The Washington and London Agreements: Future Prospects for Oil and Natural Gas Relations between Erbil and Baghdad

26-05-2025

Overview

On May 19, 2025, the Ministry of Natural Resources of the Kurdistan Regional Government signed two contracts in Washington for the development of both the Miran and Kurdamir fields with HKN and Western Zagros. Four months before that date, Iraq's Ministry of Oil signed a memorandum of understanding in London for the development of four Kirkuk oil fields with British BP, and subsequently, on February 26 and March 26, 2025, all contracts were signed for BP to begin operations in Kirkuk.

Washington's contract was quickly rejected by Iraq's Ministry of Oil, and after a short period, it regretted and again demanded adherence to the constitution, just as four months ago, when BP and Iraq's Ministry of Oil signed their agreement, the Kurdistan Regional Government demanded that Baghdad comply with the articles of Iraq's constitution regarding the participation of the Kurdistan Regional Government.

These new contracts have two aspects: first, the investing countries, and second, the type of contract for gas production. This has made the response greater than the value, which is estimated at $110 billion, because if we analyze BP's agreement with Iraq's Ministry of Oil in the same way, its value would reach $1.3 trillion. According to BP's estimates, they believe the potential for broader resources throughout the contract and surrounding areas could contain up to 20 billion barrels of oil. However, both the company and the Iraqi government announced that the investment amount is $25 billion, not $1.3 trillion.

This raises two key questions: First, why are Baghdad’s agreements considered constitutional, even those involving disputed areas such as Diyala and Kirkuk—while the Kurdistan Region’s agreements, even those within the established boundaries of Sulaymaniyah province, are deemed unconstitutional? Second, what are the specific details of the Miran and Kurdamir fields, and what contracting methods were used for these fields? Can the companies involved move beyond the contract-signing stage and proceed with oil and gas investment in these areas?

Why BP’s Agreement is Considered Constitutional, While the Agreements of HKN and Western Zagros Are Deemed Unconstitutional

According to Iraq's Constitution, two articles—Article 111 and Article 112—are dedicated to the issue of oil and gas. However, they do not address how to formulate the country's oil policy; this matter was left to be determined by the issuance of an oil and gas law. Despite a promise by the current Iraqi cabinet to issue such a law within six months, it remains unclear when it will be enacted—more than two decades later.

In contrast, the Kurdistan Region signed its oil contracts under the authority of the Oil and Gas Law passed by the Kurdistan Parliament on August 6, 2007. However, the Federal Supreme Court ruled this law unconstitutional on February 6. Despite this, the same Federal Court in Baghdad, in a decision issued in December 2024, deemed the natural resource contracts legal and rejected the Iraqi Ministry of Oil's request to declare them invalid.

Now from the legal aspect, the question is whether these Washington agreements are new or amendments to previous agreements, because if it is a new agreement, it is a completely new and legal issue, and if it is only a replacement of companies as the Ministry of Natural Resources indicated, then these contracts are also legal like the previous contracts and fall under the Baghdad Federal Court's decision regarding them.

Another point is that Iraq’s constitution has not served as a consistent basis for resolving issues and disputes over the past two decades. Instead, each time a crisis has arisen, there has been a return to the constitution and its interpretation, guided by internal and external political balances. Otherwise, if the constitution had truly been the foundation, the issue of the disputed areas would have been resolved before 2007.

Additionally, there is ambiguity in Baghdad’s position regarding the Kurdistan Region’s oil and gas law and its cooperation with oil companies operating in the region. For example, Dana Gas and Crescent Petroleum have invested in the Kurdistan Region and operate under contracts signed in accordance with the Kurdistan Region’s oil and gas law. These companies continue to develop and expand their investments in the fields allocated to them. This raises a critical question: if these laws and contracts are deemed unconstitutional, why does Iraq’s Ministry of Oil continue to award them new fields and sign additional contracts with them in Diyala and Basra for gas development?

While the Iraqi government and the Ministry of Oil interpret constitutional provisions to argue that the Kurdistan Regional Government does not have the authority to sign contracts independently, legal experts who have analyzed the relevant articles maintain that, according to the constitution, regions—not just the Kurdistan Region—do possess the right to sign new contracts.

Contractual Provisions and Oil Field Valuations in the Washington and London Agreements

The Miran gas field or Miran block was given in 2007 through a 164-page contract to Heritage Energy Middle East Company, and in 2010, in the third amendment to the contract, which is 21 pages, it was made a partnership with Genel Energy. On August 21, 2012, Heritage Company announced that it had sold its shares to Genel Energy for $450 million.

Initially, according to Heritage Company's assessment, which owned 75% of the Miran block and was the operating company, it indicated that the estimated oil amount of the field is 4.3 billion barrels of oil.

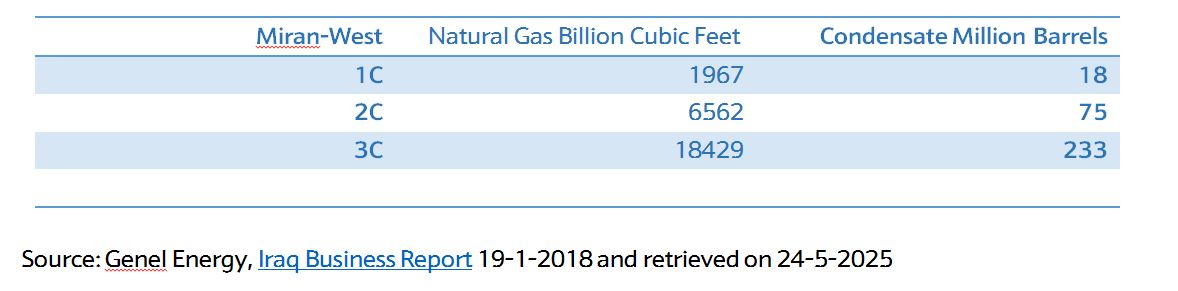

Table 1: Miran Block according to Heritage Oil in 2010.

Miran Field had recently entered the stage of preparing development plans, designing gas transmission pipelines, and integrating with the Kurdistan Region's gas network. This phase also involved estimating investment and operational costs and preparing contracts between the government and companies. At that time, the field’s development cost was estimated at $2.5 billion for the investing company, Genel Energy, to produce 200 million cubic feet of gas per day.

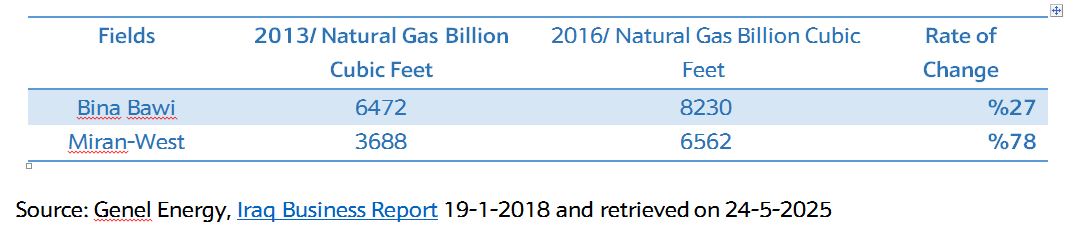

In 2018, Genel Energy announced that the consulting firm RPS Energy had completed an assessment of both the Miran and Bina Bawi fields. The assessment revealed that the reserves of both fields had increased by varying percentages. The combined natural gas reserves of the two fields were estimated at 14.7 trillion cubic feet, with condensate gas (a high-quality oil) totaling 137 million barrels. Furthermore, when comparing the field’s resources between the initial work period of 2013 to 2016, reserves increased by 27% in Bina Bawi and 78% in Miran-West.

Table 2: 100% probability of natural gas resources in billion cubic feet

Table 3: 100% probability of natural gas billion cubic feet in the Miran field

The Topkhana field, also known as the Topkhana block, was awarded to Talisman Energy Company in 2011, while all other blocks in the Garmiyan area were granted to Western Zagros. According to the 121-page contract, Talisman Energy was supposed to commence operations that same year, but it did not. Later, in May 2015, Talisman sold the Topkhana field to Repsol. In September 2019, Repsol sold its share in the Kurdamir field to Western Zagros and subsequently expressed its intention to sell its share in Topkhana as well and exit the Kurdistan Region.

With the recent agreement signed in Washington, Western Zagros has secured full ownership of the Kurdamir field and has also acquired the Topkhana field in the Garmiyan area. To date, no significant progress has been observed in the Kurdamir field. However, the coming days and months will reveal whether full-scale gas production operations will commence in both Topkhana and Kurdamir.

Economically, it is projected that the Topkhana field will remain productive until 2059. The field holds an estimated 14.9 billion cubic meters of gas and 900 million barrels of oil reserves. If properly invested in, the field could yield an annual output of 3.7 billion cubic meters of gas.

One notable aspect of these contracts is the emphasis on projected future income from the fields rather than the amount companies plan to invest. For instance, HKN Energy, a company owned by the Hillwood Group—which has investments across sectors such as communications, aviation, real estate, and more recently, energy—has an estimated net worth exceeding $5 billion. Notably, Ross Perot, the owner of Hillwood Group, was present at the signing ceremony for the Miran field contract.

Also, the investment amount of these two companies in those two fields in billions of dollars may not exceed the fingers of one hand, because the $110 billion is not investment but rather the income of the next 25 to 35 years from those two fields if investment is made and changes in all aspects - security, economic, political, technical, and natural – not happen.

An important point beyond the amount of investment capital is actually the type of investment and the countries of the companies. Because investment in natural gas means long-term investment, and the amount that will be produced as natural gas in the coming years will bring major changes to the natural gas supply balance in the Kurdistan Region, Iraq, and the region, especially with the completion of the KM250 Khor Mor project and the development of the Chemchemal gas field. The completion of these two projects, along with the Topkhana and Miran fields, will take the Kurdistan Region's position as a source of natural gas supply to a new phase. Nearly 3 years ago, the U.S. Department of Energy analyzed all the possibilities, assumptions, and prospects of this process of making the Kurdistan Region a center for natural gas supply for now and the future, and now it emerges with the support of these two contracts.

Conclusion

The current U.S. administration has demonstrated strong lobbying efforts and support for oil companies, particularly those operating in the Kurdistan Region. For example, it has previously pressured Iraq to let Kurdistan resume oil exports in order to protect the rights of these companies under their contracts. The recent emphasis by the U.S. Secretary of State and Secretary of Energy on the importance of these contracts and their support for the Kurdistan Region falls within this broader framework.

Another important point relates to gas imports into Iraq. If Baghdad needs to purchase gas, it should consider buying from the Kurdistan Region. If there is no domestic need, then Europe—America’s ally—currently requires and will continue to need that gas in the future.

Additionally, a significant development concerns the resolution of the dispute between Genel Energy and the Kurdistan Regional Government. In April 2025, Genel Energy announced that the court had ruled in favor of the Kurdistan Region regarding the Bina Bawi and Miran fields. As a result, the company must repay $26 million in debt and return all field rights to the Kurdistan Regional Government.

Moreover, signing contracts in Washington is just as constitutional as signing them in London. The constitutionality of such agreements depends on the authority and the implementing party, as well as the support they receive. This context explains why the Ministry of Oil issued a statement and clarification less than 24 hours after news of the Kurdistan Region’s contract signing was released.

In reality, this American support for the Kurdistan Region, combined with Iraq’s Ministry of Oil signing contracts with Chinese companies and the return of Iraq’s Oil Minister from Houston and Texas last year without reaching an agreement, reflects a broader picture. Ultimately, the party that introduces a new, independent economic source domestically—whether in the Kurdistan Region or Iraq—will be the one to succeed.

Finally, the issuance of a federal oil and gas law, or the amendment of constitutional articles, might provide a pathway to resolving issues related to the management and contract-signing authority of Iraq’s Ministry of Oil in disputed areas and the Kurdistan Regional Government’s rights over gas and oil fields. However, in the current phase, rapprochement and the pursuit of cooperative frameworks can help reduce the losses resulting from the blockade on oil sales from the Kurdistan Region, attract companies across all of Iraq, and expand energy infrastructure throughout both federal Iraq and the Kurdistan Region—rather than relying on expressions of dissatisfaction and disputes over unilateral management rights