledged to streamline and support these initiatives, including plans for the construction of 100,000 new housing units.

Throughout Iraq, including the Kurdistan Region and its capital Erbil, there has been an inability to meet the demand in the housing sector due to several reasons, the most significant of which are:

- Rapid population growth, which has now exceeded 41 million people and is projected to surpass 51 million by 2030, with young people aged 15-25 accounting for more than 30%.

- Migration of people from villages and districts to urban centers due to a lack of job opportunities outside these metropolitan areas, especially for the youth.

- Disparities in the provision of basic services between residential projects and surrounding neighborhoods, particularly noticeable during winter and summer.

- Evolving social attitudes towards housing preferences, particularly regarding apartments in residential projects, in recent years.

- Transitioning from cash sales to installment plans for housing projects, characterized by minimal down payments and extended installment periods.

- Limited investment opportunities and lack of trust in banking institutions for deposit and investment purposes in the Kurdistan Region and Iraq.

Real estate investment is characterized by rapid returns and ease, as emphasized by the founder and chairman of Emaar Properties PJSC, stating, 'We offer four types of products: one-room, two-room, three-room, and four-room apartments. We receive minimal problem calls daily, unlike other sectors where the same investment would yield dozens of products and thousands of service-related inquiries.'"

The affordability of houses or apartments per square meter in the Kurdistan Regional Governorate starkly contrasts with prices in Baghdad, presenting a significant difference. For instance, the cost of a house or apartment in new projects within the Kurdistan Regional Government may equate to that of an older property in Baghdad.

In conclusion, the surge in the number of residential projects in the center of cities, coupled with the current availability of infrastructure and natural resources, will exacerbate the issues that have emerged both presently and in the near future, including:

Traffic congestion and transportation bottlenecks, currently evident in road closures and gridlock, particularly around areas where apartment residential projects have been completed. Private transportation predominates, while public transit options remain inadequate. With the completion of these new projects and the growth of family numbers, the issue is expected to escalate further.

- Provide basic services such as water, electricity, healthcare, and security, as most projects still rely on outdated infrastructure, especially concerning electricity.

- Failure to adopt modern systems for water supply and daily waste collection.

- Transitioning cities from horizontal to vertical layouts, which poses significant risks for project residents during natural disasters, exacerbated by the absence of advanced fire suppression and warning systems.

- Utilizing low-quality materials in the construction of some projects, necessitating frequent repairs and replacements within a short timeframe.