Intro

In the upcoming days, Bahrain will host the 2022 Manama Dialogue again. The Manama Dialogue is scheduled from November 18th to the 20th of the same month. It is worth noting that this year's edition focuses on energy security rather than security and military issues. The International Institute for Strategic Studies (IISS) has worked on these two sectors in the past few years. However, this year's edition differs from the one it managed previously.

The title of the 18th session of the Manama Dialogue is "Rules and Competitions in the Middle East". However, according to the conference agenda this year, it begins with a speech from the President of the European Commission, Ursula von der Leyen. Her speech will be coming at a very important time because we are approaching the cold months daily, and the issue of energy and securing it for the European Union countries is a priority. This is at a time when the crisis of the Ukrainian-Russian war, food security and climate change are also major themes of the conference.

Unlike previous rounds, this time, the issue of energy security and the role of Middle Eastern countries, especially GCC, in resupplying or participating in the EU energy security supply chain is a serious matter. However, Saudi Arabia and the UAE have recently been against this request. Europe is now looking to meet its energy needs away from Russia. But so far, Europe still needs to fully assemble its markets and has yet to end its dependence on Russia. Europe insists on completing this scheme despite the high-cost difference.

During the first 10 months of 2022, what is noticeable in the energy market, especially for Europe, is the decrease in gas imports from Russia and the doubling the US gas imports. This change means a new energy map is expected to take shape in a year or two despite Stopping or continuing the Russian-Ukrainian war.

The continuation of the sanctions imposed on Russia and snowy areas increasing were reasons to hold the 27th UN Summit on Climate Change in Sharm el-Sheikh. The summit focused on ensuring energy security for the world, especially Europe, instead of reaching NET zero and climate change.

The energy security issue now is not only about ensuring demand and supply or balancing prices in the energy market. However, it is also about the security of the supply chain and energy investment (conventional and renewable energy), ensuring the security of energy transmission, and building new lines of alliances between producers and consumers for decades to come. This report will focus more on the causes of market turmoil and energy security in the world.

Causes of market turmoil and energy security in the world

The global energy market especially, oil suffers from several significant factors. The most important factors are natural disasters, technical issues, geopolitical crises, and global economic recession. However, despite all this, it is expected that oil will remain one of the main factors in global energy for the coming years, mainly because of the transport sector. From this standpoint, OPEC countries are intensifying their efforts to raise production levels and demand investment in this industry while calling for governments and institutions allied with the International Energy Agency to move away from traditional energy and invest in renewable energy.

On the other hand, natural gas markets have historically been divided into regional markets. That is sources of supply within regions and regions were connected to consumers through pipelines. Liquefied gas was considered an alternative, but the reality shows the opposite in a way that ends the natural gas market between neighboring and regional countries. In fact, a new and different market will be born like the one we are just witnessing now.

In short, we will mention the three leading causes of energy market turmoil and concerns for energy security. We will focus on the changes that will occur in the energy market.

1. Satisfy current needs, not the future needs!

The 27th United Nations Climate Change Summit was held in Sharm El-Sheikh recently. The summit discussed the transition to clean energy, how to prevent climate change and provide financial resources for poor countries to face climate change, how to ensure global energy security, control oil and gas prices, and change energy transmission lines between energy producers and consumers. Keeping the people warm this winter is more critical for energy-consuming countries, especially Europe, than preventing climate change catastrophes in the upcoming years.

Since 2020, most companies have expected to reduce investment in conventional and renewable energy, but now, says the BP CEO, "policymakers should focus on developing plans to maintain energy security and supply capacity. Also, reducing emissions and changing energy policy not only for governments but also for the policies of large energy companies. The main seven oil and gas companies (the Seven Sisters) alone recorded profits exceeding $173 billion in the past 9 months. The gains were as follows.

- Exxon Mobil's, $70B

- BP, $20B

- Shell and Total, $ 59B

In fact, 31.4% of Europe's need or demand for natural gas is for electricity and heating, 24% for homes, 22.6% for industry, 10.6% for services, and 11.4٪ for other uses. This shows approximately 50% or more is related to humans, so it must be completed on time and guaranteed to be obtained.

2. Investment in the energy sector (oil, gas and renewable energy)

During the beginning of the pandemic and the drop in oil prices below zero, the decision-makers of major companies such as Exxon Mobil, BP, Chevron, Total, and even national companies such as Aramco, Dubai National Oil Company, China National Oil Company, etc., decreased spending and investment in the sector. Besides the cost decline, in those days, they were moving towards net zero, protecting our planet, avoiding oil and gas use, and investing in renewable energy instead. This made companies change their spending to invest in renewable energy; according to Aramco's GM, "Investment in oil and gas will halve between 2014 and 2021, and the increase last year is too little and too late in the short term."

Therefore, some experts see the current energy crisis as the impact of the war in Russia and Ukraine creating this crisis is equal to the effect of declining investment in this sector. This month, the International Energy Agency released its "Global Energy Outlook 2022," noting that "a significant increase in energy investment is important to mitigate the risks of future price hikes and volatility while simultaneously sticking to the net-zero plans by 2050." Similarly, the Petroleum Exporting Countries (OPEC) issued its "2040 World Oil Outlook," calling on investors to invest $12.1 trillion in oil to ensure global energy security and meet demand over the next two decades, $300 billion more than last year.

3. Turning point in communications in terms of providing energy security

The restructuring of energy in terms of relations makes Europe head to the United States and leave Russia to ensure its energy security. The European Union has used a cheap and sustainable energy source for many years, so Russia recently laid a new line. Opening the pipeline was the only thing left to activate it, but Russia's invasion of Ukraine stopped the Russian state-owned company this project. However, now there are talks about closing the old channel and all ways of exporting natural gas.

According to BP, about 65% of energy in Europe comes from oil and gas. Before the Russian-Ukrainian war, Europe's dependence on Russia was 40%, but now dependence decreased to only 17.2% during October.

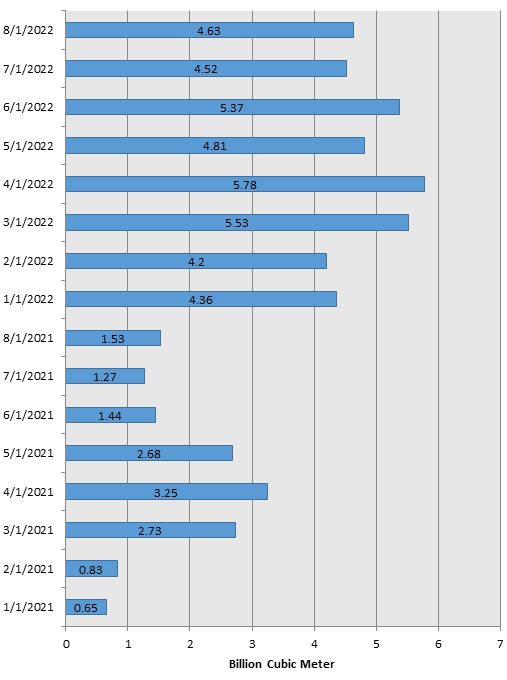

On October 3rd, the US-EU Joint Commission on Energy Security announced that it had met to implement the March agreement between Joe Biden and Ursula von der Leyen, which aims to help the EU diversify its natural gas imports. According to the agreement, the United States is obligated to send a more considerable amount of LNG to Europe, and the US is obligated to increase of 15 billion cubic meters over the amount previously exported in 2022 compared with 2021 exports. In fact, from January 2022 until October 2022, the US exported 48 billion cubic meters of LNG to Europe, as shown in the first chart. This means it increased by 26 billion cubic meters compared to 2021. According to the joint committee, the increase in exports in 2023 compared to 2021 is expected to reach more than 50 billion cubic meters. Above all, the joint committee discussed how to engage the military in ensuring supply chain security and replenishment in 2023 so that prices reflect the economic base and the mutual push of both sides for energy market stability. US LNG exports are also expected to reach more than 70 billion cubic meters in 2023, an increase of 50 billion cubic meters over the amount exported to Europe in 2021, which was 22.34 billion cubic meters.

To conclude, the Russian-Ukrainian war showed so many things to producing and consuming countries in all aspects. Especially in energy, it was proven that the only way to guarantee their needs is through domestic attempts, and they should fulfill their energy need locally. Relying on foreign sources can put you in an unpredictable position. But the big question is what does it mean to move away from Russia and turn towards the United States and its allies in ensuring energy security and markets and restructuring relations? Considering Europe will change the path of transportation only, and will not change the supply source, so far.

The only security source for local needs is local production and not dependence on external sources, but this may only be true regarding the type of allies and the existence of relationships. Because the turmoil in the relations between Russia and the European Union made Europe turn its back on Russia and head towards the US.

Finally, energy relations and security formation are broader than consuming and producing countries. It is also about big corporations, traders and various networks of interests, such as the Seven Sisters (Exxon, Chevron, Shell, BP, Texaco, Golf and Mobil) that have played a role in shaping energy policy for nearly a century in terms of exploration, production, export and even usage rights. Characters like these seven sisters may have had financial, technological and human resources from the middle of this century. But the settlement of oil companies begot seven new sisters. Sisters who control a third of the world's oil and gas reserves and production, such as Aramco, Gazprom, China National Petroleum Corporation, National Iranian Petroleum Corporation, Petróleos de Venezuela, Petróleo Brasileiro and PETRONAS of Malaysia. Therefore, it will be challenging to discuss the changes behind the reshaping of the energy map in the world because new personalities and new interests have emerged that want to play a role in reshaping the energy map in the world, whether it is traditional or renewable.