On November 14, 2023, the Iraqi Ministry of Finance published a financial report detailing expenditures and revenues over the past nine months. Notably, no dinars were allocated to the Kurdistan Region; instead, funds were sourced from loans and banks. The report indicates total expenditures of 78.25 trillion dinars and combined oil and non-oil revenues of 95.84 trillion dinars, resulting in a surplus of 17.59 trillion dinars compared to expenditures. This surplus contrasts with the 2023 budget, which anticipated borrowing to meet this year's financial requirements.

The notable increase in Iraqi revenue over the last nine months can be attributed to several factors, including the delayed approval of the budget, elevated oil prices, postponed project expenditures, and most significantly, the failure to allocate funds to the Kurdistan Region. As per the budget, an expenditure exceeding 10 trillion dinars was anticipated, but only 4.7 trillion dinars were spent, in the form of loans. The variation in Kurdistan Region expenditures by the Iraqi Ministry of Finance is linked to changes in cabinets or prime ministers in Iraq. Over the last five years, the spending patterns from the Iraqi budget have fluctuated based on the decisions of different prime ministers. Importantly, these fluctuations were not tied to oil exports from the Kurdistan Region.

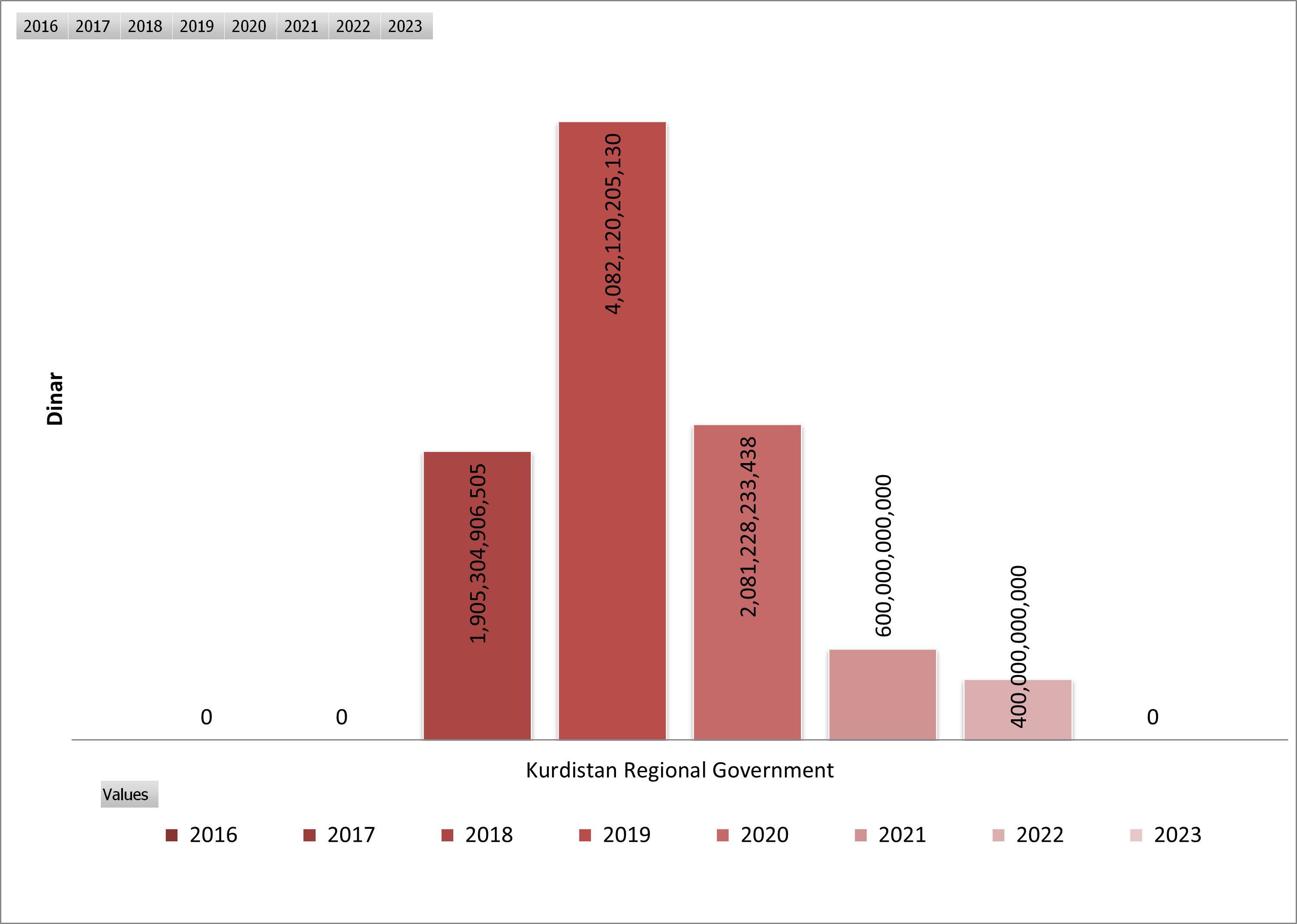

In 2019, under Adil Abdul Mahdi's leadership, Baghdad allocated 4.08 trillion dinars to the Kurdistan Region over nine months. Contrastingly, this year, similar to Abbadi's tenure in 2016 and 2017, no direct expenditures have been made for the Kurdistan Region. However, in a departure from the previous two years, funds are slated to be acquired through loans following the suspension of oil exports from the Kurdistan Region on March 25, 2023.

Over the past eight years, data indicates a steady rise in spending in Iraq, notably in operating expenditure and employee salaries. The expenditure on employment and salaries has surged by over 10 trillion dinars within this period. In 2016, the monthly spending was only 20 trillion dinars, but it has now surpassed 30 trillion dinars, despite a reduction or absence of plans to augment investment spending during this timeframe. Through meticulous data collection, we analyze Iraq's revenues and expenditures in the first nine months of the past eight years, delving into the transformations that have occurred. Our primary emphasis lies on expenditures, specifically excluding the loans to the Kurdistan Region from the Iraqi Ministry of Finance.

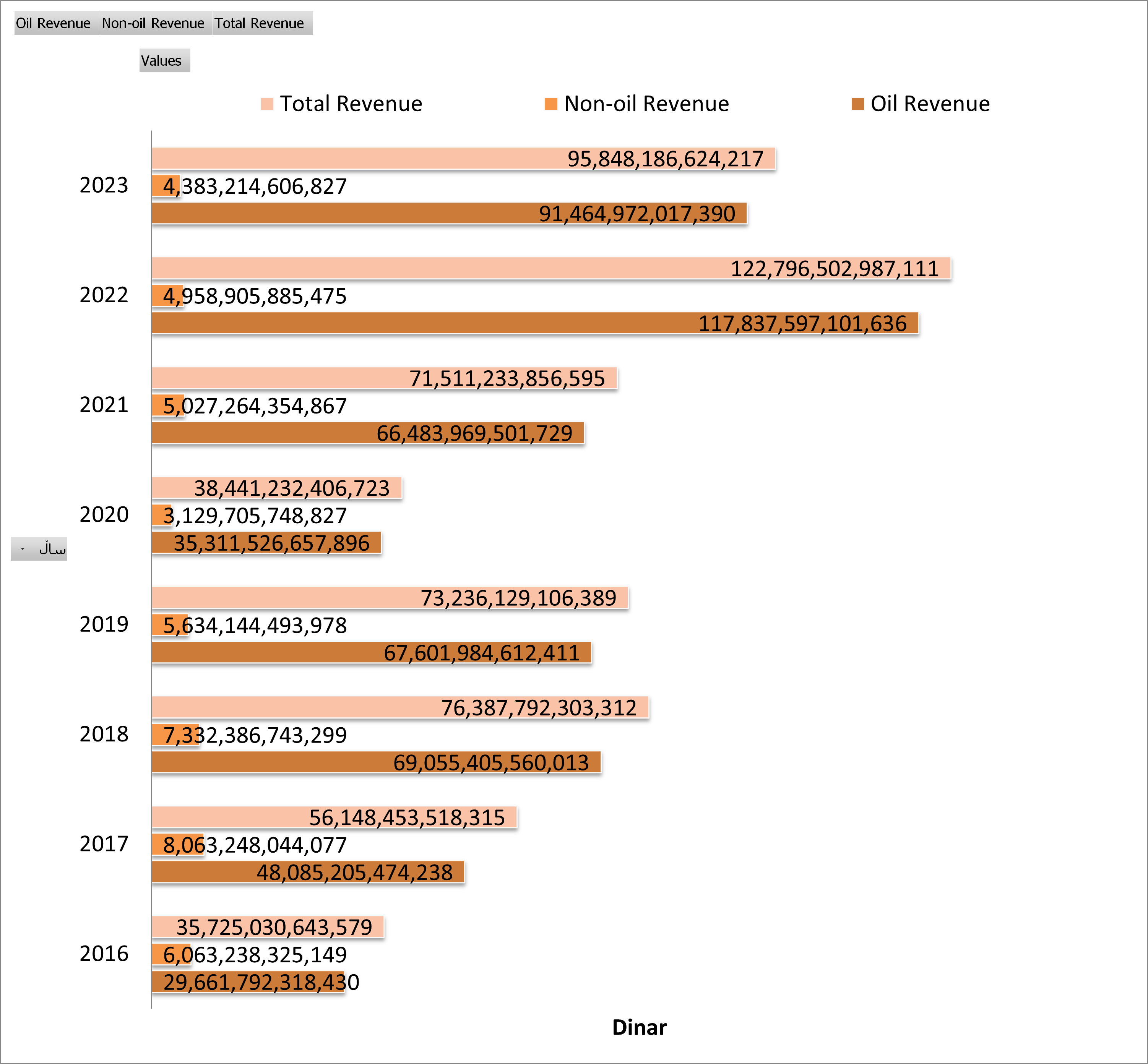

Iraq's Fiscal Landscape: A Detailed Look at Oil and Non-Oil Revenues Over the Past Eight Years' First Nine Months

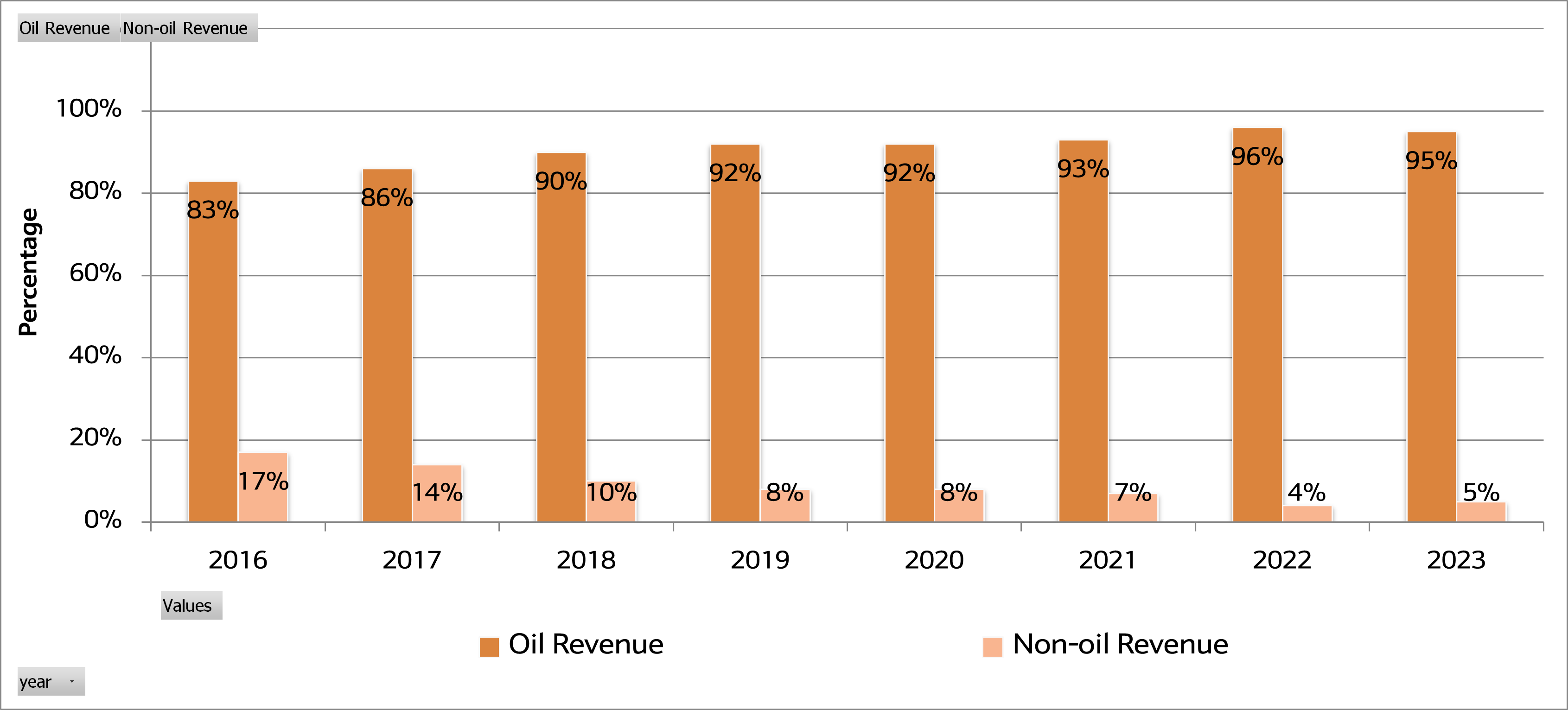

Over the past eight years, data from the Iraqi Ministry of Finance reveals a concerning trend in non-oil revenues, steadily declining without being associated with high or low total income or a proportional link to oil revenues. In 2016, total revenue amounted to 35.7 trillion dinars, with 83 percent derived from oil (29.6 trillion dinars) and 17 percent from non-oil sources (6.06 trillion dinars). Fast forward to the first nine months of 2023, where total revenue reached 95.84 trillion dinars. However, a stark shift occurred with oil revenues dominating at 95%, totaling 91.46 trillion dinars, while non-oil revenues amounted to 5%, amounting to 4.38 trillion dinars. This marks a 12% decline in non-oil revenues compared to oil, translating to a drop from over 6 trillion dinars to 4.3 trillion dinars in Iraqi currency.

On the flip side, the decline in non-oil revenues distinctly signals a failure in collecting essential funds from taxes, fees, border crossing income, and public sector contributions, encompassing areas like hospitals and transportation. Moreover, the second graph illustrates a discernible lack of correlation between the collection of non-oil revenues and oil revenues. For instance, in 2020, oil revenues were a mere 35.31 trillion dinars, a significant decrease from 2018's 69.05 trillion dinars, while non-oil revenues in 2020 amounted to 3.12 trillion dinars compared to 7.33 trillion dinars in 2018. In 2018, non-oil revenue constituted 10 percent of the total revenue, but by 2020, this share had diminished to 8 percent.

In the last eight years, Iraq's revenue has exhibited notable volatility, contrary to the anticipated global economic trend of year-on-year growth. Strikingly, the total revenue for the first three quarters of this year is nearly threefold compared to 2016, soaring to 95.84 trillion dinars in 2023 from a modest 35.72 trillion dinars back in 2016.

Graph 1: Oil and non-oil revenues in Iraq from 2016 to 2023 during the first nine months.

Source: Official website of the Iraqi Ministry of Finance, Monthly Report Department 14-11-2023.

Graph 2: Iraq's oil and non-oil revenues in the first nine months of the year between 2016-2023

Source: Official website of the Iraqi Ministry of Finance, Monthly Report Department 14-11-2023.

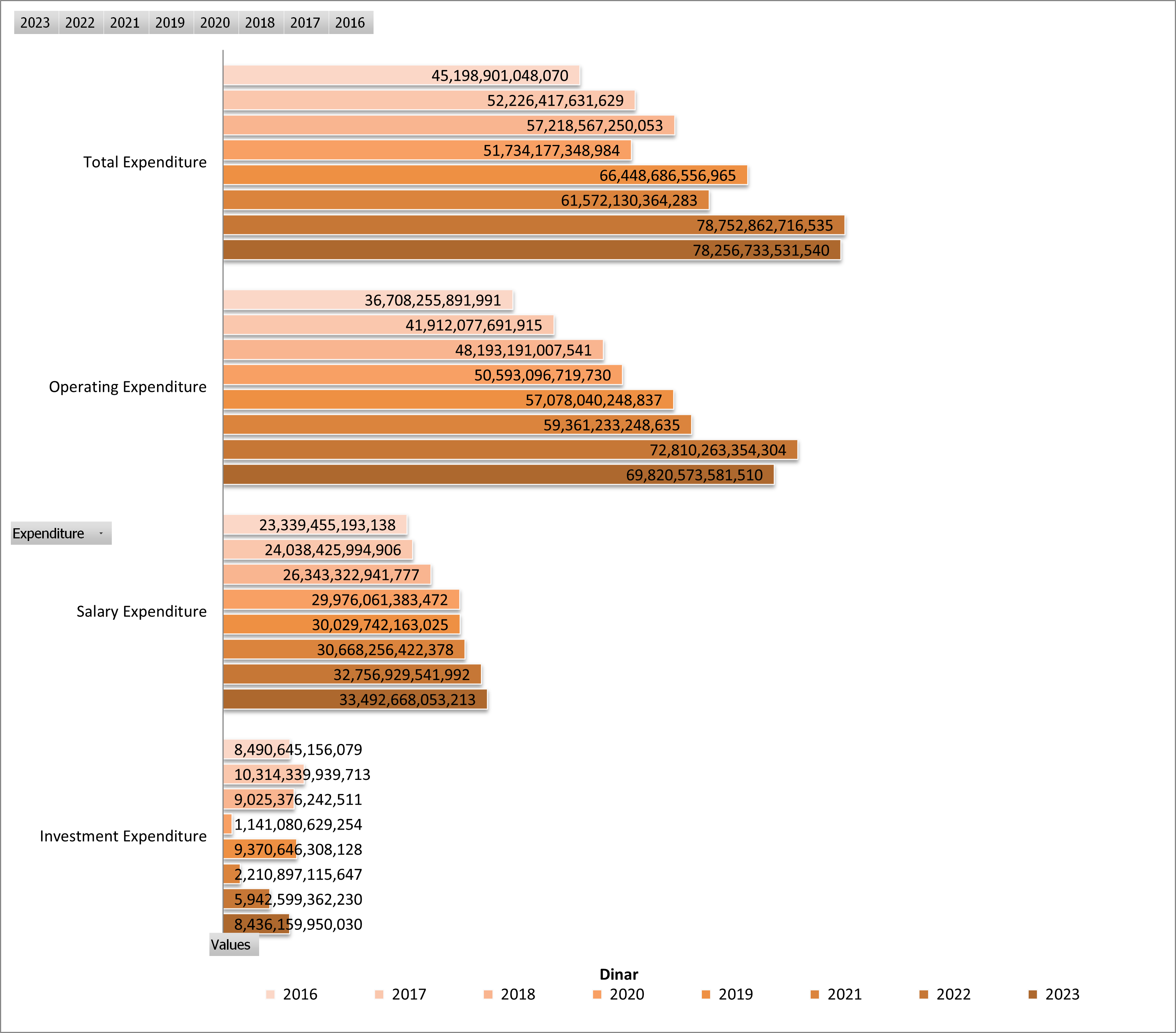

Expenditures from January to September 2016-2023 in Iraq

Over the past five years, Iraq's expenditure has surged by 73%, escalating from 45.19 trillion dinars in the first nine months of 2016 to 78.25 trillion dinars in the corresponding period of this year. Notably, this upswing is predominantly in consumption rather than investment. In 2016, with total expenditures at 45.19 trillion dinars, consumption accounted for 36.7 trillion dinars, and investment expenditures were 8.4 trillion dinars. Fast forward to 2023, where total expenditures are projected to reach 78.2 trillion dinars, comprising 69.8 trillion dinars in consumption and 8.4 trillion dinars in investment, as depicted in the third graph.

The substantial upswing in Iraq's expenditures is primarily driven by salary-related costs. To illustrate, in 2016, salary and compensation expenditures within operational costs amounted to 23.33 trillion dinars. Contrastingly, by 2023, this figure has surged to 33.49 trillion dinars. Over the course of the past eight years, Iraq has witnessed a remarkable 43% increase in salary expenditures, surpassing the 10 trillion dinars.

An intriguing observation lies in the contrast between this year and the previous one in the first nine months. Despite a decline in revenue, expenditures have remained constant. For instance, in 2022, with total revenue exceeding 122 trillion dinars, expenditures stood at 78.75 trillion dinars. However, this year witnessed a drop in total revenues to 95.8 trillion dinars, while total expenditures remained at a similar level of 78.25 trillion dinars.

The escalation in Iraq's expenditures is not directed towards investments in sectors like industry and agriculture. For instance, investment expenditures in 2017 amounted to 10.3 trillion dinars, yet in 2023, they decrease to 8.43 trillion dinars, reflecting a reduction of 1.87 trillion dinars. In 2017, the total expenditure was 52.2 trillion dinars, while in 2023, the total expenditure is projected to reach 78.25 trillion dinars.

Graph 3: Expenditures in the First Nine Months from 2016 to 2023

Source: Official website of the Iraqi Ministry of Finance, Monthly Report Department 14-11-2023.

Note: Employee salaries are incorporated into the operational budget, included here solely to highlight and emphasize the disparity in salary increments in Iraq.

From Nil to Nil: Baghdad's Fiscal Allocation to the Kurdistan Region

Exclusively considering the past eight years and relying on data published by the Iraqi Ministry of Finance, it's noteworthy that in 2016 and this current year, the Iraqi government allocated zero dinars in expenditures during the first nine months. This is visually depicted in Graph 4.

As per the most recent budget law, the Kurdistan Region's portion of Iraq's total revenue stands at over 16.6 trillion dinars, constituting 12.67% of the entire Iraqi budget, excluding the Sovereign and provincial developments funds. Over the last eight years, the Kurdistan Region's budget share has consistently decreased in relation to both the total Iraqi revenue and the utilization of its allocated funds, irrespective of oil export conditions. In 2019, Prime Minister Adel Abdul Mahdi allocated 4.08 trillion dinars during the first nine months, even with Kurdistan Region's oil exports. On the other hand, but in Mohammed Shia Sudani's era, expenditures were minimal, with almost no dinars spent, except the debt.

During the first half of 2023, the Kurdistan Region received a total of 2.59 trillion dinars, with 1.6 trillion designated as loans and 998 billion as the Kurdistan Region's share, as reported to the Baghdad Parliament by the Kurdistan Regional Government (KRG). Despite this, the Iraqi Ministry of Finance reports have not disclosed expenditures for the Kurdistan Region in the operating and investment budgets up until September. On September 17, 2023, the Iraqi Council of Ministers decided to provide an additional 2.1 trillion dinars as a loan for the months of September, October, and November. As of now, two portions have been received, leaving 700 billion pending.

Graph 4 illustrates the disbursements from the Iraqi Ministry of Finance to the Kurdistan Region throughout the first nine months of 2016-2023.

Source: Official website of the Iraqi Ministry of Finance, Monthly Report Department 14-11-2023.

Conclusion

Iraq's anticipated oil revenue for the year is poised to surpass $100 billion, equivalent to over 130 trillion dinars based on the official value of the central bank. When factoring in non-oil revenues matching those of the previous year (5 trillion dinars), the total could exceed 135 trillion dinars. Assuming expenditures mirror those of the past nine months, as over the past nine months the situation has remained consistently similar to the first nine month of the last year the total expenditure reaches 116 trillion dinars, and the Kurdistan Region's debts reach approximately 4.7 trillion dinars, Iraq's total expenditures in 2023 are estimated at 120.7 trillion dinars, still 79 trillion dinars below the 2023 budget and the oil revenue, surpassing expenditures by more than 14.3 trillion dinars. The data reveals a contrary trend; rather than a progressive increase in non-oil revenues and a diminishing reliance on oil income, non-oil revenues have dwindled from 17% to 5% of total revenues in the past eight years. This signifies a notable shift, with oil revenues escalating from 83% to 95% of gross state revenues, a pattern distinctly influenced by fluctuating oil prices and the advent of a renewed energy era.

A crucial aspect contributing to the depletion of state wealth, steering the nation away from productivity and risking economic collapse, is the surge in public sector employees coupled with a dearth of private sector engagement. Over the past eight years, expenses have escalated, surpassing an increase of more than 10 trillion dinars during this period.

In the recent visit of the Iraqi prime minister and his deputy for energy affairs, there are indications that Baghdad may no longer opt for sending dollars or dinars to the Kurdistan Region, a departure from the practice in the early years post-2003. Current discussions lean towards the prospect of re-exporting oil, even if the Kurdistan Region refrains from direct oil exports. Baghdad seems hesitant to allocate the Kurdistan Region's share in the budget, a departure from the practices in the years immediately following 2003. Since 2014, the unfunded amount has consistently approached or matched the designated share for the Kurdistan Region in the budget. In both 2016 and 2017, no funds were disbursed, and this year, only partial disbursements have been made, primarily in the form of loans with various conditions.