Overview

Iraq and the Kurdistan Region are facing a challenging summer in terms of electricity supply. For the first time, Iraq is attempting to provide electricity [i]without relying on imported Iranian gas and electricity, while the Kurdistan Region is advancing its 24-hour electricity "Light Project" into a new phase, particularly in the urban centers of Erbil, Sulaymaniyah, and Duhok.

The current situation regarding electricity in Iraq is markedly different from that in the Kurdistan Region. Iraq is striving to increase its sources of supply and electricity production with the aim of achieving, in the best-case scenario, up to 20 hours of electricity availability, including power from generators. Meanwhile, the Kurdistan Region is focused on restructuring demand to ensure continuous 24-hour electricity provision.

The Kurdistan Region has the capacity to produce over 6,700 megawatts of electricity and currently generates 4,300 megawatts, indicating it still has the potential to produce an additional 2,400 megawatts. In the event of an interruption in Iranian electricity and gas supplies due to American pressure, Iraq could benefit from this surplus, just as it presently purchases 1,600 megawatts from the Kurdistan Region. Furthermore, the Kurdistan Region is expected to make a significant advancement in gas production early next year, reaching one billion cubic meters. Whether Iraq opts to purchase the gas directly or it is converted to electricity for export, Iraq can rely on the Kurdistan Region in this regard.

In reality, the issue of providing 24-hour electricity in Iraq and the Kurdistan Region is more closely related to demand rather than supply. Over the past two decades, the capacity of electricity production has increased several times relative to population growth. However, despite this growth, electricity provision has not met the population’s needs, falling short even compared to neighboring countries, let alone developed nations.

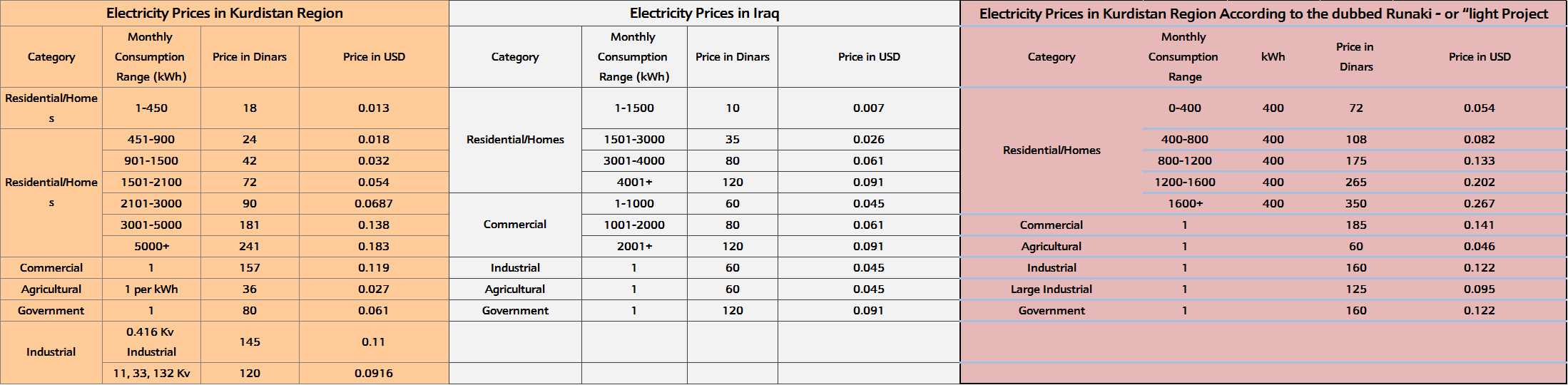

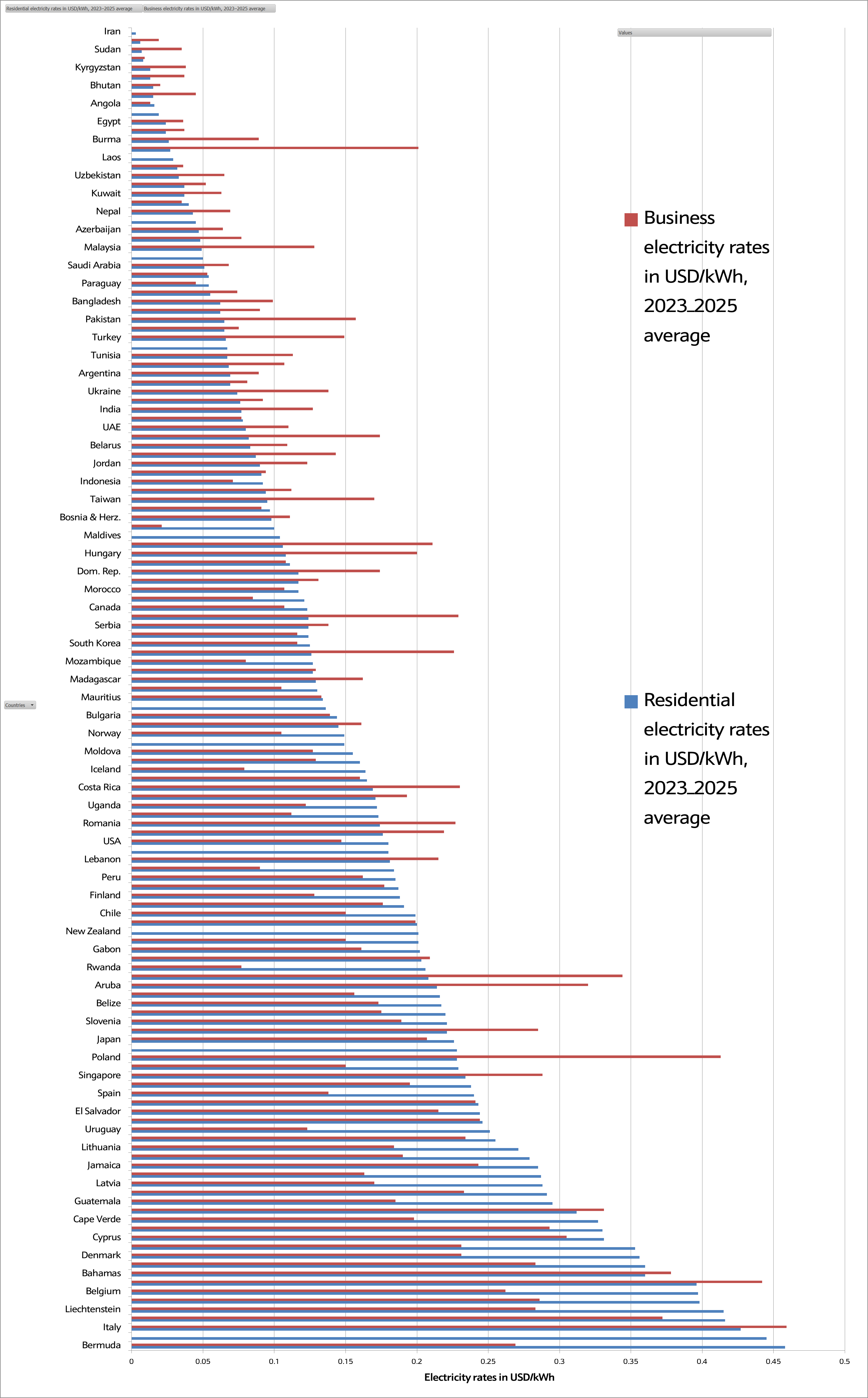

Currently, electricity prices in Iraq and the Kurdistan Region vary not only from city to city but also between neighborhoods within the same city. In terms of government-set electricity prices per kilowatt-hour, Iraq and the Kurdistan Region rank among the cheapest globally, alongside countries such as Libya, Sudan, Syria, and Iran. However, the new pricing under the Kurdistan Region’s “Light Project” aligns it more closely with countries like South Korea, Armenia, and Thailand.

Several questions arise: What is the average individual electricity demand in Iraq and neighboring countries? How do individual incomes and expenses compare? What is the price of electricity based on amperage? How much electricity does Iraq currently produce, and what will be the demand by 2030? Can Iraq meet its electricity needs by increasing production capacity, and can the Kurdistan Region address its challenges through demand-side restructuring? This report seeks to answer these questions by analyzing data from the World Bank, the U.S. Energy Information Administration, and the International Energy Agency.

Electricity Production Capacity in Iraq and the Kurdistan Region: Current Status and Projected Needs for the Next Decade

According to the U.S. Energy Information Administration (EIA), the total electricity production capacity in Iraq in 2023 was 31.3 thousand megawatts. However, due to the lack of gas, decreasing water levels, and non-operation of all power station capacities, only half of this amount is produced, which was 15.02 thousand megawatts. Despite this, if Iraq wants to end private and public sector generators and home generators and provide 24-hour electricity, it would need 73.5 thousand megawatts.

According to the same institution, the amount of energy used annually in Iraq for electricity production—including home generators, commercial generators, and the public and government sectors (referred to as "generated electricity")—is twice the demand that the country actually requires. This figure reached 150 thousand megawatts in 2023. This indicates that due to a lack of reorganization within this sector, half of the energy is wasted annually, while the population continues to suffer from electricity shortages.

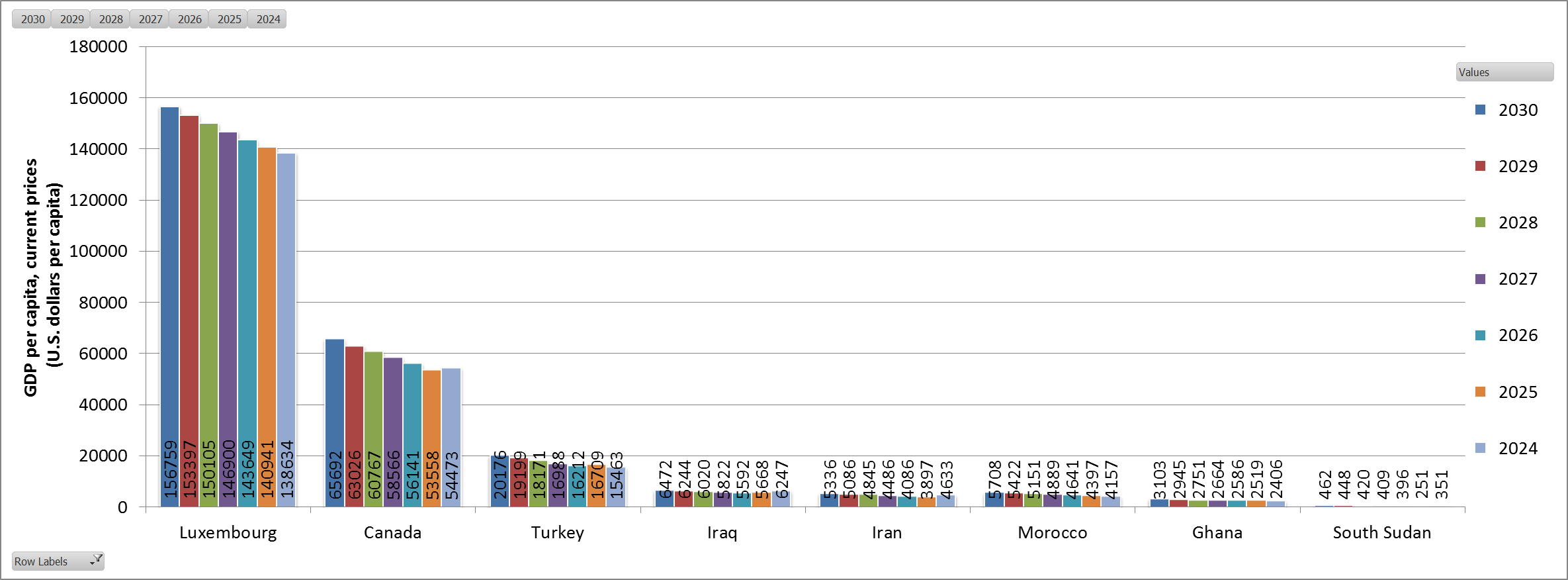

Currently, according to major global energy agencies and institutions, Iraq’s annual electricity demand reaches approximately 70 thousand megawatts, although this varies significantly by season, increasing or decreasing accordingly. Examining the first graphic, it is evident that over the past decade, electricity demand has increased by 60%, rising from 44.85 thousand megawatts to 73.52 thousand megawatts, while supply has stagnated and has not kept pace with the rising demand.

Graphic 1: Demand, Import, and Electricity Production Capacity in Iraq 2013-2023

Source: U.S. Energy Information Administration (EIA), April 14, 2025

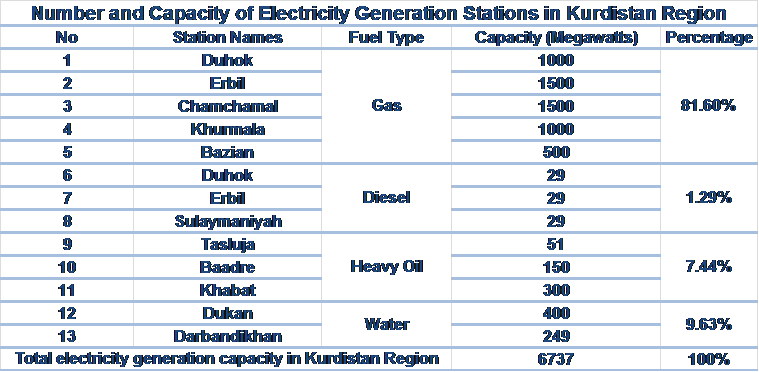

The Kurdistan Region currently has the capacity to produce 6.7 thousand megawatts of electricity from all sources, as shown in Table 1. However, according to collected information, the total electricity production in the Kurdistan Region these days is 4.3 thousand megawatts, of which 1.6 thousand megawatts is sold to the Iraqi government, meaning 2.7 thousand megawatts is available for domestic use. If we calculate this according to the latest census, the individual demand for electricity would be below 500 megawatts in the Kurdistan Region to make it 24 hours, which would certainly require an increase in supply.

The "Light Project" has been implemented since October 17, 2024, in the centers of the Kurdistan Region's cities, with plans to extend 24-hour electricity to all provincial centers in the Kurdistan Region by the end of this year. This initiative represents a significant development; however, what has been observed so far relates as much to restructuring electricity demand and increasing prices relative to generator electricity as it does to expanding the supply of electricity sources. If demand reaches its peak during the winter and summer seasons, the Kurdistan Region will have the capacity to meet it, particularly at the beginning of the year and at various times throughout the seasons, by reclaiming the amount of electricity allocated to Iraq and reducing residents’ consumption. According to the Light Project team, subscribers to the project have progressively reduced their consumption month by month due to the increased price.

Table 1: Name, Capacity, and Type of Electricity Production Plants in the Kurdistan Region

Source: Work, Activities, and Projects of the Ministry of Electricity of the Kurdistan Regional Government in the Ninth Cabinet, March 2021

Note: This table does not include the amount of production from renewable energy, either as electricity production projects or those installed in homes.

Year by year, the demand for electricity consumption continues to rise. According to the latest report from the International Energy Agency, among all forms of energy, only the demand for electrical energy is increasing, with electricity demand projected to grow by over 4% during the period from 2024 to 2027. During this timeframe, demand is expected to increase by 3,500 terawatt-hours, driven by factors such as expanded industrial production, greater use of air conditioning equipment, accelerated electrification processes, and the global expansion of data centers.

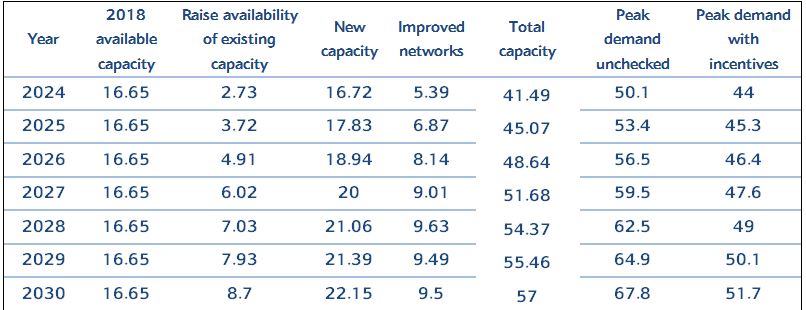

Similarly, from 2024 until 2030, an assessment by the International Energy Agency (IEA) concerning Iraq's energy sector indicates that even if electricity production capacity is increased, new electricity generation projects are completed, and renovations and reforms are implemented in electricity transmission networks, Iraq will still face a shortage of approximately 10,000 megawatts of electricity over the next five years.

Table 2: Current and Future Capacity of Electricity Demand and Supply in Iraq 2024-2030

Source: International Energy Agency (IEA), May 6, 2025

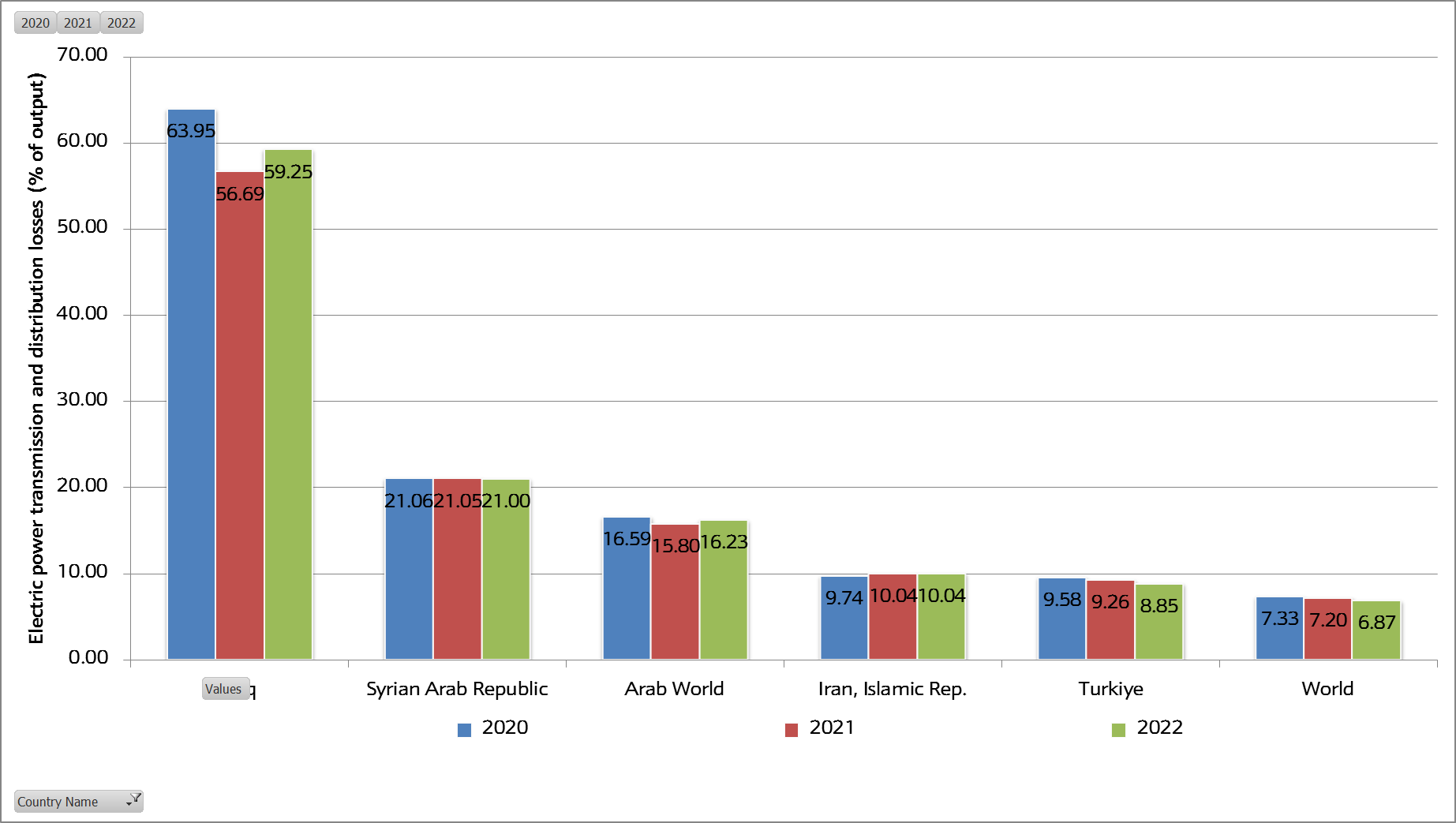

Also, according to the World Bank Group report, Iraq ranks among the worst countries in the world for electricity wastage. Between 2020 and 2022, the wastage rate ranged from 66% to 59%, meaning that about half was wasted, as shown in Graph 2.

In reality, part of this wastage is due to the old electricity transmission networks and electrical equipment (transformers), poor electricity transmission systems, etc., but more than half is stolen. For example, electricity wastage in the Kurdistan Region is similar in this regard, and according to the Ministry of Electricity, 40% is wasted, with only less than 10% due to technical reasons and the rest being used outside of electricity meters.

Graphic 2: Percentage of Electricity Loss in Iraq, Neighboring Countries, and Globally (2020–2022)

Source: World Bank Group Report, May 7, 2025

What is the Per Capita Electricity Demand in Iraq and the Kurdistan Region?

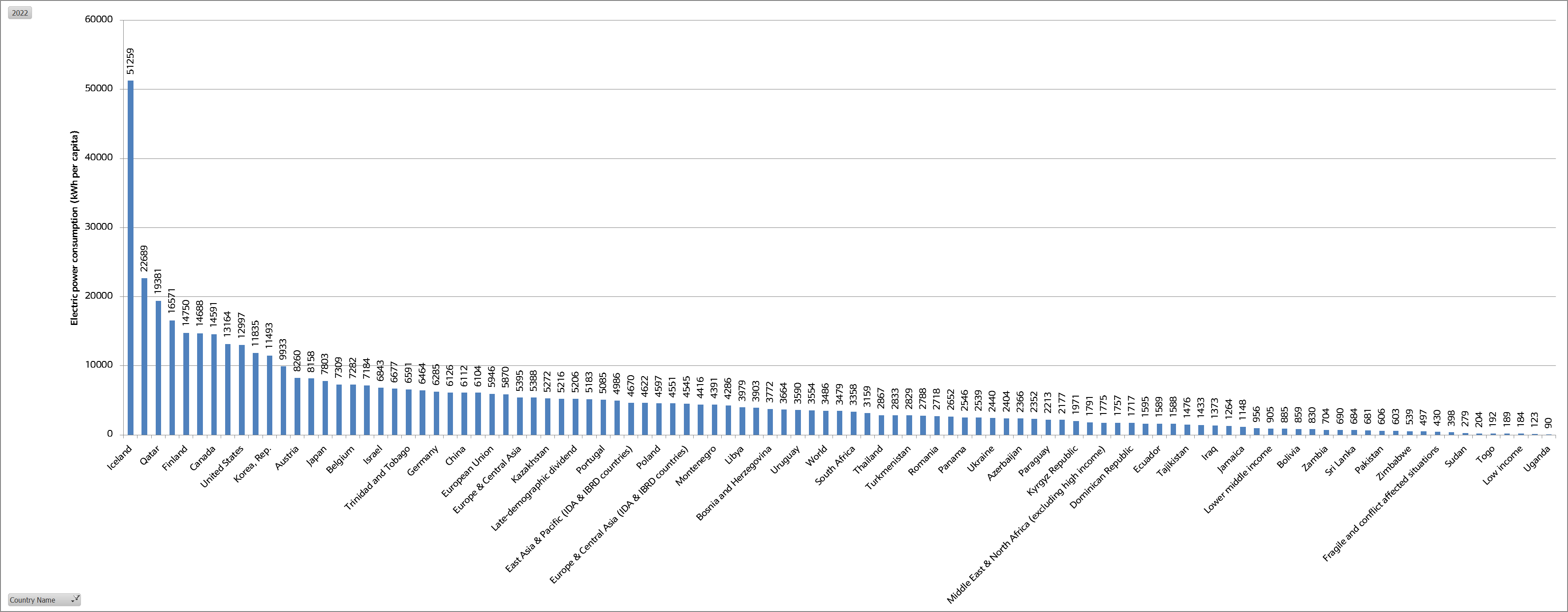

According to World Bank Group data, among 267 different countries, regions, and economies, Iraq ranks 124th in electricity consumption, with an individual demand of 1,373 kilowatts. This is three times less than the global level and neighboring countries, but twice as much as the Kurdistan Region if estimated.

Also, at the Middle East level, Iraq ranks ninth, while the highest average in the Middle East is 5,000 kilowatts. Countries like Bahrain, Qatar, and Kuwait use between 16,000 to 22,000 kilowatts per individual.

Graphic 3: Per Capita Electricity Consumption Demand across Countries in 2022

Source: World Bank Group Report, May 7, 2025

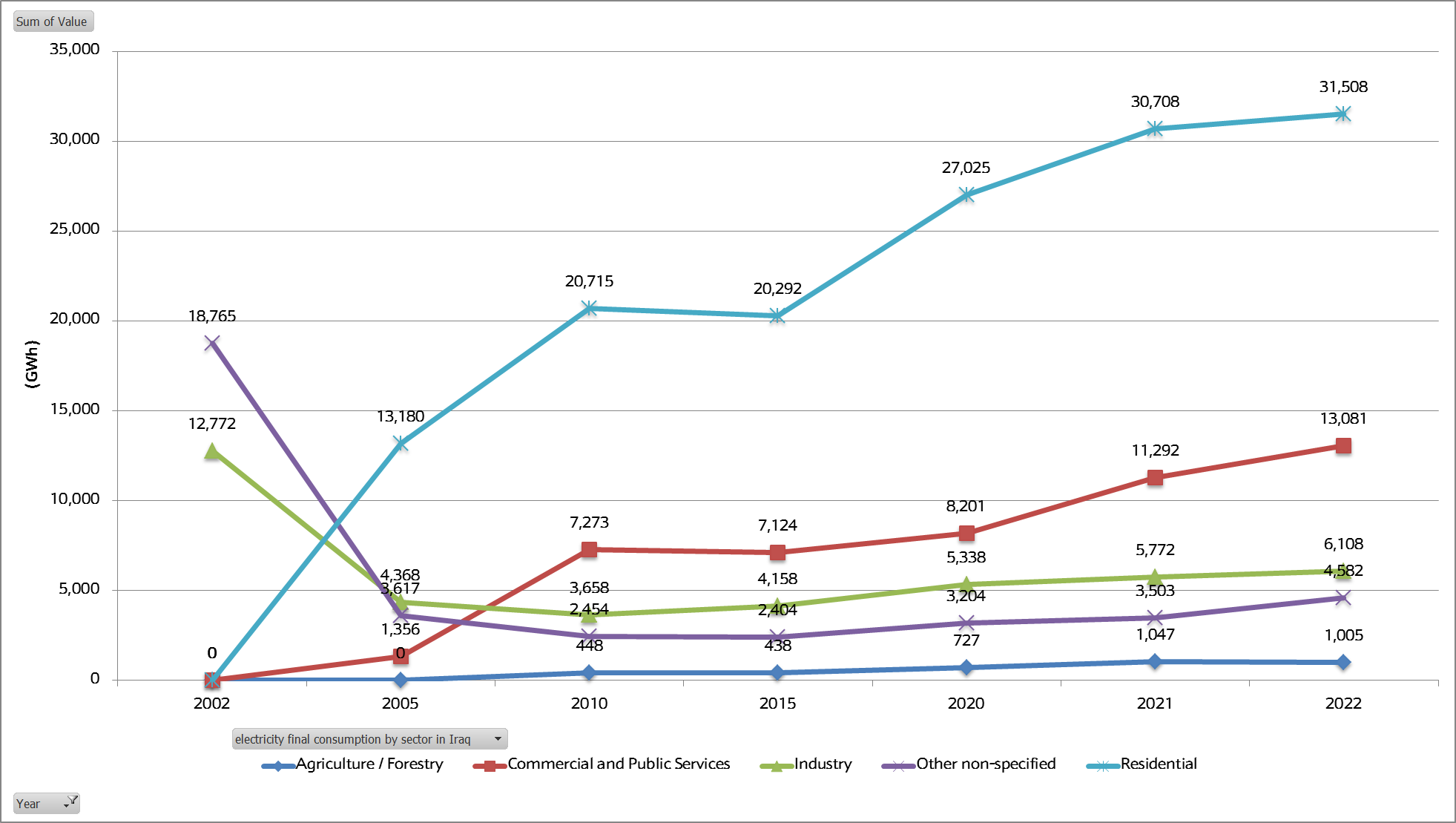

Over the past two decades, various sectors in Iraq have undergone significant changes. In the early 2000s, the industrial sector and other sectors accounted for the highest demand for electricity consumption. However, in recent years, the residential sector and the general population have come to represent half of Iraq’s total electricity demand. Specifically, out of the 70,000 megawatts of electricity required nationwide, 31,000 megawatts are consumed by the residential sector and population. This increase is largely attributable to the doubling of the population and the population’s growing reliance on electricity. In reality, this surge does not correspond to what is typically described as electrification but rather reflects a substantial increase in demand that outpaces production capacity.

A closer examination of the data reveals that electricity demand in the industrial and agricultural sectors has significantly declined. In recent periods, these sectors have experienced only marginal increases, further underscoring the weakness of Iraq’s industrial, commercial, and service sectors.

Graphic 4: Electricity Demand across Key Sectors in Iraq, 2005–2022

Source: International Energy Agency, May 8, 2025

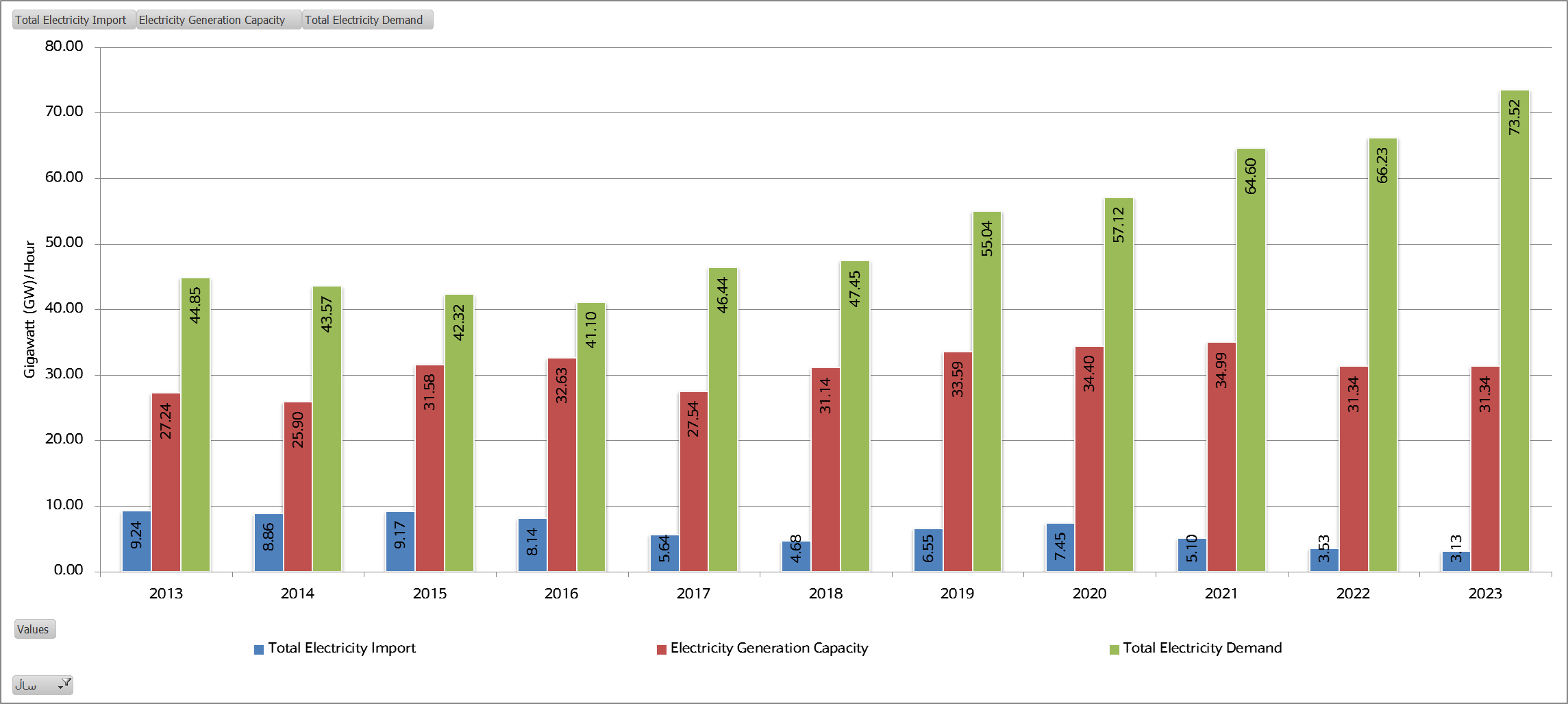

According to the latest International Monetary Fund (IMF) report on countries' economic growth, Iraq's per capita income in 2024 was $6,247 and will reach $6,472 in 2030, an increase of 3.6%. However, during the same period, demand for electricity will increase by 35.3%, meaning the rate of demand increase for electricity is ten times that of the increase in per capita income during this period.

Graphic 5: Per Capita GDP Growth Income in Iraq Compared to Several Countries 2024-2030

Source: International Monetary Fund, May 11, 2025

Electricity Prices in Iraq, the Kurdistan Region, Neighboring Countries, and Developed Nations

In Iraq, a single federal state exhibits dozens of different electricity prices, varying significantly from one neighborhood to another. Prices differ from city to city as if the economic systems were those of several distinct countries. One month the price may be at one level, and the next month it changes entirely—even when consumption remains the same. Despite this inconsistency, the federal government subsidizes 54% of the electricity price for areas under its control and allocates billions of dollars annually to support this subsidy.

The Kurdistan Region faces a similar situation regarding price disparities. Currently, the price for 24-hour electricity in a residential project is 156 dinars per kilowatt-hour, while in a neighboring district it is 110 dinars, and in another city it drops to 18 dinars. Additionally, the price of generator electricity in comparable projects differs significantly. Recently, the Council of Ministers approved a tiered pricing system, which resembles previous models but includes important distinctions.

According to data from 147 countries worldwide on electricity prices, Iraq ranks among the cheapest globally. If the Kurdistan Region’s current national electricity price is calculated, it aligns closely with Iraq’s and is even cheaper, averaging approximately $0.054 per kilowatt-hour. From the fourth quarter of 2023 to the first quarter of 2025, the average electricity price per kilowatt-hour for citizens in Iraqi residential areas was $0.015, placing Iraq as the seventh cheapest among 147 countries worldwide. In comparison, the new average tiered electricity price in Kurdistan currently stands at $0.133 per kilowatt-hour.

While it is true that the new tiered pricing is consumption-based—with prices increasing progressively according to usage, meaning households are not charged for electricity when unoccupied—the structure of the system raises concerns. It remains unclear how the pricing mechanism accounts for the needs of large families, the architectural layout of houses, and the use of imported cooling and heating equipment.

Restructuring demand, reducing sources of waste, and altering how citizens consume electricity are the only effective means to prevent the wastage of public resources—an approach supported by major global institutions. However, the question remains: what mechanisms are currently being implemented to ensure electricity provision for low-income residents with high demand? According to the Light Project, residential electricity prices in the Kurdistan Region currently range between $0.054 and $0.267 per kilowatt-hour, whereas prices vary in other cities and districts. In Iraq, electricity prices range from $0.007 to $0.091, as detailed in Table 3.

The price discrepancy between Iraq and the Kurdistan Region is widening, much like the divergence observed in fuel prices. It is clear that neither Iraq nor the Kurdistan Region can sustain the current approach, as it neither provides reliable electricity to the population nor covers the associated costs. For example, maintaining this approach has resulted in significant debts owed by the Kurdistan Region to electricity production companies and has compelled Iraq to spend billions of dollars on private sector generators. In 2018 alone, Iraq expended $4 billion in subsidies for generators, with the cost of one kilowatt of electricity consumption ranging between $6 and $12 for Iraqi consumers.

A comparison of the new electricity prices in the Kurdistan Region with previous rates reveals a substantial increase, even for low-consumption users, with prices rising by 300%, as shown in Table 3. For consumers using more than 1,600 kilowatt-hours, the price has increased from 72 dinars to 350 dinars per kilowatt-hour. While no significant changes have been made to industrial and agricultural electricity tariffs, commercial rates have been reduced.

Table 3: Electricity Prices in Iraq and the Kurdistan Region

Source: Ministry of Electricity of the Kurdistan Regional Government, May 15, 2025, and Ministry of Electricity of Iraq, May 13, 2025

Note: The exchange rate for converting the price of one kilowatt of electricity from dinars to dollars has been set at 1 dollar = 1310 dinars, based on the Central Bank rate.

Looking at it another way, if we take the general average of these newly proposed tiered prices that link the price to consumption amounts as before, the common or average price of these four tiered prices for one kilowatt of residential use in the Kurdistan Region would be between $0.133 to $0.147 per kilowatt. This new electricity price is similar to countries like Ghana, Serbia, Canada, and Morocco, as shown in Graphic 5.

In reality, price analysis isn't just about kilowatts and consumption amounts, but also includes other metrics like per capita income, community living standards, culture, needs, and production levels.

Now, the Kurdistan Region with its new pricing is completely different from Iraq, while Iraq's financial support for homes and businesses is such that in recent days, it made gas for generators free, and on average, it subsidizes 54% of the cost for residential electricity and approximately 75% of the cost of providing electricity to commercial places, which together amounts to 5.6% of the country's GDP.

Additionally, the amount of money Iraq spent in 2022 and 2023 solely on subsidizing the electricity sector reached $12 billion, meaning this was outside of the actual cost, while some days the hours of electricity provided didn't exceed the number of fingers on one hand.

Graphic 6: Average Electricity Consumption Prices in 147 Countries Worldwide (2023–2025)

Source: Bestboard and Worldreview, May 14, 2025

Differences between Erbil and Baghdad

First, the Kurdistan Region has exceeded its production capacity or demand fulfillment, while Iraq, even with the completion of all its projects, will still have a shortage of 10,000 megawatts.

Second, the Kurdistan Region is in the phase of restructuring demand and providing 24-hour electricity, while Iraq is pursuing the fulfillment of demand that increases day by day.

Third, the Kurdistan Region is moving towards the final phase of ending the use of private generators for electricity supply, but Iraq is trying to provide free gas for generators to supply 20-hour electricity through the government and generators combined.

Fourth, the Kurdistan Region has begun renovating networks and equipment and implementing smart meters to reduce electricity wastage from the electricity produced at power stations to the consumer, but in Iraq, half of the electricity produced is still wasted.

Fifth, the Kurdistan Region is now in the export phase and will take major steps in this regard next year, but Iraq is looking for new sources of electricity imports.

Sixth, the Kurdistan Region, by completing the Light Project despite shortcomings, is ending two important sources of environmental and air pollution, which are smoke emissions and noise pollution. Iraq, in its latest Council of Ministers meeting, is opening more doors to environmental and air pollution by providing free gas support for generators.

What Needs to Be Done?

What Should the Kurdistan Region Do?

First, consider individual and family income and introduce a new system to link income sources and expenses in a way that enables users to pay for what they consume.

Second, differentiation should not be based on consumption tiers but rather on income, or a new mechanism that ensures users without income sources are not deprived of basic necessities.

Third, conduct initial and strategic assessments for the security of energy resource provision in all aspects, such as supply sources, transmission, distribution, and consumption for the present and future.

Fourth, launch campaigns to raise individual and family awareness about energy consumption in all aspects to meet daily needs.

Fifth, make changes to housing structures, if not for all, then at least in investment projects, taking into account global standards for heating and cooling that would reduce total energy consumption in the future.

Sixth, control or implement facilitation decisions for importing electrical appliances that require the minimum amount of electricity for use and assist households in changing their electrical appliances.

What Should Iraq Do?

In general, Iraq should follow the Kurdistan Region's approaches in this sector, whether in terms of supply sources, energy provision, meter installation, waste reduction, reorganization, and electricity pricing. It should also assist the Kurdistan Region with pricing, as it is not acceptable to spend billions of dollars from the federal state's revenue on residents under its authority while depriving Kurdistan Region residents.

Conclusion

From 2003 until today, electricity has remained a major challenge for the governments of Iraq and the Kurdistan Region, particularly during the peak periods of winter and summer. Currently, Iraq and the Kurdistan Region have adopted two different approaches to address this issue: the Kurdistan Region is managing demand by increasing prices, while Iraq is focusing on expanding supply sources to navigate the summer without widespread protests.

Although data on individual electricity consumption in the Kurdistan Region is unavailable, and Iraq’s data cannot be directly used as a comparison, the latest statement from the Light Project team indicates that “50% of subscribers who have had 24-hour electricity for six months have used an average of less than 670 kilowatt-hours.” This consumption level is half of what an average Iraqi individual uses and is comparable to countries such as South Korea, Lebanon, and Bangladesh. If this assessment is accurate, the Kurdistan Region is currently balanced in terms of electricity demand and supply; however, it must secure new sources for the future.

Finally, Ghana’s per capita GDP growth is three times lower than that of Iraq and the Kurdistan Region, while Canada’s per capita GDP growth is ten times higher. Nevertheless, based on the collected data, the electricity prices proposed in the Kurdistan Region are similar to those in these countries. Therefore, electricity prices alone—or per capita income, GDP growth, or consumption levels—are insufficient for comprehensive analysis; rather, all these metrics must be considered together to form a complete understanding.

[i] Although in March of this year, America did not extend the waiver for Iraq to import gas, Iraq continues to import Iranian gas and electricity until now. https://shafaq.com/en/Iraq