Review of the Kurdistan Region Oil Production in 2024 and the obstacles to its export in 2025

12-03-2025

Overview

All eyes were on the tripartite meeting in Baghdad that took place last week between international oil companies (IOC) and officials from Erbil and Baghdad, which ended without results. This comes after Baghdad had previously announced that the resumption of Kurdistan Region oil exports via pipeline would happen in the coming hours. This did not happen because the international oil companies that have invested in the Kurdistan Region and produce approximately two-thirds of the total Kurdistan Region oil are not willing to put oil into the pipeline under the current terms agreed upon between Baghdad and Erbil.

In reality, amending the cost of producing a barrel of oil to $16 in the Iraqi Parliament and the implementation of the law was an important step, but the lack of clarity in the mechanism of payment to companies in the past and future, as well as the issue of the law's commitment which is only for two months from its issuance, did not resolve all the problems and allow oil exports to resume.

Now, after the budget amendment and setting the cost at $16 per barrel of oil, three main problems have emerged in the oil exportation process. First, the Kurdistan Region's request to agree on the amount produced and the amount of oil allocated for domestic needs. Second, the companies demand a written agreement regarding their debts, the protection of their contracts, and the method of receiving payment for produced oil and continuous exports. The third is the Iraqi government's commitment to the amount produced and exported in 2025.

Despite those three problems, there is also the issue of the expiration of the export pipeline contract between Turkey and Iraq, which ends this year and must be renewed. Ankara also has new demands. According to the collected data, the average daily oil production level of the Kurdistan Region in 2024 was 314 thousand barrels of oil, which is approximately 100 thousand less than the amount allocated in the budget as the Kurdistan Region's share in exchange for delivering oil to SOMO.

In this report, we examine the production levels of oil fields in the Kurdistan Region field by field and the possibilities for how Kurdistan Region oil can be reexported to the Ceyhan port. Our main focus will be on the balance of power and why each time one party comes forward, the other party increases its demands or vice versa.

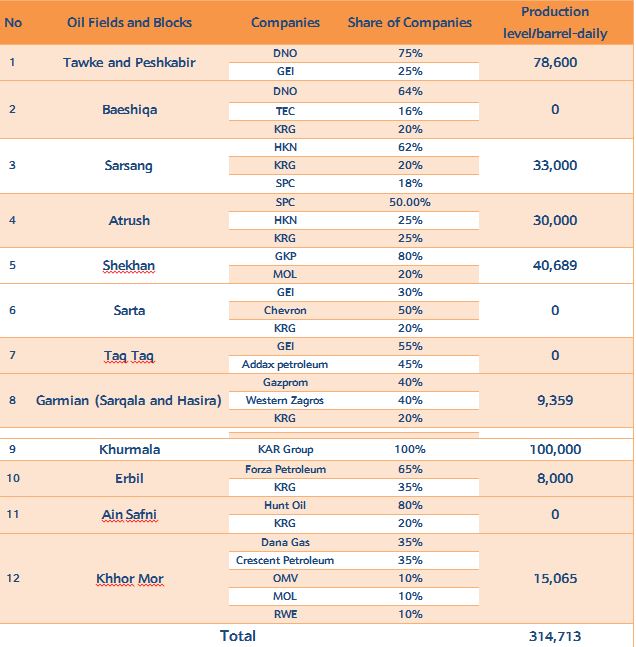

The Kurdistan Region produced over 314 thousand barrels of oil daily in 2024

Last year, various statements were made regarding the amount of oil production in the Kurdistan Region, and the international companies operating in the Kurdistan Region have not returned to pre-March 2023 levels due to domestic sales and the continued closure of the oil export pipeline, which had the capacity to produce half a million barrels of oil daily. However, now it has decreased to 314,713 barrels of oil per day, which not only falls short of the amount specified in the budget to be delivered to SOMO, but it is also requested that the domestic needs of the Kurdistan Region be deducted from this and provided.

The largest oil field in the Kurdistan Region is the Khurmala oil field, which has now seen its production level drop to an average of 100,000 barrels of oil per day, whereas previously it was twice that amount, and before the closure of the oil export pipeline, approximately 180,000 barrels of oil were produced from this field.

After Khurmala, the Peshkabir and Tawke oil fields are considered the second largest oil fields, operated by DNO company. Its production level in 2024 reached over 78,000 barrels of oil per day, whereas before March 2023, it had approximately 105,000 barrels of oil per day.

As shown in the first graphic, what is noteworthy and requires attention is the oil production level at the Taq Taq oil field, which, on average, was zero last year. Since May 2023, Genel Energy company has suspended operations there and has submitted its termination file to the Kurdistan Regional Government. This field, in the early days of Kurdistan Region's oil exports in 2014, produced over 103,000 barrels of oil per day. However, due to the deterioration of the field's geological structure in 2017, its production level dropped to below 5,000 barrels per day. According to Genel Energy's report, the oil field still contained reserves of 23.4 million barrels of oil in 2023.

Additionally, the oil fields of Sheikhan, Sarsang, and Atrush are now working at full production capacity, with the highest production levels in 2024 being Sarsang oil field at 33 thousand, Atrush at 30 thousand, and Sheikhan at over 40 thousand barrels of oil per day.

The Sarqala and Hasira oil fields production level in Garmian, according to data collected from tankers, reach over 9,000 barrels of oil per day. However, since the end of August, production at the Chia Surkh field has been halted, which had a daily production level of 2,000 barrels of oil per day.

The current amount that the Kurdistan Region produces cannot meet both domestic needs and the specified amount as stated in the budget because in the past period, it has expanded the refinery sector and despite dozens of illegal refineries that have received investments and are operating. The current capacity of the active refineries - Kar, Lanaz, Qaiwan, Dukan and Fox - has reached a daily refining capacity of over 200,000 barrels of oil.

Graphic 1: Oil production levels in 2024 in the Kurdistan Region's oil fields

Source: Official publications and oil companies as follows:

Points 1 and 2: According to 2024 https://www.dno.no/en/investors/announcements/dno-results-reflect-robust-kurdistan-production-north-sea-expansion-2025-02-06/

Points 3 and 4: According to collected information and Shamaran company's report, HKN company, after buying Taqa's shares in the Atrush field, deleted all financial publications and production reports from its website and until now has no new publications as it manages both the Sarsang and Atrush fields.

Point 5: According to Gulf Keystone company's report at https://www.gulfkeystone.com/operational-corporate-update-january-2025/

Points 6 and 7: According to Genel Energy company's report, https://genelenergy.com/media/press-releases/

Point 8: Information for this field was obtained from tankers leaving the field daily, which is 43 oil tankers, consisting of 10 tankers of 30,000 liters and 33 tankers of 36,000 liters daily. For seven months, the production level of 2,000 barrels of oil at Chia Surkh has been completely halted.

Point 10: According to information collected from Erbil fields, their daily production amount is between 40 to 45 tankers daily, which averages between 8 to 9 thousand barrels of oil, and in this report, 8 thousand barrels of oil per day has been recorded, because Forza company has not had a new report since 2023.

Point 12: According to Dana Gas's annual report, in 2024, the level of condensate gas production was sold domestically, with the company's share being 35%, which it has set at 5,273 barrels, meaning the total production of the field was 15,065 barrels. https://www.danagas.com/wp-content/uploads/2024/11/20241104-9M-2024-Investor-Presentation-V3.pdf

Conclusion

Although there is no legal obstacle to exporting oil by allocating $ 16 for production costs and Baghdad and Erbil agree to export the oil by pipeline, what about the demands of international oil companies that, because of their dominance, require new demands and written guarantees?

Also, it is true that initially Baghdad may not want all of it due to commitment to OPEC's specified production and export levels, but even if it's for domestic use, they certainly want, as they say, proper accounting for it so that the cost of a barrel of oil doesn't end up being twice as much. Does handing it over to SOMO mean exporting it or selling it domestically?

What about the domestic needs of the Kurdistan Region, which in recent years has seen an expansion of the oil refining sector and establishment of new refineries due to the availability of oil domestically? This is in addition to the question: Will domestic sales have the same global price or the current price? Also, how will the provinces of the Kurdistan Region be treated - will the subsidized gasoline price here become like Baghdad and other areas?

From March 2023 until March 2025, there have been various statements and demands, good and bad news regarding the resumption of Kurdistan Region oil exports to the Ceyhan port. What can be seen is that while the issue is between Erbil, Baghdad, and the companies, each phase clearly shows the dominance of one party and the compromise of another through the changes. Until the days before the approval of the budget law amendment, the issue was the cost of a barrel of oil, but now for the companies, the issue is the debt from the six months before the suspension of oil exports; for the Kurdistan Region, it's the amount for domestic needs; and for Baghdad, it's resuming exports as soon as possible because the Trump administration is demanding it.