One Content and Two Interpretations; New Oil and Gas Contracts in Iraq and the Fate of the Contracts in the Kurdistan Region

15-12-2023

On February 6, 2024, the Iraqi Oil Ministry is set to unveil the victors of the fifth+ and sixth rounds of oil and gas contracts covering 30 fields. While major firms from the United States and Britain have opted out, Chinese and Russian companies are eager to expand. Notably, the French have reached a historic agreement, and there are calls from the Gulf, particularly Saudi Aramco, for a reevaluation of the contract structures.

The five+ round addresses oil and gas fields that lacked investor interest in 2018 in Iraq. The pivotal change lies in the EDPC (Exploration, Development, and Production Contracts), or without exploration what modifications in these DPCs are anticipated to entice investors for the development of 30 oil and gas fields in Iraq.

The initiation of DPC Total Energy's 60,000 barrels per day development and production contract in the Artawi field has captured investor interest, notably due to reduced "minimum expenses and minimum labor costs." Furthermore, there's an anticipated significant decrease in the previous 25% royalty rate set in EDPC contracts. Despite alterations in production sharing contracts, now based on a percentage of commercial production rather than a fixed 10,000 barrels, companies stand to receive varying profit percentages from oil or gas sales after deducting investment, operating, and royalty expenses.

Returning to the essence of the title and the Kurdistan Regional Government's contracts with global oil and gas firms, any disparities in rates hinge on factors like investment risk, data accessibility, drilled well, and political and economic capabilities of Iraq as a whole reflecting a continuity with the approach taken by the Kurdistan Region over the past two decades.

30 Oil and Gas Fields in New Contracts in Iraq

For nearly 15 years, Iraq collaborated with local companies and service contracts, aiming to boost oil production and minimize associated gas wastage. Unfortunately, these efforts fell short, leading to the current need for Enhance Oil Recovery in many wells. After nearly 18 years, attempts by major oil companies to invest in the sector in the fifth round of contracts were implemented in some ways, such as contracts with Crescent Petroleum and Total, but this failed to bring investment to new fields, which are new and are not operated by the Iraqi Oil Ministry companies. Consequently, contract forms were revised to adopt a PSC (Production Sharing Contract) model, aiming to attract much-needed investment.

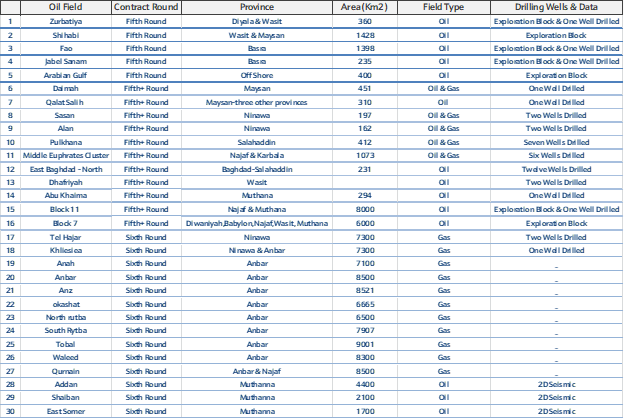

In its pursuit of international investment, Iraq has thoroughly revised its 2018 oil and gas contract model. The focus now spans 11 gas fields and three oil fields in the sixth round, followed by 11 oil fields and five oil and gas fields in the five+ round.

Amendments have been made to the clauses of the "Exploration, Development and Production Contract" (EDPC) and "Development and Production Contract" (DPC) In the second method fields have undergone exploration, with 2D seismic data and test wells have been drilled. Among the 30 new oil and gas blocks and fields poised for investor allocation, only seven require exploration. In contrast, during the 2004-2012 oil and gas contract signings in the Kurdistan Region, no 2D seismic or tested wells were available. Presently, 48% of revenue goes to the Kurdistan Regional Government, with 52% allocated for investment, operating expenses, and profits from the invested capital.

In the oil and gas sector, what is currently observed is that the Sudan's cabinet has streamlined the process of signing contracts, surpassing the progress of the previous two cabinets. Particularly, the energy contracts that have been signed are highly developed. Whether it's the signing of contracts with Total, Crescent Petroleum, or the approval of Exxon Mobil's departure and the expansion of Chinese and Russian companies. However, considering the bigger picture, after two years of signing, meetings, and activities, only one official project has been launched under Total's contract.Examining the information presented in Table 1 reveals that the gas fields earmarked for the sixth round are situated in Iraq's central and northern provinces. Some of these areas fall under dispute according to Article 140 of the constitution and the Kurdistan Regional Government.

Despite this, Baghdad views them as integral parts of the Iraqi state, not in dispute, as emphasized by Iraqi Oil minister, "Most of the contracts signed are in areas that are not disputed."

The timing for signing and implementing these contracts is crucial, as it is directly influenced by the resolution of energy-related matters between Erbil and Baghdad, along with finalizing Iraq's oil and gas law, impacting negotiations and waiting for the agreement can affect the process, and conversely, the negotiation progress can influence the timeline for the agreement and implementation.

Table 1: Round five+ and six gas and oil contracts by provinces and types.

Source: MEES Magazine, No. 40, October 6, 2023, and proposed contracts for the fifth round, fifth+ and sixth round.

Kurdistan Region's Oil Contracts: Between Baghdad Demands and International Oil Companies' Demands

On December 5, Epicor, the Kurdistan oil companies, once again emphasized the need to "protect their contractual rights," consistently voicing this demand both formally and informally. This development aligns with recent discussions following the Sudani's visit to Erbil, where a delegation from the Iraqi Oil Ministry indicated progress, also stated by Iraqi Oil Minister, "We are on the verge of an agreement, emphasizing oil exports from the Kurdistan Region via the port of Ceyhan. However, certain adjustments, particularly in the contracts, need resolution in the coming period."

Regrettably, the issues have persisted for over eight months and 10 days. During this time, all companies have resorted to selling oil domestically at half the global market price. This has resulted in significant harm to the companies, the general budget of the Iraqi state, and the Turkish state and companies. Above all, the government and people of the Kurdistan Region have borne the brunt of these repercussions.

Constitutionally, the Iraqi constitution addresses oil and gas through Article 111 and Article 112. However, these articles lack details on managing and formulating the country's oil and natural resources policy, deferring this responsibility to the yet to be released oil and gas law. Even after two decades, the timeline for its release remains uncertain, potentially awaiting the fulfillment of a party's dominance and objectives within the law.

The focus now shifts to the Iraqi government and the oil ministry as they decide on amending oil agreements with the Kurdistan Regional Government. As per the April 2023 agreement between Erbil and Baghdad, this matter is expected to be addressed post oil exports, not before. The Kurdistan Region inked oil and gas contracts based on the August 6, 2007, Oil and Gas Law, later deemed unconstitutional by the Federal Court on February 6. Should these agreements be modified, they face the exposure of two realities:

First, are the agreements legal and amended, or illegal and renewed? If they are legal and amended, what will happen to the Federal Court's decision that declared them unconstitutional and illegal?

Second, What does it signify for the Iraqi Oil Ministry to have signed an agreement with Crescent Petroleum to invest in three oil and gas fields in Diyala and Basra provinces, with implementation set to commence on November 15, 2023? This raises questions, given Crescent Petroleum's operations in the Kurdistan Region and its previous warnings against engaging with the Kurdistan Regional Government, as highlighted by the Federal Court and the Paris Court of Arbitration decisions. Is the gas and oil agreement distinct, considering Crescent Petroleum's compliance with the Kurdistan Regional Government's oil and gas law and the PSC production sharing contract, allowing the company to expand and boost gas production, even export to areas under Baghdad?

Conclusion

If the signing and announcement of the fifth and sixth round agreements fail to capture the interest of global oil and gas companies for investment in Iraq, then additional measures should be taken to attract international firms to invest in the country.

Over the past nine months, the suspension of oil exports has incurred daily losses of approximately $9 billion for all parties involved. Several questions arise: why is the Iraqi government hesitant to receive even half of the $80, especially when resuming oil exports in the previous manner and overseeing the oil sales could generate revenue? Presently, it has been more than eight months and 10 days without receiving any proceeds from this process, despite the 2023 Iraqi budget projecting a daily revenue of $28 million. The second question is why oil companies are willing to sell oil at $33-39 per barrel but are hesitant to sell it at a price close to Brent, which is $80 these days. Do they profit from the $40 range by selling domestically, as they do from the $80 range to Ceyhan Port, or what is the truth behind their pricing strategy?

The third question concerns Turkey: initially, Turkey, under the pretext of earthquake damage in North Kurdistan and Turkey, barred exports. However, now it claims to have officially notified the Iraqi government and demands daily compensation for the damage. Has Iraq recently pardoned the debt or Turkey have paid compensation as per the Paris court decision, or is this a recurring tactic whenever an issue surfaces to impede oil exports from the Kurdistan Region?

The contracts in Iraq have undergone modifications, leading to investments by Crescent Petroleum and Total Energy. These changes mirror contracts in the Kurdistan Region, albeit under distinct names and with reduced rates favoring investment companies, as outlined above. Essentially, the contracts for these two new rounds are Production Sharing Contracts (PSCs), akin to those in the Kurdistan Region but differentiated by their titles.