Overview

The halt of Kurdistan Region's oil exports via the Ceyhan pipeline, announced on March 25, 2023, at 4:30 pm, marks a year since its occurrence. However, its repercussions persist, inflicting ongoing damage on the Iraqi Federal Government, the Kurdistan Regional Government, the people of the Kurdistan Region, and both domestic and international companies.

Throughout the suspension period, the estimated loss surpasses $11 billion if the Kurdistan Region were to sell its own oil independently, escalating to $13 billion if Baghdad were to market it at the price of Iraqi oil exports in 2023.

Initially, there was optimism that the issues between Erbil and Baghdad would swiftly find resolution, leading to the resumption of oil exports. However, contrary to expectations, the underlying problems proved to be more political than technical or economic. As a result, the matter of oil exports from the Kurdistan Region remained unresolved, inflicting ongoing damage to all involved parties that persists to this day.

A year has elapsed since the issue arose, and rather than seeing resolution, it appears to be deteriorating with each passing day. According to the latest statement from the Iraqi Ministry of Oil, they claim to have been unaware of the Kurdistan Region's oil production following the strained relations between Erbil and Baghdad. About six months ago, the Kurdistan Region was delivering 80,000 barrels of oil per day to Iraq, but this was halted due to the failure to implement the agreements.

Iraqi officials frequently discuss resolving the issues and moving towards an understanding regarding the Kurdistan oil matter, but the APIKUR's statement on March 23rd stated that they have not received any proposals for solving the oil export issue.

What Prompted Baghdad to Lose $11-13 Billion in the Kurdistan Region Oil Export Issue?

Last year, Iraq won an old case against Kurdistan's oil exports in the International Court of Arbitration in Paris. Consequently, Turkey was ordered to pay Iraq $1.4 billion in compensation, and Kurdistan was mandated to hand over the infrastructure of the oil industry. However, 12 months have passed since the court decision, and Iraq has suffered losses estimated at $11-13 billion

We usually hear that the companies are selling their shares instead of the news that we heard in the past that companies like BP, Shell, and Exxon Mobil, Aramco have made contracts to work in Iraq, but why is that happening?

Last year, Baghdad had $97 billion in oil revenue, although the Ministry of Finance says it was $93.4 billion! Either way, Baghdad could have increased it to at least $108 or $104.4 billion, but it didn't. Why?

Two decades later, after preparing two oil and gas bills and tripling the time promised by Sudani's cabinet to pass an oil and gas law in Iraq, not only has the draft not been sent to parliament but it has also not been completed in the oil ministry!

If Baghdad provided a clear response regarding the billion-dollar losses and the departure of companies, along with implementing transparent measures such as the draft of the oil and gas bill, it would demonstrate a commitment to governing Iraq through cooperation rather than force. Allowing the Kurdistan Government to sell its own oil under their supervision, or having Iraq sell the oil with the proceeds managed by the Kurdistan Region, could have prevented the conflicts between Baghdad and Erbil and avoided the significant economic losses incurred. Such measures would promote transparency and accountability, contributing to the rebuilding and development of the country.

Based on last year's final accounts, the Iraqi Ministry of Finance did not allocate a single dinar to the Kurdistan Region, despite the allocation of 16 trillion dinars in the budget. Recently, the Iraqi Council of Ministers decided to deduct the previously provided loans from the 2023 and 2024 budgets, exacerbating conflicts rather than resolving them.

It has been a year since Western companies began leaving Iraq. Whatever the reasons behind this, it underscores two realities about Iraq: firstly, that the environment is no longer suitable for foreign companies to operate in the oil and gas production sector; and secondly, the current mindset of Iraqi people, especially officials and parliamentarians, towards the workforce of international companies in Iraq.

Costs Incurred due to Production and Revenue from Domestic Oil Sales in Kurdistan

According to data collected from the annual reports of international Oil and Gas companies in Kurdistan Region, the average production was the half last year with a price less than the international one and its revenue was one-third of the income it should have had.

In fact, the issue is billions of dollars, and the numbers show huge economic losses for Iraqi and Kurdish people also for the international Companies.

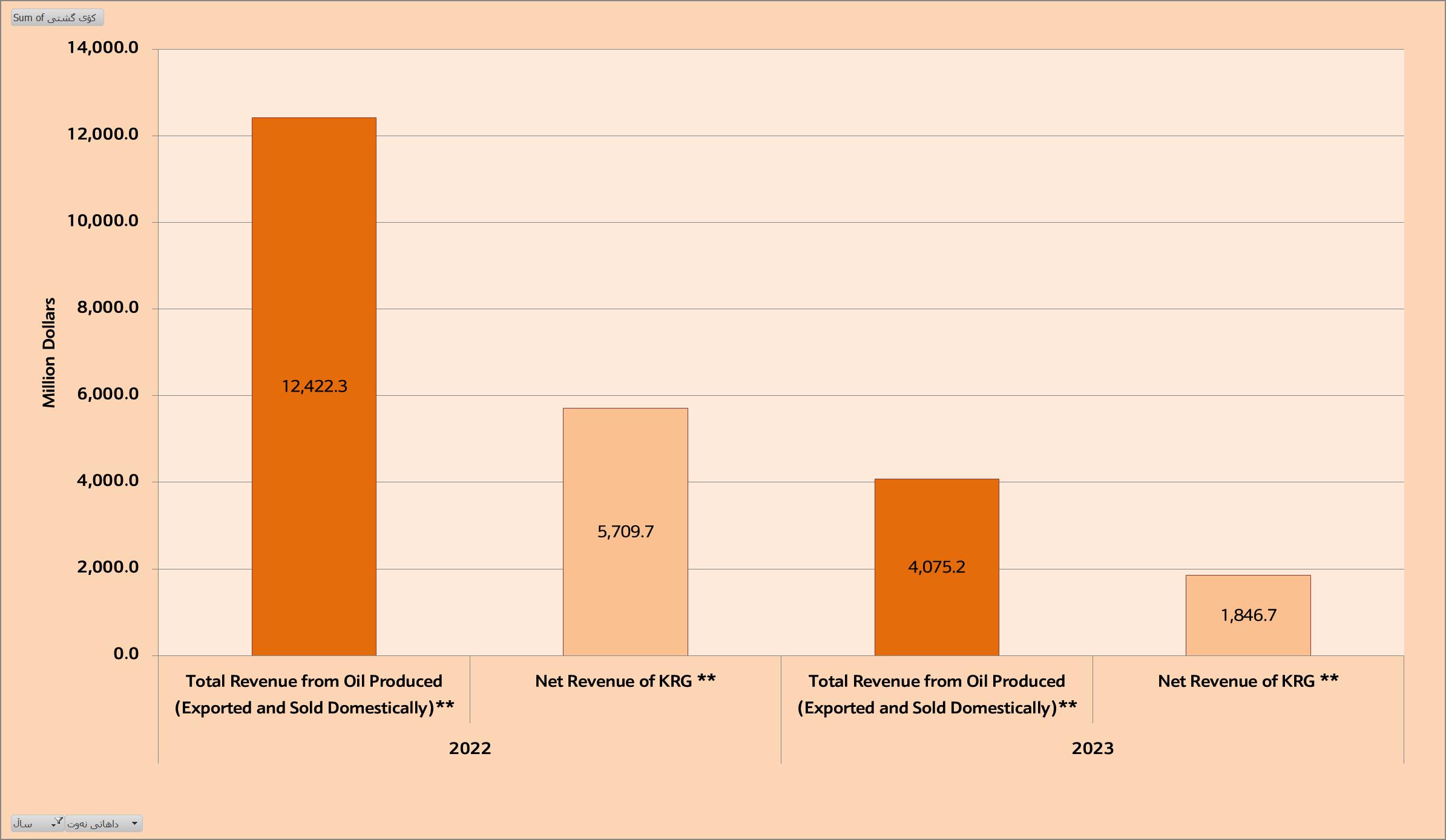

As depicted in the graph below, this loss could have been mitigated if each party had agreed to a reduced amount. Why does Iraq oppose the return of $11 to $13 billion in oil revenues to one of its federal state regions? Such a reduction, equivalent to the entire budget of countries like Syria and Afghanistan combined, begs the question. Furthermore, why do international companies settle for direct sales ranging from $30 to $40, rather than the potentially higher range of $75 to $85?

Graph 1: Contrast in Kurdistan Region's Oil Revenue Before and During Export Suspension (2022-2023).

Sources: Kurdistan Regional Government, open data and Deloitte reports.

Note 1: Data for the second quarter of 2023 is sourced from the Kurdistan Regional Government Ministry of Finance report to the Iraqi Parliament and the Ministry of Finance.

Note 2: The third and fourth quarter revenue was taken from the total sale of crude oil by companies internally by $35.

Note3: The Kurdistan Regional Government's (KRG) net revenue for the second, third, and fourth quarters of 2023 is based on the first quarter, despite companies now selling domestically and receiving advance payments. However, there is no official Deloitte report on the KRG's net oil revenue for the second, third, and fourth quarters of last year. The revenue is estimated to be similar to that of the first quarter of 2023 between the companies and the KRG.

US Pressure's Failure to Influence and Russia's Silence on Kurdistan Oil Export Suspension

In the days following the suspension of oil exports, US officials have covertly and, more recently, openly pressured Iraqis to resume oil exports from the Kurdistan Region. The resumption of oil exports was even set as a condition for the meeting between Sudani and Biden. However, with Sudani's scheduled arrival in Washington on April 15, 2024, it remains unclear whether oil exports will indeed resume or not.

US pressure and corporate lobbying in the US Congress, the British Parliament, and other parties have proven ineffective due to the complex dynamics in Iraq. When pressure is applied to the government, officials often deflect responsibility by claiming that decision-making is beyond their control. Similarly, when politicians are pressured to reach agreements, they frequently assert their lack of authority and influence, further complicating the situation.

On the other hand, Russia has various types of investments in Iraq and Kurdistan. Data shows that Russian investments in Iraq reached 10 billion dollars last year, with most of them concentrated in the energy sector throughout Iraq. Additionally, more than 2 billion dollars are invested in Kurdistan, particularly in the oil industry. Russian companies in the oil sector, such as Rosneft, Lukoil, and Gazprom, are government-owned entities and represent the country's interests, alongside other companies operating in Iraq and the Kurdistan Region.

Months before the decision to suspend oil exports from the Kurdistan Region and after the Federal Court's decision to repeal the Kurdistan Region's oil and gas bill, the Iraqi Oil Ministry warned international oil companies in the Kurdistan Region that they would be blacklisted. However, Russian companies operating in both the Kurdistan Region and central and southern Iraq have not been affected by this decision and have continued their operations in the Kurdistan Region.

Now that a year has passed since the political decision to suspend oil exports from the Kurdistan Region, why have they remained silent from the beginning until now? Rosneft owns 60% of the pipeline exporting oil from the Kurdistan Region through the Ceyhan Port, and Gazprom produces oil and gas in the Sarqala and Hasira fields, which are suffering daily losses. They are silent because they don't want to lose the $8 billion they have invested in central and southern Iraq. Even if exports were resumed, they couldn't profit as before due to American sanctions on Russia.

Conclusion

It's evident that Turkey's initial statements regarding technical pipeline issues, promises of $1.4 billion in compensation by Iraqi officials, and the Kurdistan Regional Government Minister of Natural Resources' statement on production cost agreements, alongside ongoing efforts by Iraqi officials to resume oil exports, have failed to yield results. This suggests that the issue is more political than economic or technical.

Small and large companies operating in the energy sector, particularly oil and gas, are interconnected and mutually supportive. For instance, when one company invests in this sector, another company may provide exploration and equipment, while yet another manages production and transportation. Despite the ease of conducting business, this approach in Iraq has not only led to withdrawals but also discouraged them from venturing into gas and oil production in Iraq.