The Core of the Tripartite Agreement and Company Profits per Barrel of Kurdistan Region Oil

30-09-2025

Wood Mackenzie has been tasked with reviewing production costs, investment levels, and profit margins per barrel of oil for international companies operating in the Kurdistan Region. Based on this review, Baghdad will allocate the companies’ financial entitlements for both the current and future phases.

Following the recent 20-point agreement and the resumption of oil exports, Baghdad has set the cost of producing and transporting oil at $16 per barrel. According to DNO, $14 of that amount accounts for production costs, while $2 covers transportation. This arrangement will remain in place until the end of the year, after which Wood Mackenzie will issue its report detailing the actual cost per barrel.

At its core, the 20-point agreement represents a confirmation of the rights and entitlements of all parties involved. The 30-month deadlock that halted exports was essentially rooted in these very issues, as is evident from the terms outlined. The agreement reflects a series of additional demands and negotiated conditions designed to ensure that each party’s requirements are addressed; however, it still raises disputes and questions. Most critically, the focus lies on the production cost per barrel and whether the $16 allocated to companies as financial entitlements will be adjusted upward or downward in the future.

The cost per barrel of oil and company profits in the Kurdistan Region vary depending on contractual terms, production levels, investment, and field development. This differs from the situation in federal Iraq. In the Kurdistan Region, companies factor investment costs into production expenses, whereas in Iraq, investment in the oil sector is covered by the state. Over the past decade, total expenditures in Iraq reached 110 trillion dinars, of which roughly 100 trillion dinars were allocated annually for investment. In 2024 alone, the Ministry of Oil’s investment spending exceeded 12.3 trillion dinars.

According to Gulf Keystone’s financial report published on August 28, 2025, total daily oil production during the first six months of the year averaged 44,100 barrels, which were sold domestically at $27.8 per barrel. This generated total revenue of $221.9 million, with the company’s net revenue amounting to $83.1 million.

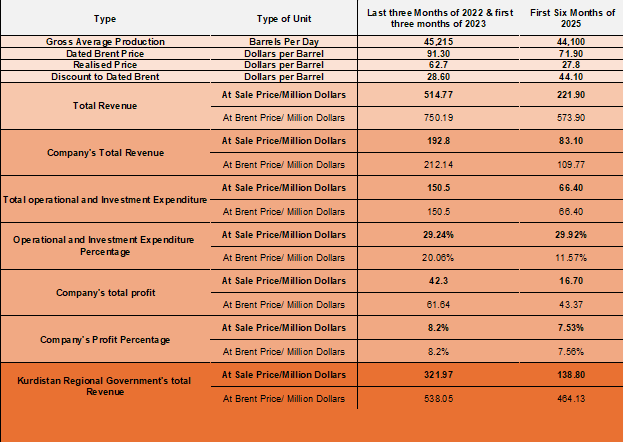

The report further indicated that total operational and investment expenditure during the same period reached $66.4 million, leaving the company with a profit of $16.7 million. This means that the company’s overall share—including both costs and profit—amounted to 37.44% per barrel of oil. Broken down further, production and investment costs accounted for 29.9%, while profit represented 7.53%, as shown in the table below.

Another important point from Gulf Keystone’s report concerns production costs. For the first six months of this year, the cost of producing a barrel of oil was divided into 72.7% operational costs and other expenses, while investment expenditures accounted for 27.2%. If companies' expenses change, this will change, not their costs and profits.

These percentages also held true for the period prior to the suspension of oil exports and sales from the Kurdistan Region through the Ceyhan port. For instance, according to reports, Gulf Keystone produced 44,202 barrels of oil per day in the last three months of 2022, sold at $74.1 per barrel, generating total revenue of $301.3 million.

Also, during the first three months of 2023, total daily oil production was 46,228 barrels, which was sold at $51.3, and total oil revenue during those three months was $213.4 million. Thus, total oil revenue during those six months was $514.76 million, for which the Kurdistan Region did not pay any amount or share to the company. Gulf Keystone indicates that oil production costs during that period were $150.5 million, and the company's profit was $42.3 million. This reveals that the production cost percentage of total revenue was 29.2% and the company's profit percentage of total revenue was 8.2%, as shown in the table below.

Table 1: Difference in Kurdistan Region oil sales at Brent price versus Ceyhan Port and domestic price in the last three months of 2022, the first three months of 2023, and the first six months of 2025, based on Gulf Keystone’s oil production.

Source: Gulf Keystone Company Report, August 28, 2025. Retrieved on September 29, 2025.

Before September 27, 2025, the Kurdistan Region relied on two methods of oil sales. The first was through exports via the Port of Ceyhan, where prices were not only significantly lower than Brent price but also carried a difference of up to $20 to $25 per barrel. The second method, used over the past 30 months, involved domestic sales at prices up to $44 below Brent price. While part of this price gap can be attributed to the quality of the crude, a substantial portion resulted from Baghdad’s legal challenges, buyers’ fears of sanctions, and restrictions imposed by the Iraqi state to prevent the purchase of Kurdistan Region oil.

Following the recent 20-point tripartite agreement, a new phase of Kurdistan Region oil sales has begun. This shift is not only because the oil is once again being exported and sold through the Port of Ceyhan, but also because SOMO is now handling the sales. With SOMO in charge, contracts are expected to reflect the crude’s quality and achieve prices much closer to Brent benchmarks. This marks a significant departure from the previous two phases in terms of revenue generation.

According to Gulf Keystone’s report, the Brent price during the last three months of 2022 was $101.4 per barrel, while in the first three months of 2023 it was $81.2. This means that over the six-month period, the average Brent oil price stood at $91.3. By contrast, the average selling price of oil from the Shaikan field was only $62.7. When sold domestically in the first six months of this year, the average price of Shaikan crude dropped even further, to just $27.8 per barrel, compared with an average Brent price of $71.9 for the same period.

An analysis of these two six-month periods—covering production costs, investment, company profits, and Kurdistan Regional Government (KRG) revenue—shows that if the oil had been sold at Brent prices, the KRG’s revenue would have nearly doubled. In addition, company operations, production cost percentages, and profit ratios would have been somewhat more stable.

Specifically, during the last three months of 2022 and the first quarter of 2023, if Shaikan oil had been sold at Brent prices, total revenue would have reached $750 million. In that scenario, company profits would have risen from $42.3 million to $61.6 million, and KRG revenue would have increased from $321 million to $538 million.

In the first six months of this year, Shaikan field production totaled 7.98 million barrels. At the average Brent price, this output would have generated $574 million in revenue. After deducting $66.4 million in costs and $148 million in company profits, $359 million should have accrued to the KRG. In reality, however, the KRG received only $138.8 million during that period.

The consulting firm Wood Mackenzie is set to review production costs per barrel of oil, while negotiations continue on several fronts: between the international companies and the Kurdistan Regional Government (KRG) regarding outstanding debts from the last quarter of 2022 and the first quarter of 2023, and between Erbil and Baghdad over salaries and the federal budget. Current figures show that production costs account for 18.5%, investment returns for 8.1%, and investor company profits for 7.5% of the total revenue generated per barrel of oil from the Kurdistan Region’s fields.

A crucial point to note is that production and investment costs for the international companies operating in the Kurdistan Region—many of which also hold shares and conduct oil and gas operations elsewhere—are structured around profit rather than strict expenditure. This means their reported expenses can be adjusted.

In practice, shareholder reports make it clear that as overall oil revenues rise, company profits grow at a slower rate, while the Kurdistan Region’s share of oil sales revenue increases more substantially.

This raises an important question: Is Baghdad prepared to grant companies a profit margin of 6% to 9% when selling the produced oil at Brent prices? Production costs per barrel and the capital invested to expand output are already established. Any subsequent changes to costs or rates—whether increases or reductions—stem from the companies’ own financial and investment policies, not from the demands of the KRG or Baghdad.

What is striking is that the Iraqi government's setting of $16 and the budget law's approval by parliament in previous periods, as well as its incorporation into the tripartite agreement for the total production and transportation costs of Kurdistan Region oil for the companies, did not come arbitrarily but were based on domestic sales. This is because during those 30 months when exports were halted, the Kurdistan Region produced oil was sold at an average of $30 per barrel.

Looking at company data, whether a barrel of oil was sold at $62.7 or $27.8, the profit margins and total production costs—including investment costs—are clear. For example, before the closure of the Ceyhan oil pipeline in March 2023, when oil sold at an average of $62.57 per barrel, combined costs and profits for the companies totaled $23.43, leaving $39.14 for the Kurdistan Region. However, if oil was sold at the Brent price of $91.18, total costs and company profits per barrel would amount to $25.79, while the Kurdistan Region’s share would rise to $66.4.

Now that Iraq’s State Oil Marketing Organization (SOMO) is handling the sale of Kurdistan Region oil, the key question is how this arrangement will affect both the Kurdistan Region’s revenues and investment in the sector. It remains to be seen what Wood Mackenzie will conclude regarding production costs, investment expenditures, and company profits under the existing oil field contracts.