Overview:

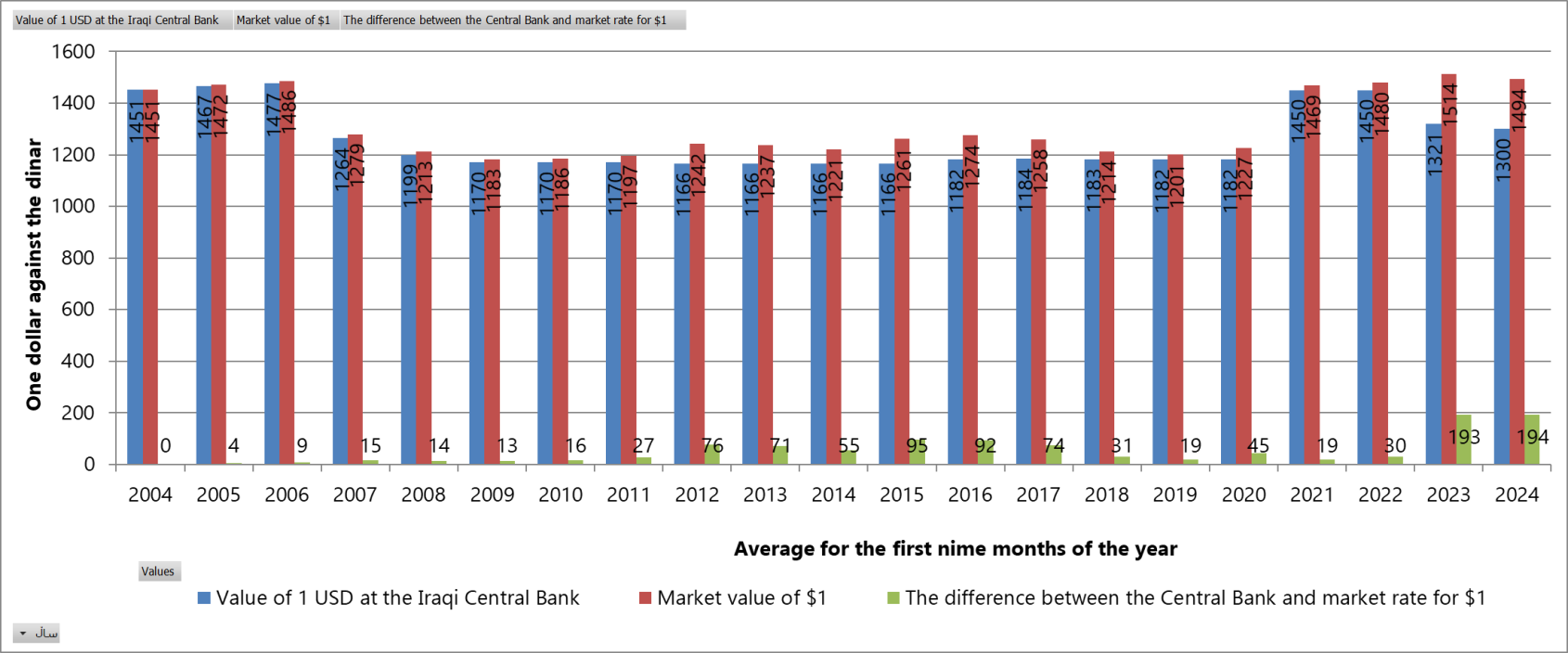

Over the past two decades, the gap between the value of 100 US dollars at the Central Bank and in Iraqi markets has widened, increasing from an average of 5 dinars to 194 dinars this year. This disparity highlights significant risks to the future of the Iraqi Dinar. The Iraqi currency’s value is not tied to market forces such as supply and demand, bank interest rates, inflation, or the balance between imports and exports. Instead, it is determined by the state, exacerbating concerns about the fragility of the country's financial and economic system.

There are various accounts and discussions regarding the methods of exchanging dinars for dollars at the Central Bank, the market's daily demand for dollars, and the outflow of dollars from Iraq. Central to these discussions are the Central Bank's figures and procedures for issuing dollars through remittances and cash, the amount of printed Iraqi dinars, and the revenue generated from oil sold in dollars. Additionally, the flow of dollars into Iraqi markets, from Basra to Zakho, raises questions about the specific numbers of Type A foreign currency exchange companies authorized to exchange dinars for dollars at the Central Bank. Why are these companies able to receive 1,310 dinars per dollar, while the market rate exceeds 1,530 dinars per dollar? Furthermore, what are the total numbers of currency exchange companies across Iraq, including the Kurdistan Region? Why are currency exchange companies in the Kurdistan Region excluded from receiving 1,310 dinars per dollar, and why are airports in the Kurdistan Region unable to provide dollars to tourists?

In this report, we will focus on the sixfold discrepancy between the Central Bank and market rates for one dollar, and examine how this gap could change if the Central Bank were to issue more or fewer dollars. To explore these questions and the future of the Iraqi dinar, we will analyze data from the Central Bank, the Central Statistical Agency of Iraq, and market trends to provide insights.

How do currency exchange companies acquire dollars from the Central Bank and resell them in the market?

According to the Central Bank's data, there are 1,333 currency exchange companies in Baghdad alone, and 600 more across other Iraqi provinces, excluding the Kurdistan Region, bringing the total to 1,933 companies in central and southern Iraq. If we include the Kurdistan Region, the total number of currency exchange companies in Iraq would exceed 2,500.

According to the data, there are 88 Type A companies registered with the Central Bank in Iraq, more than 57 Type B companies, and 300 Type C companies. Only Type A companies, along with several banks, are eligible to apply to the Central Bank to purchase dollars in cash.

Indeed, these numbers fluctuate daily for two main reasons. First, the formation of new companies, as Type A companies are created through the merger of two Type B companies or one Type B and five Type C companies, while a Type B company is formed by merging 10 Type C companies. As a result, the numbers are not fixed and vary over time. The second reason is the closure of companies, whether due to being blacklisted, having their dollar requests denied, or involvement in money laundering activities.

The federal government is currently working to regulate the dollar market, control remittances, and prevent the outflow of dollars by shutting down all Type C companies and currency exchange offices across Iraq. As part of this effort, it has called on the Kurdistan Region to take similar measures to close these types of companies, which make up the majority of exchange businesses operating in the region.

For nearly a year and eight months, the only way to bring dollars into the market has been through Type A companies and dollar applications submitted by citizens traveling abroad, except to countries sanctioned by the United States. Each citizen is allocated $3,000, down from the previous amount of $7,500. This process involves company representatives stationed at the airports of Baghdad, Basra, and Najaf, where applications can be made either at the airport or at designated offices.

In the past two years, the Iraqi Central Statistical Agency has not published detailed data on the number of tourists arriving and departing from Iraq, which was previously included in its annual reports. For 2023, however, it only announced the total number of arrivals and departures at all airports, exceeding 9 million tourists.

In fact, the number of Iraqi tourists traveling abroad and the supply of cash dollars to these tourists do not align for two key reasons. First, many tourists now use visa cards, as most countries are moving toward cashless transactions. Second, airports, currency exchange companies, and even Umrah pilgrims in the Kurdistan Region are excluded from accessing the 1,310 dinar exchange rate per dollar.

Although the average value difference for $100 remained nearly unchanged in the first nine months of this year compared to the same period last year—193 dinars in 2023 and 194 dinars in 2024—the Central Bank issued only half the amount of cash this year. This highlights that the market is not directly influenced by the Central Bank's daily cash issuance, as the difference should have doubled by now. Refer to Graph 1 for the trend in the value difference between the Central Bank and market rates for the dollar from 2004 to 2024.

Graph 1: Central bank and market value for one dollar and their difference over the first nine months of 2004-2024

Source: Central Bank of Iraq, Sales Window, 2-10-2024

Currently, fluctuations in the dollar market and currency exchange offices in the Kurdistan Regional Government (KRG) operate contrary to the Central Bank system. On days when the Central Bank issues fewer remittances and more cash, the value of the dollar rises against the dinar. This is counterintuitive, as the increased issuance of cash dollars should lower the dollar's value. However, due to the Central Bank's rejection of official remittance requests and the ongoing demand for the rejected amounts, companies turn to the market and currency exchange companies for remittances, driving up the dollar's value against the dinar.

How much and how are dollars remitted and disbursed daily?

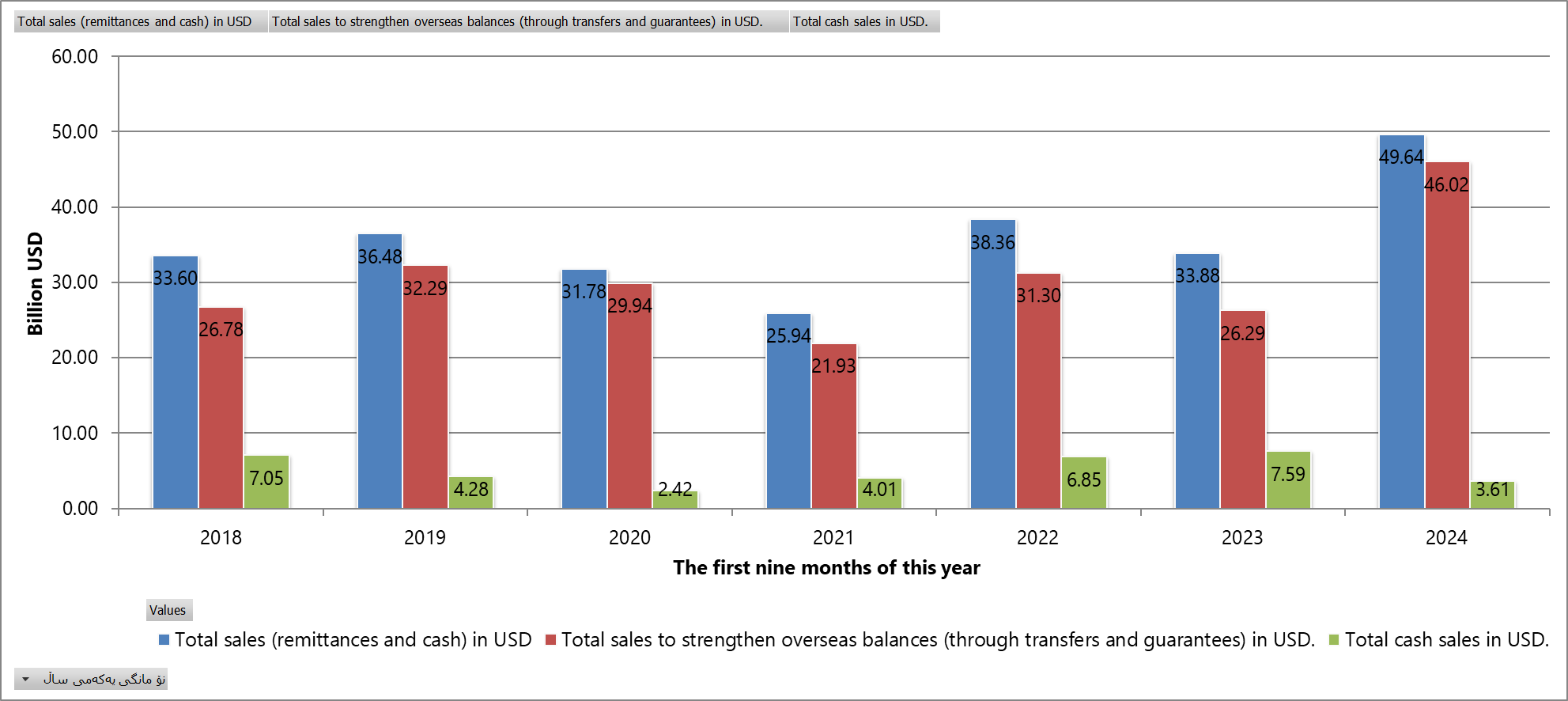

In the first nine months of this year, total dollar disbursements through the Central Bank’s sales window reached $49.6 billion, consisting of $46 billion in remittances and $3.6 billion in cash. This represents a 46.7% increase in dollar issuance compared to the previous year, according to Central Bank data.

The Central Bank's tightening of cash issuance, along with measures to control dollar outflows through remittances and a decline in cash inflows from the United States, resulted in $3.98 billion less cash being issued in the first nine months of this year—less than half of what was issued during the same period last year.

Despite the introduction of new guidelines and measures for issuing dollars to the market, the value of the Iraqi dinar remains unstable, fluctuating daily by 1,000 to 3,000 dinars for every $100 in the market. The gap between the Central Bank and market rates continues to widen. This instability is not solely driven by economic indicators or Central Bank policies but is also influenced by political and security developments, fluctuating commodity prices—especially oil—and public confidence in the future of the Iraqi currency, all of which impact its value in the market.

According to Central Bank data, the supply of dollars to the market and the Iraqi market's demand for dollars have been unclear in recent years. Despite higher revenues this year compared to the past three years, the Central Bank has issued fewer dollars, as illustrated in the second graph.

Graph 2: Dollar issuance by the central bank in remittances and cash in the first nine months of 2018-2024

Source: Central Bank of Iraq, Sales Window, 2-10-2024

Income in Dollars, Expenditure in Dinars: A Gap of $1 Trillion and 100 Trillion Dinars

The future of the Iraqi dinar is largely dependent on U.S. policy rather than Iraq's own monetary policy, as 99% of Iraq's oil and products are sold in dollars. Although one-third of this oil is sold to China, Iraq has been unable to trade in yuan despite efforts to diversify currency use. This is due to the lack of a trade balance, not just with China, but with other countries as well.

Over the past two decades, Iraq's oil export revenues have exceeded $1 trillion, yet the country's total gross domestic product reached only $253 billion by 2023. This highlights Iraq's dependence on a consumer-driven economy and reliance on imports of goods and services. To meet these needs, the government remitted $46 billion overseas in the first nine months of this year.

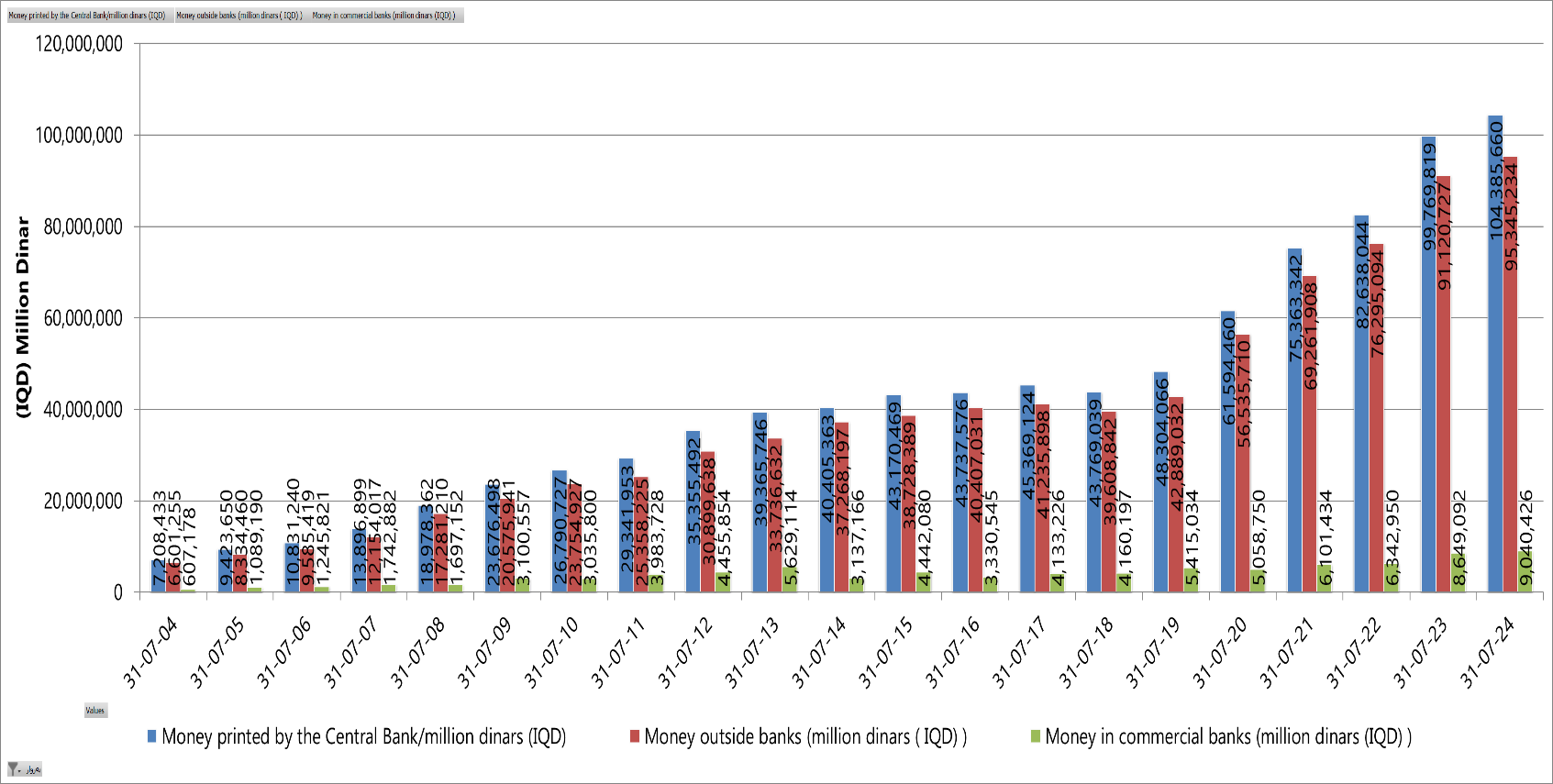

Another aspect of Iraq's revenue in dollars and expenditure in dinars is the Central Bank's printing of over 104 trillion dinars in the past two decades. Of this, 95 trillion dinars are held outside commercial banks, while 9 trillion remain within the banking system. This highlights the weakness of Iraq's banking and financial system and the low level of trust its population has in both banks and the state.

The increase in Iraq's printed currency over the past two decades has accelerated significantly in recent years. For example, in 2019, the total amount of printed money was half of what it is today. As shown in the second graph, on July 31, 2019, the total printed currency stood at 48.3 trillion dinars, whereas by July 31, 2024, it had risen to 104.3 trillion dinars.

Graph 3: Total Iraqi money printed by the central bank, those in banks, and those in the market 2004-2024

Source: Central Bank of Iraq, Sales Window, 08-9-2024

Reasons Behind the Fluctuations in the Dinar’s Value Against the Dollar in the Market

The value of the Iraqi dinar against the dollar fluctuates because, unlike Gulf or Asian countries where market forces like inflation and bank interest rates influence currency values, Iraq's currency value is determined by the state. This approach makes the dinar more similar to currencies in Iran and Turkey, where government control plays a larger role in setting exchange rates.

According to the Central Bank's currency database from 1995 to 2024, only currencies from countries with market-linked, sanctioned, or unstable economies have experienced significant daily, monthly, and annual fluctuations. As a result, more than 30 low- and middle-income countries have seen their currencies lose 10 percent of their value against the dollar. Despite an increase in the issuance of dinars in 2023, Iraq’s real market value has also declined against the dollar, according to World Bank data.

In fact, the reasons behind the fluctuations in the value of the dollar in Iraq, as we see these days, there may be other stories about the Iraqi dollar, in cash, going out to other countries, but not through the dollar markets in Erbil, Sulaymaniyah, Basra, and Baghdad because what is presented in cash and the central bank's figures is less than half the value of Iranian exports to Iraq, let alone the Iranian state through the market to get dollars.

An official channel for exporting dollars from Iraq to other countries, including Iran, was recently uncovered, involving a banking network and the Federal Reserve Bank of New York. A notable example is the case of Ali Ghulam, a 42-year-old Iraqi who owns three banks—Al-Ansari, Al-Qabid, and Al-Sharq Al-Awsat. He allegedly withdrew billions of dollars from the banking system and transferred it abroad. In late 2022, the U.S. Treasury blacklisted his banks on charges of money laundering.

Conclusion

The widening gap between the Central Bank and market rates, which was initially zero, has grown due to various complex and contradictory factors, leading to a weakened future outlook for the Iraqi dinar against the US dollar. The key factors include:

- Continued reliance on cash, with trillions of dinars held by capitalists, fueling market movement.

- A lack of public confidence in the Iraqi currency and banking system, driven by past experiences, which deters people from keeping their capital in banks.

- The tendency of Iraqis to hoard foreign currency, especially dollars.

- A doubling of the Iraqi printed currency in less than five years, despite declining revenues and increasing debt relative to GDP growth.

- An inefficient banking system that struggles to manage remittances, leading to continued outflows of dollars through dollar markets, even in small amounts.

- Discrepancies in the accuracy of financial data, such as an unexpected decrease in total printed money from 2017 to 2018, despite overall trends indicating annual increases.

- The real value of the Iraqi dinar against the US dollar may align more with the market rate rather than the Central Bank’s set rate.

- A lack of trade diversity and balance, with Iraq heavily reliant on imports of thousands of goods and services while primarily exporting only oil and its products.