Overview

In recent years, there has been a notable surge in residential development projects, particularly in the construction of residential towers. Presently, around two-thirds of the ongoing projects in Sulaimani province's central area are dedicated to apartment complexes, marking a significant increase compared to the total number of housing initiatives undertaken in the region over the past two decades. This shift towards vertical development is reshaping the traditional urban landscape of Sulaimani from horizontal to vertical orientation. While this transformation holds promises of positive outcomes, it also raises concerns about potential negative consequences for the city's future.

Based on the most recent statistics from the Investment Board[1], over the past 18 years, 1,225 projects across 13 diverse sectors have been granted licenses, amounting to a total capital of $69.287 billion. Notably, the housing sector has been a significant contributor, with a total capital investment of $20.261 billion and 216 licensed projects.

Reports indicate that the licensing of investment projects within the housing sector has been temporarily halted. Despite this, there has been a notable influx of housing projects in various provinces, particularly in Sulaimani, in recent years. Surpassing half of the total projects within the sector over the past two decades, these initiatives have been actively solicited and allocated to investors.

Based on gathered data, there are presently 98 residential projects available in the market situated within the central area of Sulaimani province, varying in size and unit numbers. Of these, 37 projects are slated for completion within the current year and the subsequent years. Interestingly, despite numerous new residential projects having secured permits, construction has yet to commence on many of them.

The upcoming years are expected to witness the completion of over 47,000 housing units, adding to the existing stock. Notably, the cumulative number of housing units constructed in the central area of Sulaimani province since 2006 totals 90,000 units.

In this report, we outline the statistics regarding projects and residential units within the central area of Sulaimani province.[2] This includes insights on the shifting landscape from horizontal to vertical development, the licensing process's opportunities and challenges, the drivers behind rapid tower construction, and the intended purposes of various unit types sought by customers. Additionally, we ponder a crucial question: does Sulaimani truly necessitate all these new units?

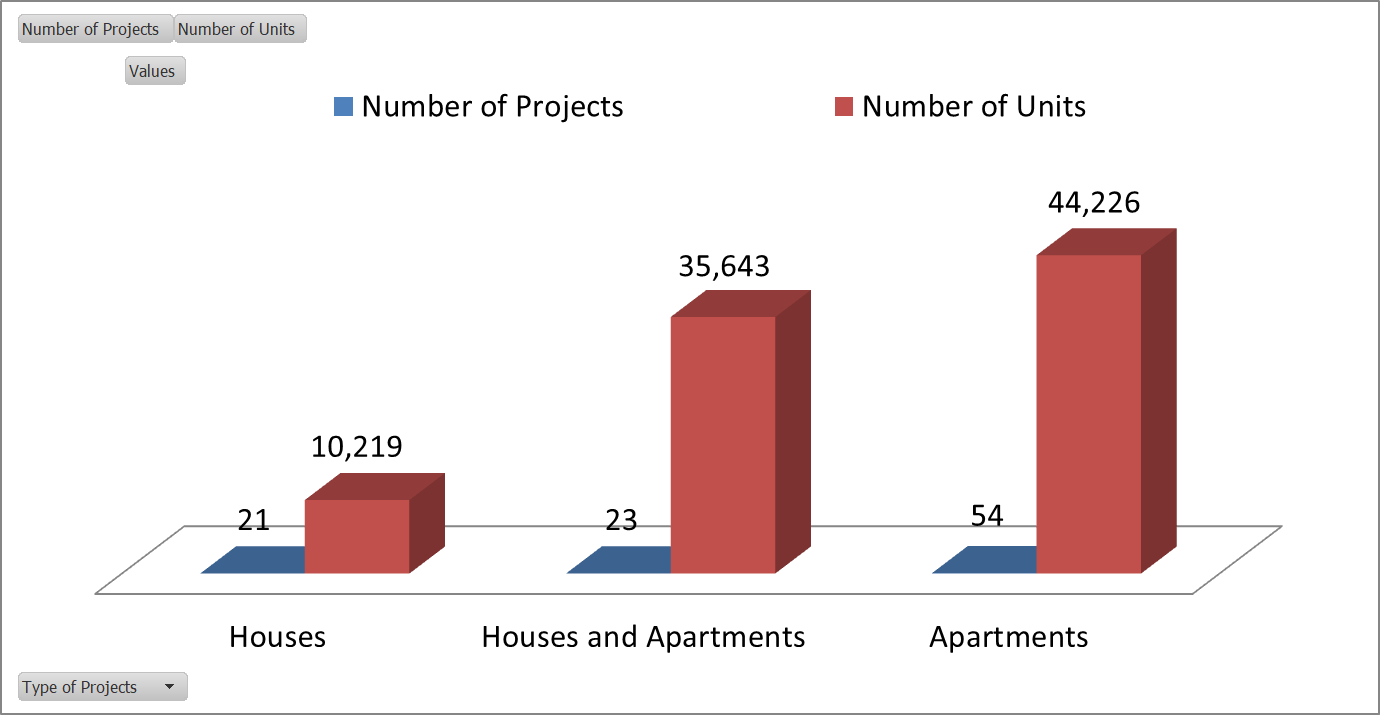

Residential Project Trends in Sulaimani

Currently, there are two predominant types of construction projects underway: apartments and villas. This trend serves as a stark representation of the economic stratification within society and the diminishing presence of the middle class across the Kurdistan Region. A closer examination of residential projects within the central area of Sulaimani province reveals that among the 98 projects currently available in the market, 54 are dedicated to apartments, while 21 focus on villas and houses. Additionally, 23 projects encompass a blend of both property types. Notably, apartments constitute over two-thirds of the total residential units.

According to data from the Investment Board, the Kurdistan Region witnessed its peak investment capital in 2021, totaling $8.5 billion over the past 18 years. A primary contributing factor to this surge has been the authorization of residential permits within the real estate sector, coupled with the delegation of investment authority to provincial levels.

Similarly, within the same dataset from August 1st, 2006, to May 2nd, 2024, the real estate sector accounted for 29.24% of the Kurdistan Region's total investment capital. While the Investment Board has granted licenses for 216 investment projects within the housing sector, the actual number of projects in this sphere surpasses the capacity of the Investment Board to grant licenses.

This is mainly due to the recent trend where many projects have obtained approval from other ministries and institutions within the Kurdistan Regional Government (KRG), particularly those where the investor owns the land.

Graph 1: Number and Type of Projects and Housing Units in Sulaimani Province Center (2006-2024)

Source: Baghi Shaqlawa Real Estate, December 13, 2024, MJ Company, March 20, 2024, with data collection in residential projects, April 29, 30, 2024 and May 1,2024

Reasons Fueling Rapid Tower Construction

Currently, there is a notable acceleration in the construction of housing projects within the residential sector and in the central area of Sulaimani province. The process of obtaining permits and completing procedures to initiate projects has expedited. In fact, the units slated to be introduced to the market within the next four years surpass half of all units constructed in central Sulaimani over the past two decades.

Noteworthy within Sulaimani's real estate landscape is the substantial investment from one particular company, which accounts for one-fifth of all residential projects in the area. Remarkably, this company has entered the sector within the past two years. Presently, it is actively engaged in the development of five residential projects, encompassing over 18,000 housing units. Moreover, it is set to finalize the handover of keys for one of these projects imminently and is poised to unveil a new project, as illustrated in the graph below.

Graph 2: Housing Project Names and Unit Counts Scheduled for Completion in Sulaimani from 2024 to 2028

02.jpg)

Source: Baghi Shaqlawa Real Estate, December 13, 2024, MJ Company, March 20, 2024, with data collection in residential projects, April 29, 30, 2024 and May 1,2024

In reality, the projects depicted in the second graph do not represent the entirety of licensed housing projects in the years following the coronavirus pandemic and the eight-year suspension of investment project licenses in the central area of Sulaimani province. Other projects have obtained permission but are yet to commence. This delay can be attributed to two primary reasons. Firstly, market conditions and market uncertainty have played a significant role. Secondly, investors are awaiting land allocation from Sulaimani province and the municipality to construct thousands of new housing units.

The swift pace of housing project development is not confined solely to Sulaimani province but extends across all provinces within the Kurdistan Region and even into central and southern Iraq. A key driving force behind this trend is the notable profitability and relatively short payback period associated with investment capital in this sector. The sector's profitability isn't merely doubled but tripled, despite ongoing returns to investors resulting from continued service provision to projects post-completion.

Typically, when estimating residential project expenses, the cost per square meter falls within the range of $300 to $600, if constructed using top-quality materials and craftsmanship, the selling price per square meter in these projects ranges from $500 to over $1,000. For villa-style houses, prices can exceed $2,000 per square meter. This indicates the potential for substantial profit margins upon project completion.

A notable trend observed in the real estate market of the Kurdistan Region, particularly in Sulaimani province, is the rise of housing projects featuring minimal down payments and affordable monthly installments, along with the option for extended payment plans post-completion.

The housing landscape in Sulaimani stands distinct from other cities, notably Erbil, with approximately 90% of property buyers within Sulaimani being local residents purchasing for personal use or familial purposes. Despite the surge in real estate firms in Sulaimani, investors and investment entities predominantly engage in direct sales to buyers, often maintaining dedicated sales departments for this purpose.

Regarding domestic buyers, the primary demographic comprises individuals from the city, whether residing locally or abroad. Following closely are residents from the surrounding areas, particularly the neighboring districts. However, this trend signals a concerning pattern, hinting at migration and depopulation of these districts due to limited living and employment opportunities.

Furthermore, a minimal percentage of individuals from central and southern Iraq, seeking refuge from the precarious security conditions in their regions in recent years, have purchased properties in Sulaimani. Nevertheless, this figure has dwindled significantly over time. Initially constituting 15% of the customer base, they now represent only 5%.

The future trajectory of the real estate market in the Kurdistan Region and Sulaimani has sparked divergent opinions among investors in Sulaimani. Those with ongoing projects and monthly installment plans express concerns about the sector's sustainability, attributing potential collapse to salary delays and unresolved issues. This apprehension stems from the fact that many unit buyers are employees or local entrepreneurs. Given the region's economy's reliance on wages and the predominant role of the public sector as the market's driver, delays in salary payments have prompted some unit buyers to request companies to sell their properties, even at a loss.

Conversely, investors who leverage their capital to engage in the real estate sector and execute projects emphasize the growing demand for housing units in Sulaimani. This demand surge is fueled by the influx of migrants from surrounding areas and Iraqi citizens relocating to Sulaimani due to climate-related concerns. For instance, a family from Baghdad sought refuge from the capital's poor air quality and opted to reside in one of Sulaimani's new residential developments.

Moreover, historical factors contribute to this demand. Housing project construction permits had previously been suspended for over eight years, and while reinstated, the process faces another hiatus, leaving uncertainty regarding when licensing for housing projects will resume. Both perspectives on the future of Sulaimani's real estate sector hinge on the relationship between the Kurdistan Region and the Federal Republic of Iraq. A conclusive agreement on salaries would not only guarantee regular monthly incomes and project completions but also stimulate market activity. Moreover, it would facilitate lending opportunities for employees and foster greater accessibility for Iraqi citizens to the Kurdistan Region's cities. Conversely, failure to reach such an agreement could spell doom for the sector, prolonging project completion timelines and impeding market viability.

Impacts of Urban Transformation from Horizontal to Vertical

The narrative of cities and urban development stretches across millennia. Penguin Random House (2021) categorizes cities into various types, including those at the heart of ancient civilizations, waterfront cities, meticulously planned urban centers, and contemporary metropolises. From historical landmarks like Rome, Istanbul, and Babylon to modern hubs such as Seoul, Dubai, Baku, and Singapore, cities have evolved through diverse contexts. However, the expansion of cities in the Kurdistan Region has often outpaced the development of essential infrastructure for both present needs and future sustainability. A comparative examination of two cities, London and Singapore, sheds light on this disparity. In London, a city with a rich historical tapestry, the challenges of street congestion prompted significant infrastructure investments. The City of London initiated pivotal projects, such as the establishment of the first underground railway line between Paddington and Farringdon in 1863, and the completion of the London sewerage system in 1875. These endeavors aimed to foster a healthier urban environment conducive to the well-being of its inhabitants (Penguin Random House, 2021, p. 88).

In contrast, Singapore, an island nation recognized by National Geographic as a harbinger of urban innovation, is proactively laying the groundwork to meet the needs of its populace over the next five decades. By prioritizing comprehensive infrastructure planning, Singapore aims to ensure the provision of resources for its growing population well into the future.

As an illustration, Singapore has made significant strides in unit construction, pioneering the development of essential infrastructure such as highways, railways, and energy networks. Moreover, it has established an extensive underground network for internet cables. In terms of water resources, Singapore has constructed 70 reservoirs to harness rainwater efficiently. Furthermore, it has invested in advanced technology for converting seawater to potable water at a reduced cost, ensuring a sustainable and cost-effective solution for future water supply needs.

The projected future influx of housing units in these cities significantly surpasses the capacities of municipal and investment authorities. Often, only a fraction of planned zones sees completion or progress, despite the Kurdistan Region's shift towards rapid urban development, favoring vertical expansion. This transformation from horizontal to vertical urban layouts will entail both notable positive and negative ramifications.

Among the positive outcomes of this shift is the consolidation of a sizable population within a compact area, resulting in reduced costs for essential services like water, sanitation, electricity, and transportation infrastructure. Conversely, negative consequences loom over the city's livability and sustainability in the long term, exacerbated by inadequate infrastructure provision for fundamental needs and the strain on natural resources such as water and energy. Additionally, the scarcity of green spaces and employment opportunities for the burgeoning population pose significant challenges. To contextualize, the construction of approximately 50,000 new housing units in Sulaimani could accommodate a minimum of 200,000 new residents, considering the current population growth trajectory.

Moreover, achieving timely completion of all these housing units in the coming years might not pose an insurmountable challenge in certain aspects, despite facing hurdles such as a severe economic downturn, financial constraints, and a volatile security and political landscape. However, the provision of essential services like roads, water supply infrastructure, sewage systems, and energy resources presents a pressing concern. Currently, the responsibility for these services lies with the investor in proximity to their project. But who will address the construction and maintenance of roads beyond the project boundaries? Who will undertake the establishment of new transportation routes, with some streets remaining incomplete for nearly a decade? Likewise, who will ensure the development of additional water supply sources, transmission lines, and treatment facilities? Given the prevailing circumstances, certain residential projects resort to daily water supply via tanker services, indicative of the challenges in ensuring reliable infrastructure and services amidst the existing conditions.

Another implication of this transformation pertains to public capital and individual investors engaging in these projects. It is commonly expected that unit prices would escalate steadily over time, given the diminishing availability of residential land and the growing urban population. However, contrary to this anticipation, certain projects have experienced a decline in unit prices. Several factors contribute to this phenomenon, including the subpar quality of units, initial pricing structures for long-term installments, disparities between cash payments and installment options, and the sudden influx of a large number of new units within a short timeframe.

Another notable aspect of this market is the pricing of units, spanning from $60,000 to over $150,000, a range that appears disconnected from the economic landscape and labor market realities in the Kurdistan Region. Furthermore, despite the absence of an advanced banking system to adequately support the market, not only in Sulaimani but across the Kurdistan Region and Iraq as a whole.

Conclusion

Housing projects have evolved into a significant economic force, driving commerce and labor activity, particularly in provincial centers and certain autonomous administrations within the Kurdistan Region. Surpassing all but the industrial sector, this domain stands as the second-largest investment sector. However, when factoring in the capital invested in projects licensed and developed independently from the Investment Board, it undoubtedly claims the top spot as the premier investment sector in the Kurdistan Region over the past two decades.

Lately, a significant issue concerning millions of dollars in the real estate sector has surfaced in Erbil, causing a ripple effect not only within Erbil but also across Sulaimani and other regions. Consequently, the market's trajectory, particularly regarding prices, has taken a downturn. Factors such as oversupply and dwindling demand have exerted considerable influence, exacerbating the impact of the prevailing economic and political conditions.

The Sulaimani real estate market stands apart from other cities, closely intertwined with the broader economic landscape, particularly the financial well-being of local residents. With approximately 90% of buyers being domestic and primarily hailing from Sulaimani's city center and surrounding districts, the market heavily relies on domestic income streams. Consequently, the state of salaries, including any delays, holds significant sway over market dynamics. Some investors have highlighted the critical role of salaries and the repercussions of any delays in their disbursement. For instance, historical instances reveal that salary delays have led certain buyers to resort to selling their units to investors at prices lower than their initial purchase, underscoring the tangible impact of income uncertainties on the real estate market.

Indeed, this approach to unit sales entails two significant risks. Firstly, it potentially stagnates other sectors of the economy and the market by obligating citizens to allocate half of their income to investors and project owners. Secondly, in the event of an ongoing financial crisis and salary delays, it not only delays project completion but also jeopardizes their success, as a significant portion hinges on the income of individuals awaiting their salaries, who have invested in these housing projects.

In conclusion, the Sulaimani real estate market has witnessed a surge in projects and towers due to the issuance of licenses and investors' eagerness to capitalize on this sector. However, without prompt and thorough planning coupled with effective government oversight, there is a looming risk of squandering tens of millions of dollars of citizens' wealth and hundreds of millions of dollars of investors' funds.

The absence of such monitoring jeopardizes the potential outcome, leading to unfinished concrete structures. Implementing rigorous oversight and evaluation of these projects is imperative to ensure the construction of units capable of withstanding potential human and natural disasters in the future.

References

Interviews were conducted with investors from MJ, Danya City, Awin City, Central Park, Bashwr City, Daik City, Qaywan Group, as well as Offices and Real Estate Companies, spanning April 29th, 30th, and May 1st, 2024, in Sulaimani.

Data on investments by sectors, capital, and area from January 8th, 2006 to May 2nd, 2024, was sourced from the Kurdistan Regional Government's Investment Board, Research, and Information Office.

Great cities: The stories behind the world’s Most fascinating places (DK history changers): DK: 9780744029222: Amazon.com: Books. Available at: https://www.amazon.com/Great-Cities-stories-behind-fascinating/dp/0744029228 (Accessed: 05 May 2024

Note:

[1] Between January 8th, 2006, and May 2nd,2024

[[2]] The quantity of housing units or housing projects fluctuates due to the phased implementation of most projects. Some commence after the completion of existing units in the market, while others are yet to begin. Additionally, certain projects aim to expand permits for constructing new units within the same development.