Overview

The currencies of Iraq's neighboring countries are undergoing significant depreciation. This year alone, the Iranian rial has weakened by 20%, the Turkish lira by 38%, and the Syrian pound—despite some recent appreciation following Assad's fall—has lost 50% of its value against the US dollar. These dramatic fluctuations in the currencies of Iraq's neighboring countries directly impact the Iraqi Dinar in two key ways. Firstly, Iraq's trade with these countries exceeds $20 billion annually, creating significant economic interdependencies. Secondly, the presence of unsupervised currency markets and remittances from Iraq to foreign countries has caused the Iraqi Dinar, in these markets, to trade at a rate approximately 15% lower than the official value set by the Central Bank of Iraq against the US Dollar.

The causes of depreciation in neighboring currencies vary. The decline of the Iranian rial is attributed to external factors, including US and European sanctions. The Turkish lira's depreciation stems from a growing fiscal deficit, budget imbalances, and political stances taken by the AKP in response to regional developments. Meanwhile, the collapse of the Syrian pound can be traced to ongoing war, instability, economic sanctions, and uncertainty surrounding the emerging Jolani-led state. Why does the Iraqi currency fluctuate daily in the market, consistently trading at over 20,000 dinars above the Central Bank's official rate for every $100?

Iraq is expected to change the process for issuing cash dollars early next year. Instead of the central bank, several banks will issue cash dollars daily to tourists traveling abroad through airports. Currently, this system is implemented differently in the Kurdistan Region's airports compared to those in central and southern Iraq. At present, the Commercial Bank of Iraq (TBI), responsible for issuing dollars to tourists at the airports in Erbil and Sulaimani, provides only a small portion of dollars with the central bank’s rate and value to travelers departing from these airports. In contrast, travelers from other airports receive significantly larger amounts daily, despite the central bank's established daily cash limit for tourists. This discrepancy arises because all other dollar transactions must be conducted through banks and credit.

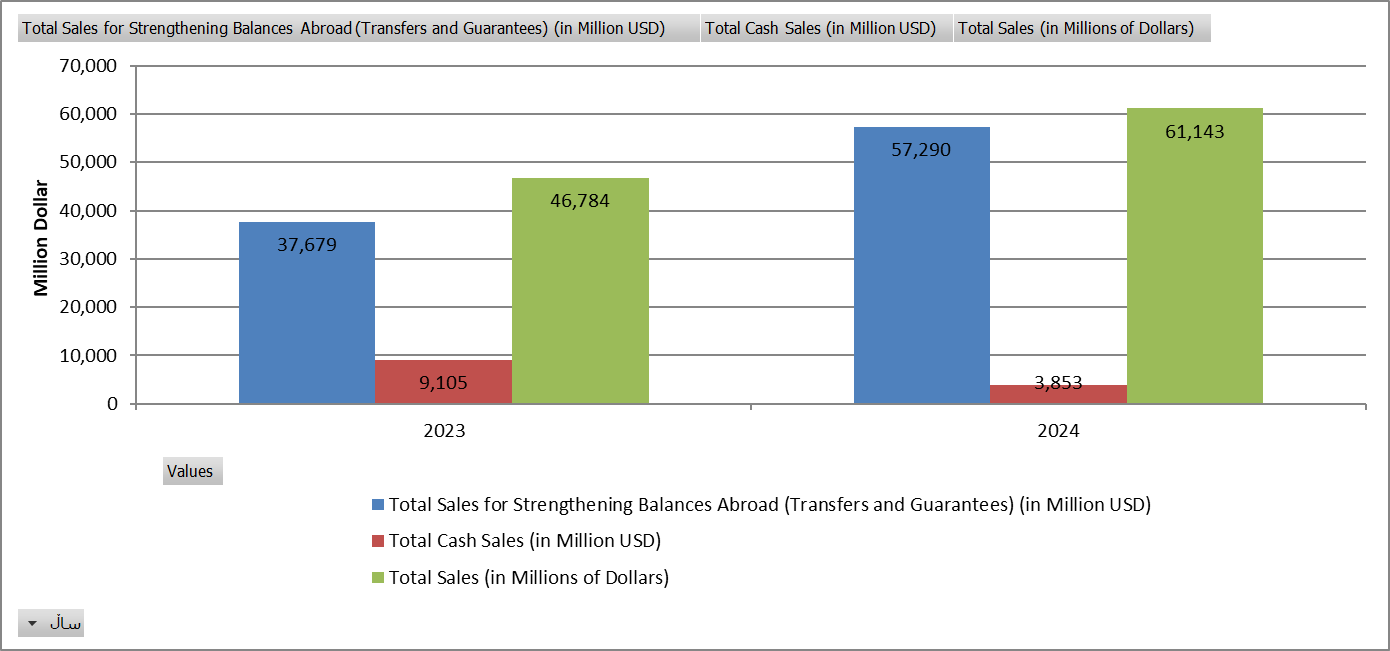

The Central Bank of Iraq (CBI) has implemented significant changes in the issuance of cash dollars and remittances this year compared to last year. Total remittances have exceeded $58 billion, while cash issuance stands at only $3.8 billion. In contrast, last year's total remittances were $37.6 billion, with cash issuance at $9.1 billion. Although this year's cash issuance is less than half of last year's, the average difference between market prices and central bank rates for $100 has remained nearly unchanged. Another key point regarding currencies is that the value of all currencies, including the US dollar, has been volatile this year. The US dollar, widely used for global trade, has fluctuated—falling against some currencies while rising against others. Looking ahead, forecasts from Citibank, JPMorgan, and Deutsche Bank predict a stronger US dollar, with uncertainty surrounding the value of other currencies against it. This is attributed to potential policy changes by the US administration, including possible tariff increases, rising inflation, and economic growth anticipated in 2025.

Drawing on data from the Central Bank of Iraq and forecasts from global economic institutions, we will assess the future of the Iraqi Dinar, Iranian Rial, Turkish Lira, and Syrian Pound against the US Dollar in 2025.

Is the Iraqi Dinar Poised to Decline in 2025?

In 2024, the amount of money issued through remittances increased by 32% compared to the previous year, while the amount issued in cash decreased by 56%. However, an intriguing and puzzling observation is that the dollar's value has neither declined at the same rate as the reduction in cash supply to the market nor exhibited significant changes. This year, the total amount of cash and remittances issued by the Central Bank of Iraq (CBI) surpassed $62 billion. Of this, remittances accounted for over $58 billion, while cash issuance dropped to $3.8 billion, as illustrated in the first graph.

Graph 1: Dollar Issuance in Remittances and Cash in 2023 and 2024

Source: Central Bank of Iraq (CBI), December 29, 2024

Note: Central Bank dollar issuance data as of December 26, 2024.

Another noteworthy detail from the Central Bank of Iraq's data is the fluctuation in the total amount of money printed. According to the data, as of October 31, 2024, the total amount of money printed by the central bank was 104.1 trillion dinars[i]. However, by November 30, 2024, this amount had decreased to 101.3 trillion dinars. Of this total, less than 10% is held within banks, while more than 90% is circulating outside the banking system. This substantial volume of cash outside the banks has a greater potential to influence the dollar's market price than the central bank's issuance of cash dollars.

The Outlook for the Iranian Rial, Turkish Lira, and Syrian Pound in 2025

Since 2018, the Iranian Rial has lost nearly 90% of its value against the US dollar. As of December 18, 2024, the exchange rate reached 777,000 Iranian Rials per dollar, meaning 100 dollars now equates to over 7.7 million Iranian Rials—marking its lowest level against the dollar. Further fluctuations are anticipated with the inauguration of the new US president next year.

Last year, the Turkish Lira was projected to lose a third of its value against the US dollar by 2024. Currently, the value of the Turkish Lira continues to decline daily against the dollar, recently reaching its lowest level, with one US dollar exceeding 35 Turkish Liras. Similar to the Iranian Rial, the Turkish Lira has lost over 90% of its value against the US dollar in the past five years. In 2018, one dollar was equivalent to 4.5 Liras; now, it has risen to 35 Liras. This sharp decline is largely attributed to the growing fiscal deficit, which reached 16.6 billion Liras by the end of November 2024, while the cash deficit climbed to 62.2 billion Liras. These challenges persist despite ongoing expectations of worsening inflation in Turkey.

According to UN data, 90% of Syria's population lives below the poverty line. Following Bashar al-Assad's fall and departure, he has left behind an economy that will require decades and billions of dollars to recover. The Syrian currency is also undergoing significant changes, including the reprinting of the Syrian Pound to remove Bashar al-Assad's image and address its devaluation. Since the onset of the Syrian crisis in 2011, the Syrian Pound has lost over 90% of its value against the US dollar.

In the days leading up to Assad's departure, one US dollar reached 30,000 Syrian Pounds, compared to 50 Syrian Pounds per dollar before the Syrian crisis. Currently, the Syrian market trades at rates between 10,000 and 15,000 Syrian Pounds per US dollar, or approximately $100 for 1–1.5 million Syrian Pounds. Interestingly, in the Iraqi and Kurdistan markets, the Syrian Pound holds a higher value than within Syria.

The value of the new Syrian currency, which Turkey has offered assistance to print, remains unknown for the coming year due to uncertainty about the central bank's reserves and the total amount to be printed. As a result, the future of the Syrian Pound and its value against the US dollar in 2025 remains uncertain.

The Impact of Dollar Volatility on Global Currencies in 2025

As a globally traded currency, the US dollar represents approximately one-third of the world’s economy. In 2024, due to the policies of the US Federal Reserve, the dollar experienced mixed performance—depreciating against some currencies while appreciating against others, particularly in the Middle East, including Turkey, Iran, and Syria, at varying rates.

According to the Pinpoint Analysis Institute for Global Currency Exchanges, the US dollar fell by 11.5% against the Thai Baht, 8.1% against the British Pound, 6% against the Swedish Krona, and 4.4% against the Euro. Conversely, it appreciated by 24.8% against the Turkish Lira, 8.3% against the Brazilian currency, and 1.1% against the Indian Rupee.

The year 2024 was marked as a turbulent period for financial markets, with shocks in inflation, central bank policies, digital currency changes, and economic growth. However, for the global economy, international trade, and the outlook for currencies in 2025, much depends on the policies introduced after the inauguration of the new US president. As the world’s largest economy, the US accounts for $30.3 trillion of the global $115 trillion economy, making its direction crucial for the future of currency stability.

Conclusion

Changes in a currency's value or depreciation generally have two significant effects. On one hand, they can strengthen domestic production, boost exports, and attract foreign tourists. On the other hand, they reduce the ability to import goods and services due to rising costs, lower the production capacity of domestic industries reliant on imported goods, and diminish citizens' ability to travel abroad.

Next year, the policies of the new US administration and geopolitical developments may impact the Iranian Rial, Turkish Lira, and Syrian Pound and global currencies. Additionally, the Iraqi Dinar is influenced by the inflow and outflow of US dollars, despite ongoing changes in the banking system, advancements in digitalization, increased reliance on SWIFT-based money transfers, reduced cash transactions, and a rise in remittances.

Suppose the Iraqi Dinar fluctuates against the US Dollar early next year. In that case, it is likely more influenced by the demand from traders and individuals operating in Iraq's and the Kurdistan Region's dollar markets than by changes in the central bank's cash supply. If the markets were solely tied to the central bank's cash supply, the dinar should have depreciated against the dollar in proportion to the reduced cash supply this year.

The central bank has set the value of the Iraqi Dinar, which ideally should align with the stable currency models of Gulf countries rather than its current state. This is unlike a free market system, such as in Turkey or the UAE, where the state determines the exchange rate against the US Dollar. Therefore, any depreciation of the Iraqi Dinar in the market is more attributable to US fiscal policies toward Iraq rather than the central bank's supply of cash dollars to the market.

[i] The decline in printed currency may be attributed to the obsolescence of 2.8 trillion dinars, resulting in an additional cost to print new currency in the same amount. Alternatively, the reported figures may be inaccurate.

کلیك بکە بۆ بینینی سەرچاوەکان

References