Introduction

In the midst of the previous month, intensive discussions took place among technical representatives from Erbil, Baghdad, and Ankara. Their aim was to forge an agreement enabling the export of oil from the Kurdistan Region via the Ceyhan port. A meeting between the Ministry of Natural Resources and International Oil Companies (IOCs) was convened to lay the groundwork for this oil export through the pipeline. While a specific date has yet to be confirmed, the discussions indicate that oil exports are poised for a prompt resumption. These discussions followed Mohammed Shia Sudani's statements in New York on September 20, 2023, where he expressed his readiness to expedite oil exports and resolve the ongoing legal disputes between Iraq and Turkey concerning oil export matters.

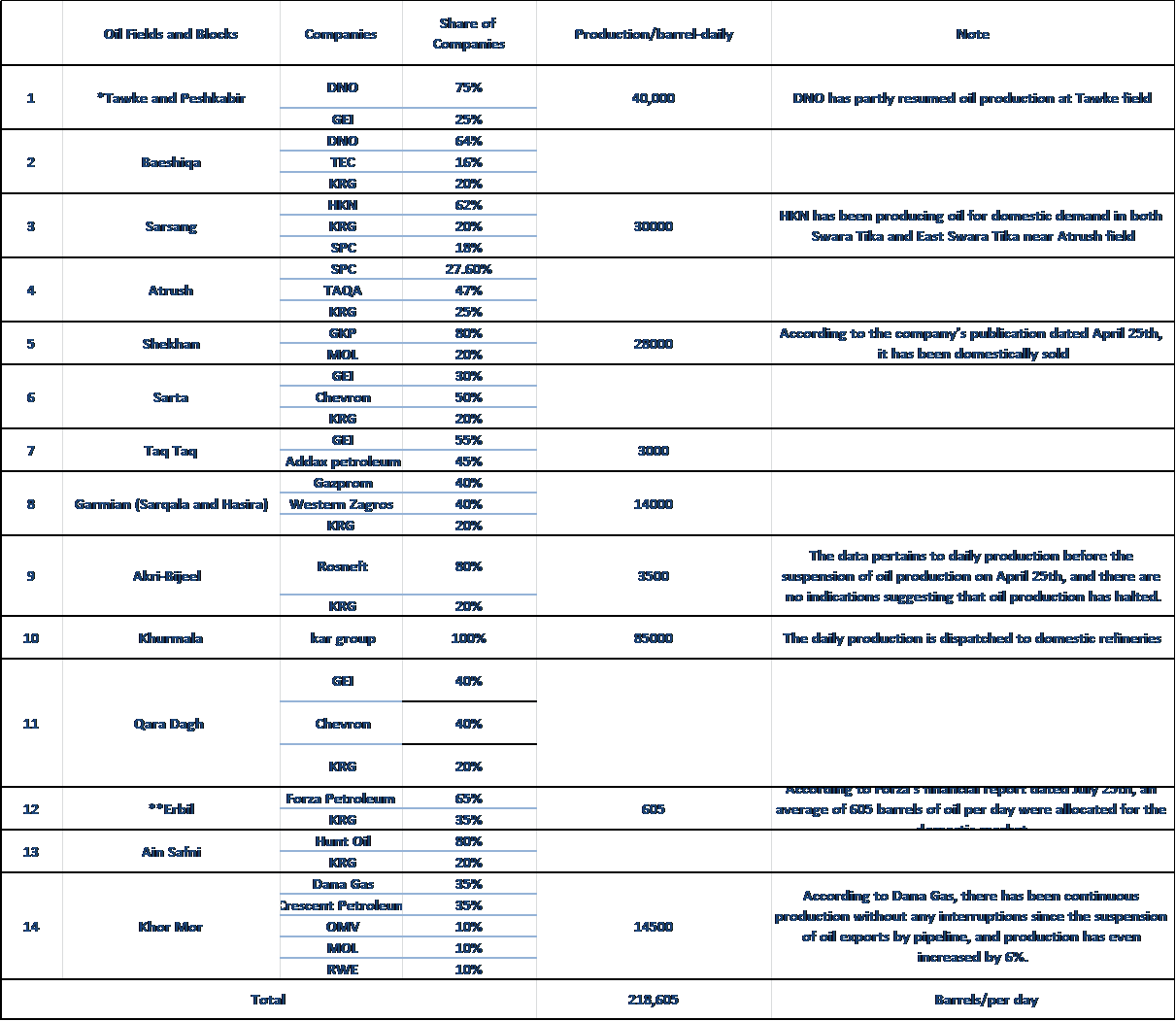

Presently, the combined daily production from 13 gas and oil fields, including the Khor Mor oil and gas field, which produces both condensate and gas, stands at an impressive average of 220,000 barrels. These resources are exported to domestic refineries and cater to the domestic market's demand.

According to reports from technical meetings and discussions involving various interested parties in the Kurdistan Region's oil industry, the focal point of these deliberations has been the reopening of the oil export pipeline via Ceyhan. However, two significant questions emerge: Firstly, will international companies be willing to accept Iraq's production costs? Secondly, from a technical standpoint, given that the oil fields in the Kurdistan Region are inherently challenging and necessitate pumping for extraction, it is anticipated that the process of restarting oil production could span anywhere from one to three weeks.

In this discussion, our focus will center on the prospects of oil exports and the anticipated oil production levels from the region's oil fields for the country. We will delve into the crucial question of why the Kurdistan Region should consider the resumption of oil exports via the Ceyhan pipeline.

When Kurdistan Region will resume crude exports via the Turkish terminal of Ceyhan?

Amid the intensifying disputes concerning the Kurdistan Region's share in the 2023 Iraqi budget law and the proposed resolution through debt, as highlighted by Mohammed Shia Sudani ahead of his New York visit, a significant portion of the monthly budget, specifically 500 billion out of 700 billion, was allocated. Consequently, this development spurred a series of rigorous trilateral technical negotiations in mid-September, which included SOMO, Turkish Botas, and the Ministry of Natural Resources.

In the technical meeting involving all three interested parties, the central subjects of discussion encompassed critical matters including "pipeline fees, the quantity and quality of exported oil, minimum throughputs, re-export cargoes, and the reciprocal commitments regarding oil exports."

Energy and Natural Resources Minister Alp Arslan Bayraktar stated during the trilateral discussions that the technical issues plaguing the Kurdistan-Ceyhan oil pipeline have been successfully resolved, and the pipeline will be prepared for oil exports in the near future.

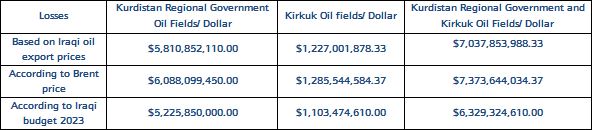

The suspension of oil exports from the Kurdistan Region and Kirkuk through the Ceyhan port has endured for more than six months and six days, resulting in mounting losses for all interested parties engaged in this endeavor. According to Iraqi oil prices, this loss surpasses $7 billion, and when evaluated against Brent oil prices, it exceeds $7.3 billion. As stipulated in the 2023 Iraqi budget, the loss is projected at $6.3 billion, which represents a collective setback for all three interested parties involved.

Table 1: Calculated Losses Resulting from the Six-Month and Six-Day Suspension of Oil Exports from the Kurdistan Region and Kirkuk via the Ceyhan Port (March 25, 2023, to October 1, 2023)

Note 1: Regarding Kurdistan Regional Government (KRG) oil, as reported by DNO, an average of 395,000 barrels of oil was being exported through the Ceyhan port on the day immediately preceding the suspension of oil exports.

Note 2: In the case of Kirkuk oil, the monthly average exports for January, February, and up to March 25, 2023, were as follows: 79,895 barrels in January, 101,228 barrels in February, and 69,099 barrels in March, all directed to global markets via Ceyhan port.

What Is the Current Production Level of Oil in the Kurdistan Region?

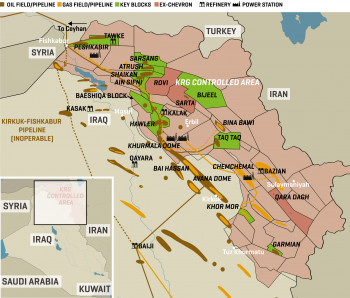

Among the 57 oil fields and blocks situated in the Kurdistan Region, only 13 oil fields and one gas field were in active oil production or had previously been so before the pipeline's cessation. As illustrated in Figure 1, investigations indicate that within the territories under the governance of the Kurdistan Region, there are currently only 9 oil production fields staffed at a minimal level, solely dedicated to fulfilling domestic oil demands.

An intriguing aspect to note pertains to the pricing of oil sold within the domestic market and to refineries. According to various companies, this price range typically falls between $30 to $45 per barrel. For instance, according to HKN, during the second quarter of 2023, encompassing April, May, and June, the average selling price stood at $41.47. In contrast, the average price for Iraqi oil exports during this period was $73.76 per barrel, while the average price for Brent crude oil reached $78.31 per barrel.

Figure 1: Overview of Oil Blocks, Pipelines, Oil Fields, Gas Fields, Gas Pipelines, Refineries, and Power Plants in the Kurdistan Region.

Source: Information derived from MEES, July 25, 2023

Based on the gathered data, the Khurmala field has recently achieved its peak production rate of 85,000 barrels per day, with DNO following closely at 40,000 barrels per day, as illustrated in the table. Conversely, the Erbil oil field registers the lowest production level at just 607 barrels per day. As per statements from Kurdistan Regional Government (KRG) officials, the Kurdistan Region presently supplies Baghdad with a daily quota of 85,000 barrels of oil. This leaves approximately 134,000 barrels out of the current production of 220,000 barrels. According to HKN, Gulf Keystone, and DNO, these surplus barrels are destined for the domestic market.

Another noteworthy aspect of this upsurge in domestic production is its connection to meeting the demands of domestic refineries, boasting a daily refining capacity of approximately 335,000 barrels of oil. Notably, the Dukan refinery, which had remained inactive for nearly two years, recommenced operations in early June. With a daily refining capacity of 20,000 barrels of oil, it currently processes an average of approximately 12,000 barrels of oil each day.

Table 1: Daily Average Oil Production Levels in Kurdistan Region Oil Fields

Source: Data compiled from oil company publications in the third quarter of 2023.

Note: The daily averages for certain oil fields may vary due to oil production for domestic use and domestic refineries, which may result in figures higher or lower than those stated here.

*The data collected indicates that DNO's production has currently risen to 60,000 barrels per day in the fields under its operation. However, the company's most recent publication on August 17, 2023, cites a production rate of 40,000 barrels per day.

**In the Erbil oil block, current daily production stands at 9,500 barrels, as per the information gathered.

Conclusion:

Companies whose production relies on oil exports through the Ceyhan pipeline may consider resuming operations either in the middle or towards the end of this month. This expectation arises due to signs pointing towards a resurgence in oil exports from the Kurdistan Region and Kirkuk to the Ceyhan port. However, the potential for such a resumption hinges on the ongoing negotiations. Notably, Iraq and Turkey are currently engaged in a compensation dispute triggered by Paris Court decision that awarded financial compensation. The interpretation of this compensation differs between Iraq and Turkey, adding complexity to the situation. In reality, the resumption of oil exports from the Kurdistan Region and the notification sent to international companies operating there, regarding production and export through the pipeline, hinges on two primary factors.

Firstly, Baghdad's ability to disburse the 1.3 trillion dinars allocated in the budget to the Kurdistan Region is contingent upon the Kurdistan Region's participation in contributing to Iraq's overall revenue.

Secondly, it pertains to the operational dynamics of oil companies. Currently, these companies are inclined to prioritize domestic production over exports to international markets. This is primarily due to Iraq initially budgeted $6 per barrel for production costs, and they currently have double that amount invested in each barrel's production process.

In conclusion, the resumption of oil exports holds greater significance for Iraq and Turkey than for the Kurdistan Region itself. Turkey is incurring mounting losses daily, and, as per the agreement, cannot afford further delays due to technical constraints. This situation also heightens the pressure on Iraq concerning its dealings with the Kurdistan Region.