Overview

Over the past 15 months, the narrowing of differences between Erbil and Baghdad has not led to a final agreement to export oil to the port of Ceyhan. Despite the losses incurred from keeping the pipeline shut, it remains uncertain when oil exports will resume. Reports indicate that the latest trilateral meeting between Baghdad, Erbil, and international companies made no progress in the negotiations. Baghdad's insistence on the budget-stated cost of oil production and the companies' demands to safeguard their contractual rights, especially their financial entitlements, remain significant obstacles.

According to the content of the oil contracts and the annual reports of companies operating in the Kurdistan Region, two major differences between these companies and Baghdad are unlikely to be resolved in the current negotiations. These differences pertain to the cost of producing a barrel of oil and the method of recovering invested capital and profits.

Iraq produces and sells the world's second-cheapest oil after Saudi Arabia, with a production cost of $2.16 per barrel. However, the total cost from production to sale reaches $10.57 per barrel.

The cost of producing a barrel of oil varies by country, field, and management model. For instance, it costs $24 per barrel in the United States and $21 in Norway. In Nigeria, recent contractual changes have increased production costs from $28.90 to $48 per barrel.

This report, based on production sharing contracts (PSCs) in the Kurdistan Region and the annual reports of companies, examines the differences between Baghdad and the companies regarding the cost of producing a barrel of oil and the financial entitlements of the companies investing in the Kurdistan Region.

Oil Contracts and Financial Entitlements of International Oil Companies

According to the oil contracts, the Kurdistan Region has not only guaranteed the protection of the rights and financial entitlements of the companies, but also established mechanisms based on the age of the contracts for the different stages of investment and operation. These stages include exploration, discovery, development, and production.

According to the contracts, international companies have outlined three financial entitlements: production costs, recovery of investment, and profits over the contract's duration. This report elaborates on a financial eligibility framework for international oil companies operating in the Kurdistan Region, considering the general model of Production Sharing Contracts (PSC) and specific contracts for the Sarta, Atrush, and Erbil oil fields. It involves three scenarios, referred to as the "R factor" in contracts, calculated by dividing total revenue by total expenditure.

Scenario 1: According to the Production Sharing Contracts (PSC) and specific contracts for the Sarta, Atrush, and Erbil oil fields, if expenses exceed revenues, the company will receive 32% of oil revenues after deducting a 10% royalty from the produced oil. This amount covers production costs, invested capital, and profits, predominantly the former.

Scenario 2: When revenue exceeds expenditure by two and a quarter times, the company receives between 14% and 32% of the oil revenue. Similar to the first scenario, this covers production costs and invested capital.

Scenario 3: For international oil companies in the Kurdistan Region, once revenues surpass expenditures by more than two and a quarter times, the company will receive 14% of oil revenue, covering production costs, invested capital, and profits. This stage is marked by further recovery of production costs and increased profitability.

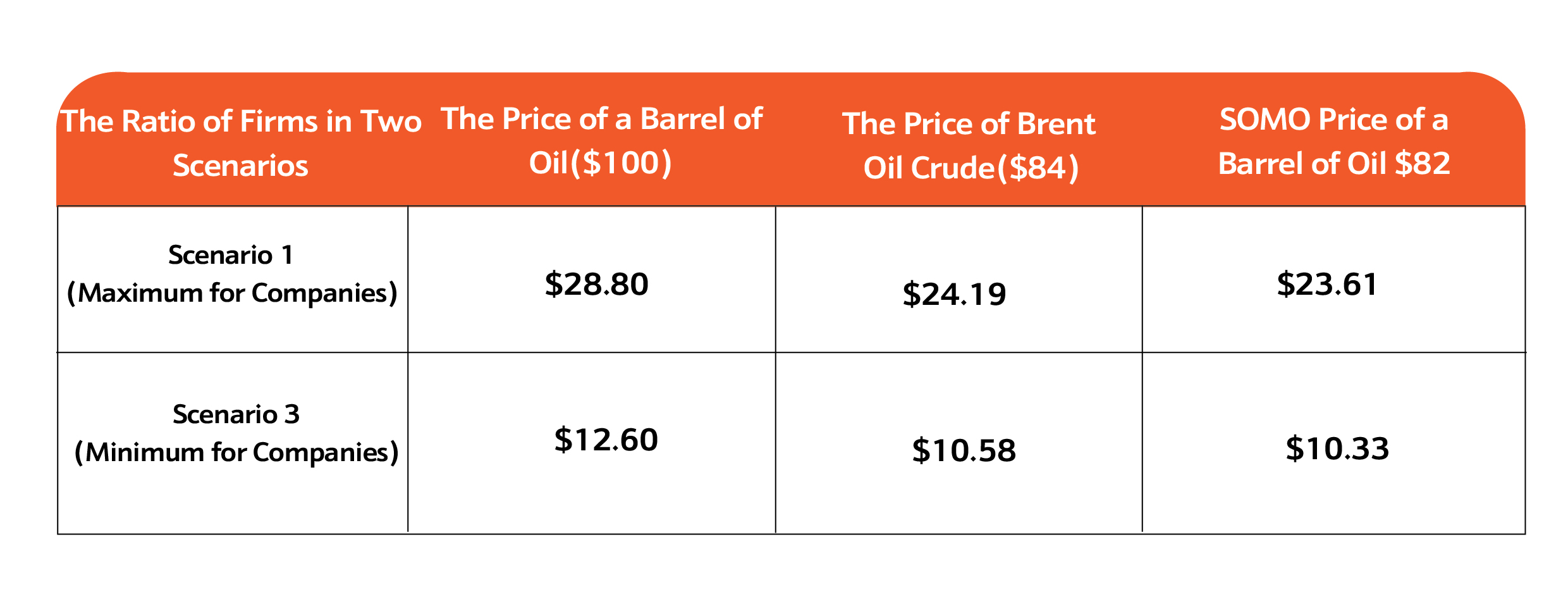

In Table 1, two scenarios depict how the revenues from a barrel of oil produced in the Kurdistan Region are allocated as financial entitlements to the companies.

For example, if oil is priced at $100 a barrel, or according to SOMO or Brent prices, the maximum initial financial entitlement to companies under their contracts is $28.8 and the minimum is $10.33, more than two and a half times the amount Baghdad has proposed for companies for oil production in the Kurdistan Region.

However, according to information, most of the companies operating in this sector of the Kurdistan Region are still in the first scenario, not the second or third, the Kurdistan Region has also been in debt to those companies due to the difficult economic situation over the past decade.

Table 1: Financial entitlements of international oil companies (including production costs, investment expenses, and profits) for one barrel of oil production from inception to contract completion in the Kurdistan Region.

Source: Ministry of Natural Resources, Contracts Department, June 26, 2024

Notes:The companies have not yet entered the third scenario because, despite the ongoing oil export lock, international oil companies (IOCs) continued investing and developing the fields, incurring ongoing investment costs.

The current price of oil produced in the Kurdistan Region differs from the international market price (Brent). Therefore, a new mechanism was introduced between the companies and the government after March 2023, where companies receive payment directly for the oil sold at varying rates.

These rates are determined by the production sharing contracts for the Sarta, Atrush, and Erbil oil fields in the Kurdistan Region. The highest rate for companies' initial entitlements is 32%, while the lowest rate is 14%.

Baghdad's Proposal on Oil Barrel Pricing in Kurdistan

After a year and three months of bilateral and trilateral negotiations, Baghdad continues to adhere to its initial proposal for exporting oil through the pipeline to the port of Ceyhan, amounting to 16.8 thousand dinars for companies, covering production costs, investment expenses, and profits as outlined in the 2023 and approved 2024 budget tables. However, this figure alone closely matches the cost of producing a barrel of oil in the Kurdistan Region.

In reality, Baghdad's principal proposal in the annual budget for oil production in the Kurdistan Region aims to align costs similarly to fields in central and southern Iraq, targeting total oil production costs of $11 to $12 per barrel, comparable to the $10.57 per barrel in central and southern Iraq.

The cost of producing a barrel of oil varies significantly across countries, contract types, and individual fields. For instance, in Brazil, the production cost per barrel is $9, but when factoring in operational, investment, transportation costs, and taxes, it rises to $34.99 per barrel. In contrast, Iraq's production cost is $2.16 per barrel, and in Saudi Arabia, it is $3 per barrel. However, the total cost in Iraq amounts to $10.57 per barrel, while in Saudi Arabia, it is $8.98 per barrel, the lowest worldwide.

Moreover, within Iraq, the cost of producing a barrel of oil varies significantly, even reaching up to five times the set cost of oil production in the Kurdistan Region, particularly evident in fields operated by the Ministry of Oil. An illustrative example is the production cost of Qayara oil, which recently ceased production due to costs exceeding $30 per barrel.

According to data from the Erbil oil field in the Kurdistan Region, the operational cost to produce a barrel of oil is $10.7. This figure solely represents the production cost per barrel, excluding additional expenses such as investment, transportation, and marketing. This substantial disparity underscores the need for companies to pursue protective measures for recovering investments and profits within these contracts, despite their accrued debts.

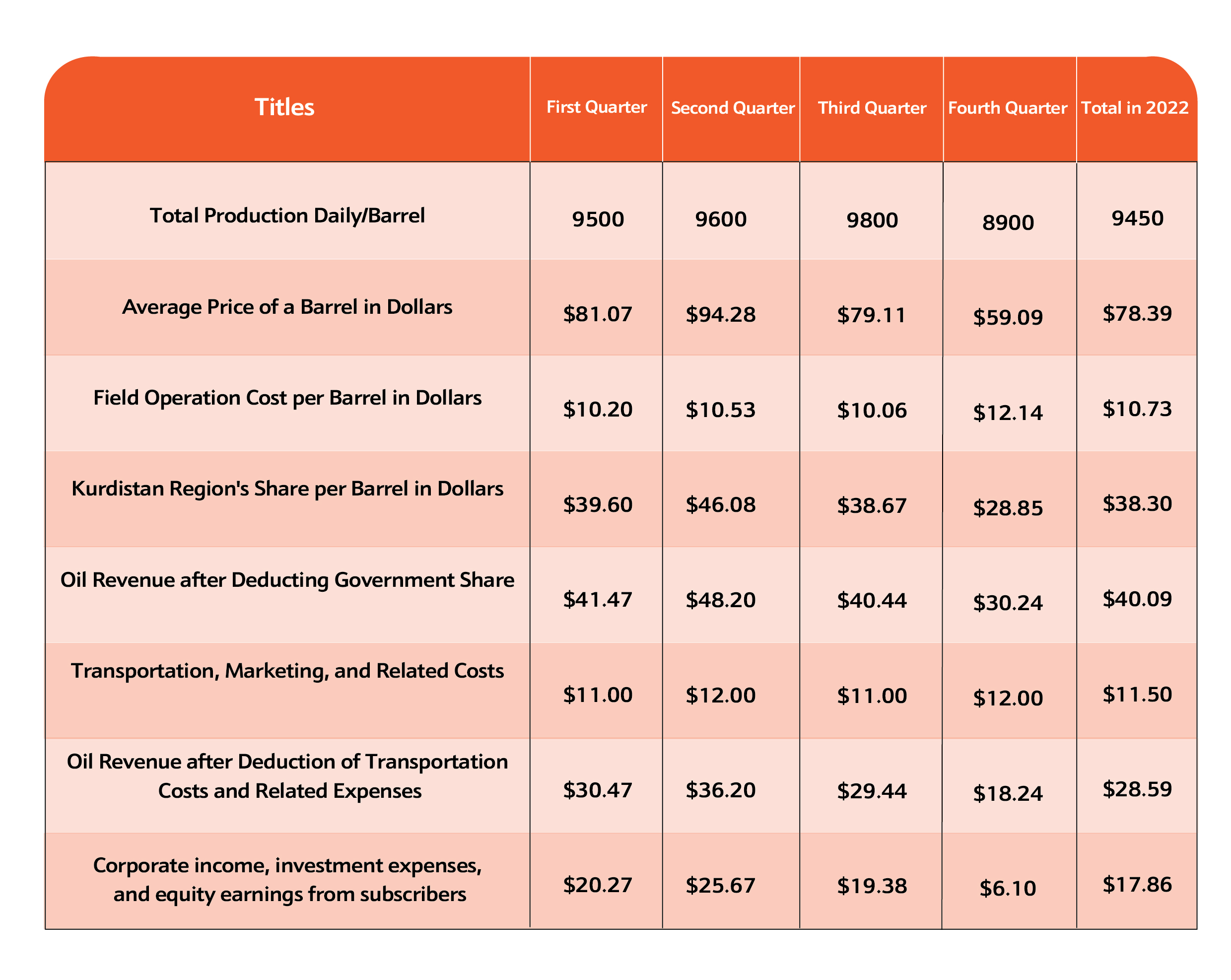

According to its annual report, Forza Petroleum averaged 9,450 barrels of oil per day in 2022 before the pipeline closure, selling at an average price of $78.39 per barrel, with an operational and production cost of $10.73 per barrel.

In 2023, the Iraqi Ministry of Finance reported an overall expenditure of 12.9 trillion dinars for the Ministry of Oil. Ministry of Oil reports on production and exports that year indicated 1.66 billion barrels produced and 1.23 billion barrels exported. Analyzing the funds allocated by the Ministry of Finance to the Ministry of Oil for that year reveals that the cost per barrel of oil exceeded the set production cost per barrel in the Kurdistan Region.

Table 2: Revenue and Expenditure per Barrel of Oil from the 2022 Operations of the Erbil Oil Field by Forza Petroleum

Source: Forza petroleum Annual Report, July 1, 2024

Note 1: The report includes only the amount of oil produced, the price of each barrel of oil sold, and the cost of production, estimating oil transportation fees and companies' entitlements as capital expenditures and profits.

Note 2: According to the contracts, the KRG will receive up to 20% of the companies' final profits.

Conclusion

Currently, IOCs in the Kurdistan Region are selling oil domestically, a practice deemed detrimental by all parties involved. However, companies can sustain this practice because domestic sales yield significantly higher immediate cash flows than Baghdad's proposed terms, potentially double the amount.

For Baghdad to facilitate the re-export of Kurdistan oil to the port of Ceyhan, it must address several fundamental challenges in agreement with Erbil:

- Differentiate the cost of oil production in the Kurdistan Region from that in central and southern Iraq.

- Reach a balanced solution on the model of oil production sharing contracts entered into by companies.

- Collaborate with Erbil to settle the debts owed to oil companies that have operated for years without receiving their entitled payments, given the challenging economic conditions in the Kurdistan Region.

- Resolve the issue of Turkey's compensation to Iraq, especially concerning the Paris Court of Arbitration's ruling requiring Ankara to pay $1.4 billion to Baghdad.