Overview

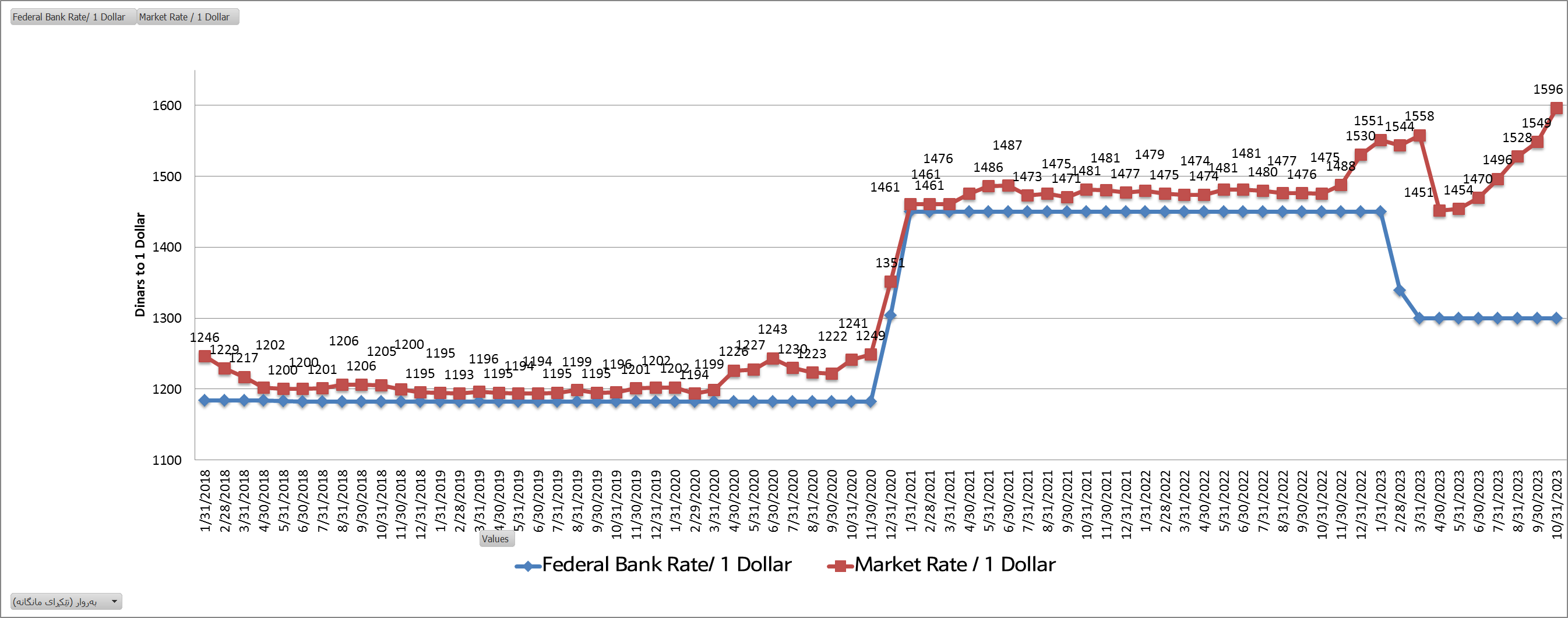

The Iraqi government and central bank are implementing daily measures to stabilize the dinar's value against the dollar. However, the exchange rate remains highly volatile, and we've witnessed a significant depreciation of the Iraqi Dinar against the US Dollar in both the Iraqi and Kurdistan Regional Government (KRG) markets. This year, the disparity between the central bank's rate and the market's rate for one dollar has reached an unprecedented level, with the difference reaching 296 dinars per dollar, a level not seen in the past six years.

As per the central bank's data, the gap between the market and central bank exchange rates has traditionally fallen within the range of 10 to 50 dinars per dollar. However, since the start of this year, this difference has significantly widened, often exceeding 100 dinars and occasionally reaching as high as 300 dinars. These disparities starkly contrast with standard “ financial and banking regulations”, which typically consider a range of 1 to 5 thousand Iraqi dinars or 1% to 3% as normal.

Conversely, the situation in the currency markets in Iraq is rather straightforward. Traders dealing in dinar to dollar transactions wield more influence over market prices than even the central bank and the Iraqi government. This is evident as the Iraqi government has attempted to raise the dinar's value against the dollar for nearly eight months, yet the value continues to decline daily!

Regarding the actions taken, the Sudani's cabinet initiated its first practical step on February 7, 2023, by reducing the exchange rate of one dollar at the Federal Bank from 1,450 dinars to 1,300 dinars, with the intent of devaluing the dollar against the dinar. Intriguingly, despite these significant measures, the gap between the two currencies continues to widen with each passing day.

In recent days, the spokesperson for Sudani's cabinet made a significant announcement regarding the evolving situation. He stated, "If the dinar's exchange rate continues to exhibit increased volatility against the dollar, there may be a necessity to directly provide citizens with access to dollar purchases." This statement is perceived as a clear warning to individuals who earn substantial sums in dinars daily, with estimations suggesting these earnings could reach as high as 1.9 trillion dinars by the end of August 2023. Notably, the Iraqi government has been engaging in currency trade with China in yuan, the UAE in dirhams, and Iran in Iranian currency.

Here, we'll focus on two crucial points. First, we'll delve into why there is disparity between dinar's values in the market and those maintained by the central bank while they should align closely. What factors contribute to this disparity? Secondly, we'll examine the potential consequences of the decision to suspend dollar transactions from the start of the upcoming year on the flow of dollars into and out of Iraq. We'll also analyze the implications of the central bank and the Iraqi government's efforts to promote the domestic use of the dinar. How do these measures affect trust in banks, and what challenges might domestic and international companies and institutions face when paying their employees in dollars? Will they revert to cash payments or seek alternative methods for conducting dollar transactions and paying their employees through banks?

Drivers of the Iraqi Dinar’s Depreciation in Free Market “Street Bazar”

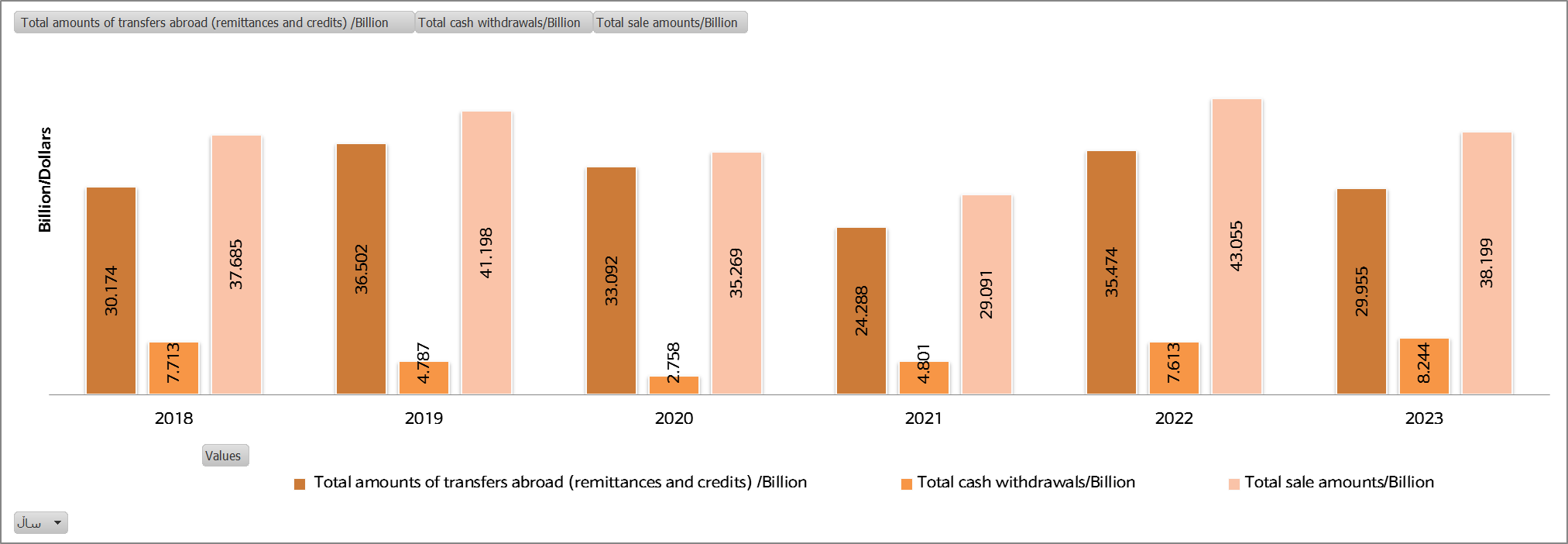

As per data from the Central Bank of Iraq for the past 10 months (from January 1, 2023, to October 31, 2023), the Central Bank supplied $8.244 billion in cash and $29.955 billion in remittances. In comparison, during the same period in 2022, the figures were $7.613 billion in cash and $35.474 billion in remittances. Comparing previous years, as illustrated in the first graph, this year witnessed the highest cash supply levels. However, the value of the dinar in the markets is becoming increasingly volatile due to a decrease in remittances. For instance, in 2023, remittances declined by $5.51 billion over a 10-month period compared to 2022, while cash disbursements surged by $630 million during the same period.

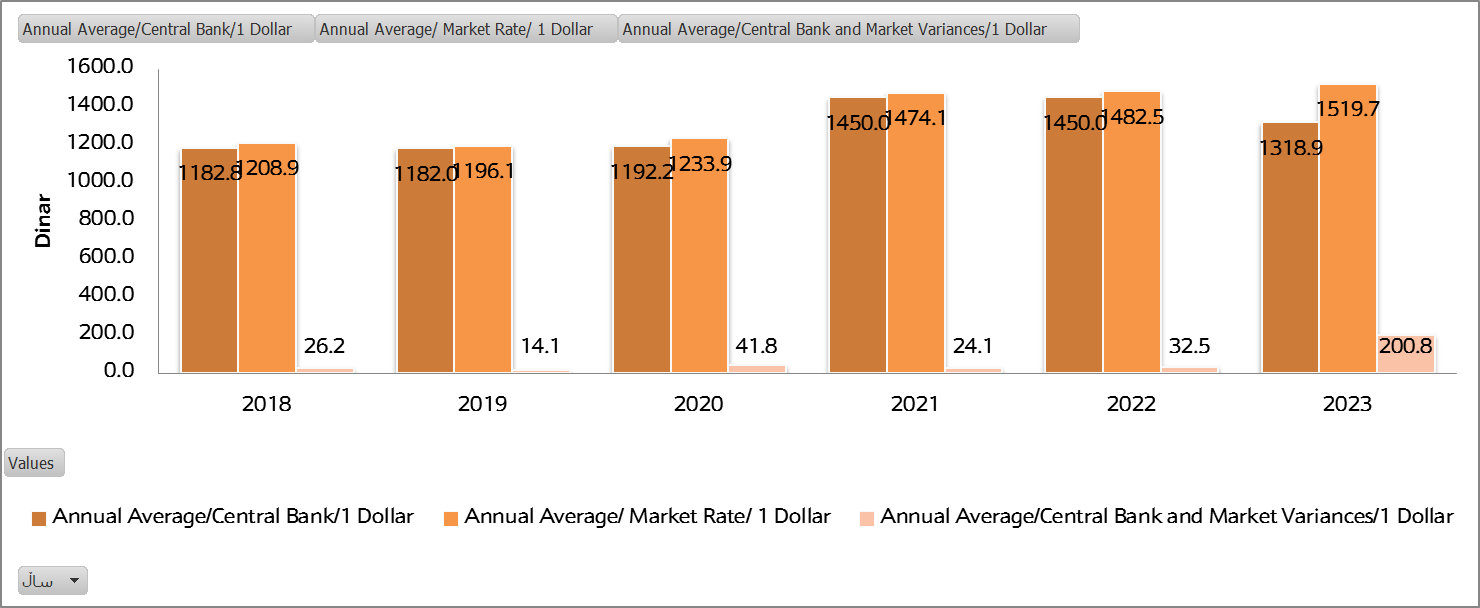

Surprisingly, even with the highest cash reserves in the past 10 months, when compared to the last five years, the average annual disparity between the central bank and the market is projected to surge to 200 dinars in 2023, a stark contrast to the 20 to 40 dinars observed over the previous five years.

Graph 1: Dollar supply by the Central Bank of Iraq from 2018 to 2023, during the first ten months of each year

Source: Central Bank of Iraq (CBI).

Note: The year includes only the first 10 months, for instance, in 2023, from 1-1-2023 to 31-10-2023.

Graph 2: Average annual exchange rate of $1 to the dinar between the Central Bank and the market spanning from 2018 to 2023

Source: Central Bank of Iraq(CBI).

Another noteworthy aspect pertains to the role of the Central Bank in Iraq, where it acts as the guardian of the dinar, not the dollar. The Central Bank receives dollars, augments them, and converts them into dinars for the Ministry of Finance. It raises the question of why the dinar's value can't match the rate it sets. The current scenario is indeed unusual and atypical, as the observed differences should not allow a select group of traders to amass millions of dinars within just an hour, as depicted in the third graph.

Graph 3: Monthly Average Exchange Rates of the Dollar to the Dinar between the free Market and the Central Bank from 2018 to 2023

Source: Central Bank of Iraq (CBI) and currency market data for 2023.

Note: The market price for 2023 is derived from the Baghdad currency market.

The persistent devaluation of the Iraqi dinar is distinct from the depreciation trends observed in currencies like the Turkish lira and the Iranian rial. This discrepancy can be attributed to the distinct nature of the Iraqi economy, which operates not as a conventional free-market system, but rather as a complex and unconventional blend of economic components. Notably, state-owned companies play a dominant role in the country's largest manufacturing sector, oil and gas, accounting for a substantial 88% of total exports. The income generated from this sector will be distributed.

Simultaneously, the Iraqi market cannot be characterized as monopolized or entirely closed. It remains remarkably open, enabling the annual importation of billions of dollars worth of goods. The market's composition is a complex mixture of original, replicated, and used materials, incorporating both domestic and foreign sources. This environment offers individuals considerable freedom in terms of buying and selling activities!

Surprisingly, amidst the complexities of Iraq's economic landscape, the nation maintains a level of economic freedom that places it in the 143rd position out of 165 countries, as reported in the latest Economic Freedom of the World in 2021 study. This report assesses countries across five critical dimensions of their economies: the Size of government, the legal system and property rights, Sound Money, Freedom of trade internationally, and regulations.

Notably, Iraq scored 7.53 out of 10 points in terms of sound Money, reflecting a relatively strong performance in this aspect. However, it received a significantly lower score of 2.29 points in the category of legal system and property rights, placing it at the 160th position out of 165 countries in this specific dimension.

A significant factor contributing to the dollar rate escalation against the dinar is Iraq's trade relationships with other countries. For instance, in 2021, 57 percent of Iraq's exports were directed towards India and China, while a substantial 68.8 percent of its imports were sourced from the UAE, Turkey, and China. These trade imbalances reveal a substantial disparity in exchange with various nations.

For instance, trade with Iran emerges as a key driver of the dinar's depreciation against the dollar in the markets. The Iraq-Iran trade volume, which amounts to approximately $10 billion, excluding fuel, represents a substantial imbalance. By all conventional economic measures, Tehran should not accumulate such significant reserves in US dollars. How can Iraq maintain an annual trade volume of approximately $10 billion and concurrently import goods from Iran to fulfill this exchange? For instance, in 2018, Iran exported goods worth $8.95 billion to Iraq while importing only $57.4 million worth of goods from Iraq, highlighting the stark trade disparity.

As per directives from the central bank and government, Iraq's trade with its three primary partners Iran, China, and the UAE is set to be conducted in their respective currencies. However, it remains unclear why Turkey, Iraq's second-largest trading partner with an import value of $11.1 billion in 2021, does not engage in trade using the Turkish lira. The rationale behind this decision is unknown. If the concern is the lira's depreciation and instability, it's noteworthy that the Iranian currency faces an even more precarious situation!

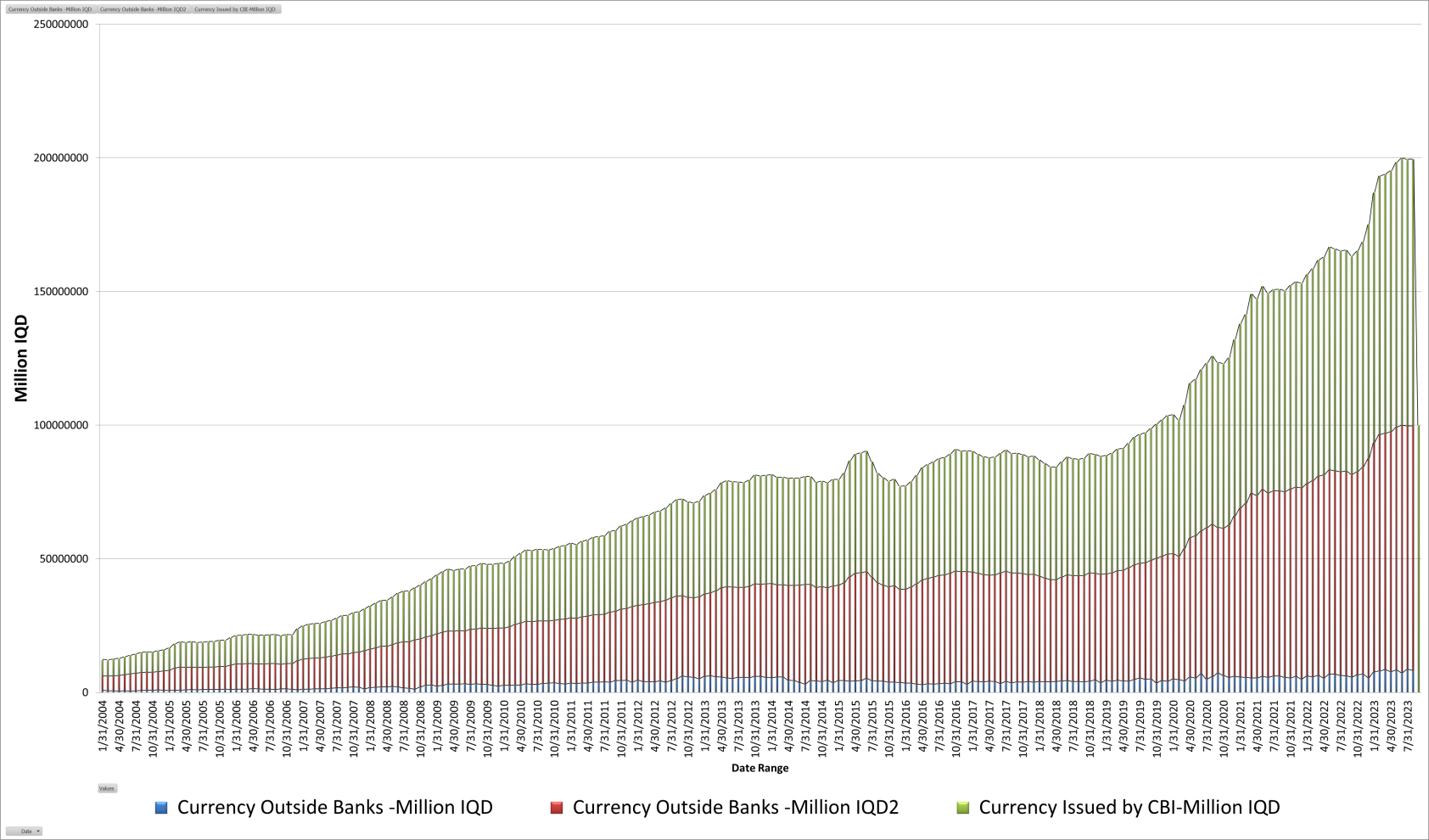

Another key aspect contributing to this disparity is directly linked to printing Iraqi dinars and the widespread presence of dinars in the market, rather than within the banking system. For instance, data from the Central Bank of Iraq reveals that by 31-10-2023, the quantity of printed dinars had exceeded 100 trillion, a significant surge from early 2004 when it was a mere 6 trillion dinars, and even from early 2019 when it stood at 44 trillion dinars. It's important to note that out of the 100 trillion dinars in circulation, approximately 91 trillion exist outside the banking system, while only 8.3 trillion are held within commercial banks. Graph 4 below represents the mentioned data.

Graph 4: Iraqi Printed Currency in the Market and Commercial Banks from 2004 to 2023

Source: Central Bank of Iraq, CBI, 2-11-2023

Note” Data Range: 01/31/2004 To: 11/01/2023

Inflows and Outflows of Dollars in Iraq

On October 5, 2023, the Iraqi government announced its decision to suspend all dollar transactions, the use of dollars, and ATM withdrawals starting from the beginning of the upcoming year. It is crucial to ascertain whether this decision aligns with prior policies or has undergone a comprehensive evaluation. Notably, this suspension excludes major corporations and foreign investors, but concerns embassies, consulates, humanitarian organizations, and other international entities that rely on funds from abroad, with salaries denominated in dollars. The question arises: how will these organizations navigate their financial operations at the beginning of the next year?

Could they opt to convert their dollar earnings into dinars, renegotiate existing contracts with their employees in dinars, and how would this affect foreign employees whose daily expenses or specific needs are primarily in Iraqi dinars? The currency exchange dynamics raise concerns about who might gain or lose from this transition, which could have significant economic repercussions.

The impending implementation of this decision in the early months of the next year could introduce additional volatility to the dinar's value against the dollar. This may lead to considerable market confusion and potentially impact numerous companies and private sector institutions. It's crucial to emphasize that the issue of the dollar's depreciation is linked to the management of dollar outflows from the country. If the government successfully controls these outflows, it could potentially strengthen the Iraqi dinar against other currencies. This is because the exchange rate of the dinar against the dollar must be under government control, rather than being subject to fluctuations by currency traders.

Organizations and companies are currently exploring various approaches to address dollar contracts with their employees. While it may be relatively straightforward for domestic companies with fewer legal repercussions, it poses a greater challenge for foreign entities. Converting dinars to dollars independently can result in substantial losses, with the minimum of these conversions incurring a fee of over 3%, or approximately 6% for every $100 exchanged. Such high conversion fees are unprecedented in comparison to other regions.

The measures currently in place in banks differ significantly. Each citizen can now send up to 13 million dinars directly abroad every month, Iraqi tourists are allowed to receive $5,000 at the central bank's rate, and businessmen can access dollars at the central bank's rate as well. There's a need to explore various avenues to leverage the current disparities in market prices and the Federal Reserve. However, a crucial aspect is the formalization of money flow in and out of Iraq, as the nation has been accustomed to sending US dollars abroad through unofficial channels for nearly two decades, unlike the measures of SWIFT banking system.

Conclusion

Stabilizing the dinar against the dollar in the near future proves to be a challenging task. Despite the daily efforts of the Iraqi central bank to increase the money supply, the dinar's value continues to decline, opposite to the measures have been taken. This dilemma is exacerbated by the excessive printing of Iraqi dinars, surpassing 100 trillion, and ongoing trade with Iran, leading to the flow of US dollars to Iran, against policy. Moreover, currency traders manipulate exchange rates, given that around 90% of the Iraqi printed money is actively circulating in the market.

Another intriguing aspect of the implementation of dollars in Iraq was the statement from the Sudani's government's spokesperson on October 30, 2023. He warned that if the dinar's persistent volatility continued, the Iraqi government might be forced to directly provide dollars to its citizens. This statement posed a direct threat to individuals buying dollars from the central bank and selling them in the market. As of August 31, 2023, the Ministry of Finance had incurred a substantial loss in dollar-to-dinar exchange rates, resulting in a revenue deficit of approximately 1.9 trillion dinars, a significant departure from the expected revenue boost for Iraq.

In conclusion, the restoration of stability and bringing the dinar closer to the central bank's target price won't be achieved solely by regulating domestic dollar and dinar transactions. The root issue lies in curbing the smuggling of dollars out of the country. Iraq's recent mandate for private companies and some public institutions to transact in dinars may have limited impact because the core problem persists. Despite this innovative approach in a world moving away from cash, Iraq's requirement for companies to disburse their employees' monthly salaries through chambers, rather than banks, presents challenges.

In fact, just last month, an international company operating in the Kurdistan Region had to distribute funds from the finance chamber instead of utilizing traditional bank transfers.

Currently, it's relatively straightforward to transfer dollars at the rate of 130,000 dinars through various means and bank accounts, often taking less than an hour to complete. This ease of transfer contributes to more dollars leaving Iraq and fewer flowing into the country. However, the legality of such transactions and the purpose behind these dollar movements are known and tracked.

Sources

Economic Freedom of the World in 2021 - Cato Institute

Iraq (IRQ) and Iran (IRN) Trade

Central Bank of Iraq. (n.d.). Monetary Sector: Currency. Central Bank of Iraq. https://cbiraq.org/SubCategoriesTable.aspx?SubCatID=93