Iraq Finalizes Fifth-Plus and Sixth Rounds of Oil and Gas Contracts, Yielding Over 30% Profit for Participating Companies

15-05-2024

Overview

After six years of preparation for another round of oil and gas contracts in Iraq, which included holding several workshops for companies and reviewing contract types by adjusting property ratios and profit participation percentages, 13 out of 29 prepared projects managed to attract investor attention. From May 11 to 13, 2024, in Baghdad, under the supervision of the Prime Minister, the fifth-plus and sixth rounds of contracts were conducted. Apart from Americans, twenty-two companies from around the world participated, with only Chinese companies and a single Iraqi-Kurdish company securing profits of up to 30% after investments.

According to contract data for the projects in the fifth-plus and sixth rounds, only two out of 11 gas fields garnered interest from companies: the Khliesiea gas field in Anbar and Nineveh provinces, and the Qurnain gas field in Anbar and Najaf provinces. Among 14 oil fields, Chinese companies expressed willingness to invest in eight fields at varying rates, leaving six fields unclaimed by any of the 22 participating companies. None of the companies expressed readiness to invest in the remaining oil fields. Moreover, out of the four joint oil and gas fields in these areas, only three attracted investors.

Another point related to these contracts is the content and models, as well as the profit rates of the companies. These rates are similar to those that the Kurdistan Region has signed with international oil companies operating in its fields. Meanwhile, the Iraqi federal government continues to express grievances against the share of oil companies in the Kurdistan Region, which is the main reason for not resuming the export of oil from the region.

In this round, 22 companies from 13 countries indicated readiness to invest in Iraq's oil, gas, and joint fields, but only Chinese and Kurdistan Region companies secured contracts with profit shares ranging from 6.67% to 32%.

Why Did Iraq Implement Profit Sharing in the 5-plus and 6th Rounds?

After twenty years of overseeing oil field operations, neglecting the development of gas fields and allowing the burning of associated gas during oil extraction, managed through partnerships with both state-owned firms and international service contracts, Iraq has struggled to significantly boost production, curb gas flaring, and invest in gas infrastructure. Consequently, it has turned to two fresh contracting models termed "profit sharing" as a solution.

Moreover, despite recent modifications, notably in the preceding round of these two in 2018, Iraq managed to secure numerous contracts, including those with Crescent Petroleum and Total. However, this did not succeed in attracting investment to new fields where Iraqi Oil Ministry companies have not previously operated.

During these two rounds, Iraq embraced profit-sharing agreements, offering both "Exploration, Development, and Production Contracts" and "Development and Production Contracts" (DPC) for both gas and oil fields. These agreements permitted companies to earn profits of up to 30%, a level unprecedented in previous contracts. Over the past two decades, Iraq has struggled to achieve its stated oil production target of 7 million barrels per day, with many wells requiring Enhanced Oil Recovery techniques to revive production. In recent years, international oil majors, notably Exxon Mobil and others, have shown reluctance to invest in Iraq, with several withdrawing from projects. This decline in well development and the absence of new ventures pose a significant threat to the sector, which contributed 93% of the country's total revenue in 2022.

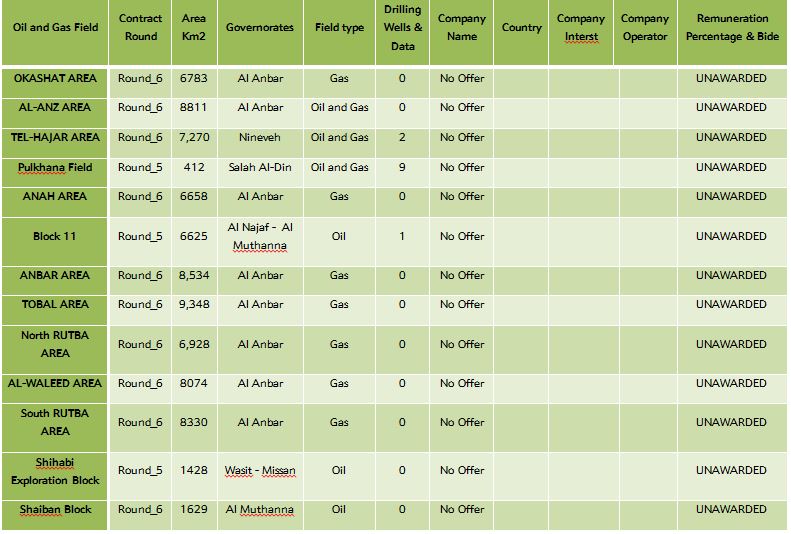

Despite the implementation of profit-sharing agreements, Iraq struggled to garner investor interest in 16 oil, gas, and joint fields. This is despite the fact that research and 2D seismic data were prepared for four of these fields, and test wells have been drilled.

The Percentage of Companies' Profits and Factors Behind Chinese and Kurdistan Region Companies' Investments in Oil and Gas Fields

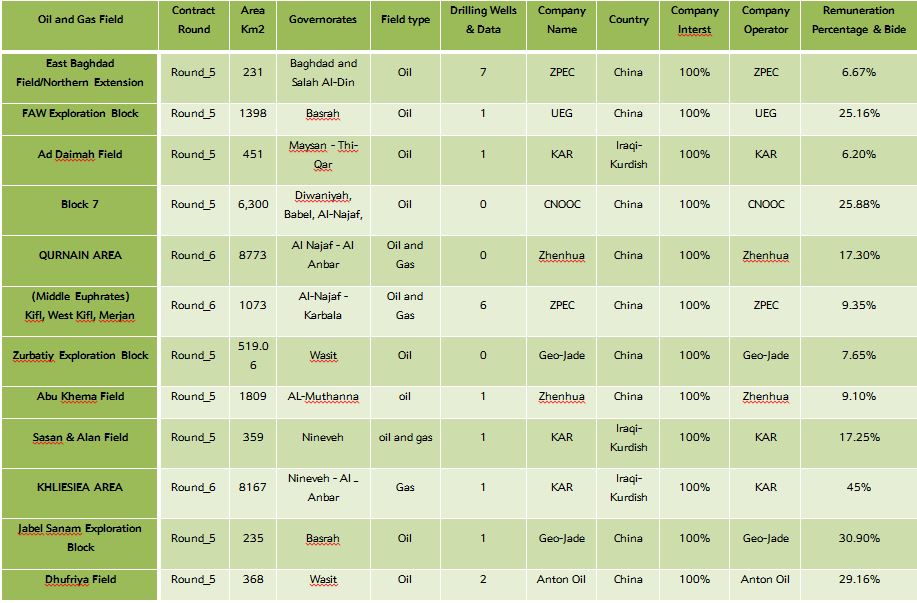

Based on the contract data released over the course of these three days, companies' profit margins surged from 6.667% to 32% post-investment costs, as detailed in the provided table.

Despite the keen interest of energy analysts in the lucrative returns from investments in the signed fields during these two rounds, Chinese firms have emerged as prominent players in Iraq's energy sector, particularly in oil. Notably, they have gained control of three oil and gas fields through Kar Company's involvement in acquisitions.

The growing Chinese presence in Iraq's energy domain, whether through purchasing stakes in oil companies or securing ten contracts for Iraqi oil investment, can be attributed to Iraq's substantial oil exports to China. In 2023, Iraq's oil exports to China amounted to 1.18 million barrels per day, constituting 35% of Iraq's total oil exports.

In 2022, Iraq imported goods worth $14 billion from China, while its oil exports totaled $34 billion, with $33.8 billion stemming from exports to China alone.

Table 1: Details of winners of the fifth-Plus and sixth rounds of oil, gas, and joint contracts in Iraq

Source: Iraqi Ministry of Oil, Contracts Department, May 1 to 3,2024

Kar, the only local Iraqi company operating in the Kurdistan Region, secured three contracts in the fifth-plus and sixth rounds, showcasing the region's private sector's ability to invest in the oil sector, particularly in gas. Two of the fields are oil and gas, while one is solely gas, this demonstrates the company's expertise in oil production and its commitment to minimizing the wastage of associated gas.

Another notable observation arising from the projects in these two recent rounds of oil and gas field developments over the past three days pertains to the availability of information regarding the oil fields. It's evident that fields lacking exploration data and test wells failed to attract investment from companies, as indicated in Table II. Interestingly, despite this, Chinese companies and Kar Company secured contracts for specific fields. Notably, eight out of the 22 participating companies vied for tenders and successfully signed contracts.

Table 2: Details of the 5th and 6th rounds of fields where no company was willing to invest in Iraq

Source: Iraqi Ministry of Oil, Contracts Department, May 1 to 3,2024

Reasons for US Companies' Non-Participation and the Absence of Field Acquisitions by European, Gulf, British, and Russian Companies

The fifth-plus and sixth rounds of Iraqi oil, gas, and joint ventures were initially slated for late April 2024 but were extended by an additional two weeks to accommodate potential investment from US companies. However, despite the extension, US companies not only abstained from participating and submitting tenders but also showed a lack of interest. This indifference can be attributed to concerns voiced by Iraqi leaders, particularly those within the government, about the potential expulsion of Americans on a daily basis.

This uncertainty raises doubts among US companies regarding the safety and protection of their investments in a sector where hundreds of billions of dollars could be at stake. These apprehensions persist despite the ongoing challenges faced by US companies that have previously invested in the oil sector in the Kurdistan Region.

Furthermore, despite the participation of Dutch Shell and British BP, Gulf companies like Qatar Energy and UAE ADNOC failed to secure any contracts in these two rounds. Despite their entry into the competition, UAE companies did not manage to clinch any contracts.

Indeed, two primary reasons could explain the failure or inability of these companies to compete: Firstly, their struggle to compete with firms that secured contracts due to their utilization of inexpensive labor and equipment, as well as affordable technology. Secondly, their focus on investing in renewable energy and their respective governments' agendas to transition towards cleaner energy sources in the future.

While both Gazprom and Lukoil took part in the two rounds, they failed to secure any contracts. This outcome is notable, considering that Russian companies have been actively investing in the energy sector across Iraq, including the Kurdistan Region. However, they are currently facing challenges in receiving payments for their investments, which may affect their willingness to invest further.

Conclusion

What's unfolding in Iraq's oil and gas sector is this: Mohammed Shia Sudani's cabinet has streamlined the contract-signing process, allowing for agreements that secure up to 30% of corporate profits, surpassing the achievements of the two preceding cabinets.

Under this cabinet's tenure, significant strides have been made in energy contract development, ranging from agreements with Total and Crescent Petroleum to the recent signing of 13 contracts in the past few days. Yet, a crucial question looms: amidst diverse political factions, domestic and regional economic interests, and even armed groups hindering Khor Mor gas development, can Iraq effectively execute the strategies outlined by the winning companies? Notably, the implementation phase of these contracts spans the next 20 to 25 years.

In conclusion, the new Iraqi government was expected to enact an oil and gas law within six months to address the longstanding issues between Erbil and Baghdad. However, clarity on this matter is still lacking, and the prospect of exporting approximately half a million barrels of oil per day to the Ceyhan port remains unresolved.