Turkmenistan Gas Imports: The Crossroads of Sudani's Promise and Iraq's Gas Initiatives

20-11-2023

Overview

On November 8, 2023, the Iraqi delegation and Turkmenistan's representatives formalized a protocol in Ashgabat, Turkmenistan, outlining key terms for the sale of Turkmen gas to Iraq. The agreement entails Turkmenistan exporting 9 billion cubic meters of gas to Iran annually, with Iran reciprocally exporting the same volume to Iraq. Despite Prime Minister Mohammed Shia's statement in Baghdad on May 4, 2023, projecting an end to gas imports within one to three years, the new accord implies Iraq's continued import of Turkmen gas for a duration of five years if implemented!

The accelerated advancements in the gas sector between Turkmenistan and Iraq can be traced back to August 2023, commencing with the Iraqi Oil Ministry delegation's visit to Turkmenistan. Subsequent pivotal events include Turkmenistan's Minister of State for Gas Affairs, Maqsad Babayev's visit to Baghdad on October 5, 2023, and the recent trip of the Iraqi Minister of Electricity to Turkmenistan. These developments may be influenced by US sanctions against Iran. Notably, this summer, US Secretary of State Anthony Blinken granted a 120-day amnesty for gas imports from Iran to Iraq, a relief extended multiple times. With the imminent end of this extension, the United States seems to be adopting a less lenient stance.

Upon the eventual signing of this agreement, two noteworthy aspects emerge. Firstly, the long-awaited agreement between French Total Energy and the Iraqi Oil Ministry, inked in the summer of 2023 following a year-long delay. Total Energy's ambitious plan involves a substantial $27 billion investment, with a primary focus on developing the sector, particularly gas flaring reduction.

Secondly, the Iraqi Oil Ministry's initiatives encompass projects and fresh contracts aimed at curbing gas flaring. According to World Bank data, gas flaring is currently prevalent in 198 oil fields and wells across Iraq and the Kurdistan Region, amounting to a substantial volume of 17.94 billion cubic meters. If these emissions were sold, their estimated value would exceed $2.05 billion.

We will delve into the intricacies of importing gas from Turkmenistan, the commitment made by Sudani, and the destiny of multibillion-dollar projects designed to eradicate gas flaring and combustion in the oil and gas fields of Iraq and the Kurdistan Region.

Turkmenistan Gas; A blow to the Total agreement in Iraq

Upon the enforcement of the signed agreements and protocols, Iraq is poised to annually import 9 billion cubic meters of natural gas from Turkmenistan. Notably, Turkmenistan's gas exports to Iraq will take an indirect route through Iran. Under this arrangement, Iran is set to annually export 9 billion cubic meters of natural gas to Iraq, while Turkmenistan concurrently exports an equivalent volume of natural gas to the north and northwest regions of Iran.

This mode of operation or gas exchange has precedent in the collaboration between Turkmenistan and Iran. In 2021, Turkmenistan successfully entered into a contract to supply 1.5 to 2 billion cubic meters of gas to Azerbaijan, facilitated through Iran.

Turkmenistan's endeavors are intricately tied to two key factors. Firstly, there's the historical issue of non-payment for Turkmenistan's natural gas exports to Iran, a scenario that unfolded in the summer of 2017. Secondly, it is rooted in Turkmenistan's strategic efforts to diversify its natural gas export routes, a pursuit intensified after the dissolution of the gas trade agreement with Russia in 2009. To address these challenges, Turkmenistan initiated the construction of a 182-kilometer gas pipeline from the Devlet Abad gas field to the Khangiran gas field in northeastern Iran in 2010. Originally boasting an export capacity of 6 billion cubic meters per year, the pipeline recently underwent expansion, doubling its capacity through the installation of additional pumps to meet growing export demands. This comes despite the presence of an older gas pipeline along the Caspian coast, stretching from Turkmenistan's Korpedz field to Iran's Kurdku, established in 1997, with an annual capacity of 8 billion cubic meters of gas.

Turkmenistan holds the world's fourth position in terms of natural gas, contributing to 10% of global natural gas discoveries or reserves. Over the last two decades, the country has made substantial investments in gas production and the development of natural gas pipelines.

In essence, this agreement signifies a departure from the pact between Total Energy and the Iraqi Oil Ministry, initially signed in November 2021 and subsequently reaffirmed on July 11, 2023. The agreement outlines key projects, prominently featuring gas production initiatives in West Qurna 2, Majnoon, Artawi, Tuba, and Luhais in southern Iraq, collectively targeting a daily gas production capacity of 300 million cubic feet.

This unfolds amidst the Iraqi Oil Ministry's imminent announcement of the sixth round of gas and oil contracts scheduled for January 2024. Encompassing approximately 30 oil and gas blocks along with 14 contracts, this upcoming round features 11 new agreements focused on the production and development of gas fields in Iraq. Notably, eight of these fields are situated in Anbar province.

Sudani’s promise; The fate of natural gas projects and associated gas in Iraq

As per BP's data, Iraq's gas production in 2021 reached 9.4 billion cubic meters, while consumption stood at 17.1 billion cubic meters, resulting in the importation of 7.7 billion cubic meters. In the previous year, Iraq produced 9.8 billion cubic meters but had to import around 9 billion cubic meters from Iran to meet its demands. On May 4, 2023, Mohammed Shia Al-Sudani emphasized the financial strain, stating, "We burn money every day, approximately 1.2 billion cubic feet of gas daily, while importing about 1 billion cubic feet of gas daily from Iran, incurring a cost of no less than $4 billion annually!"

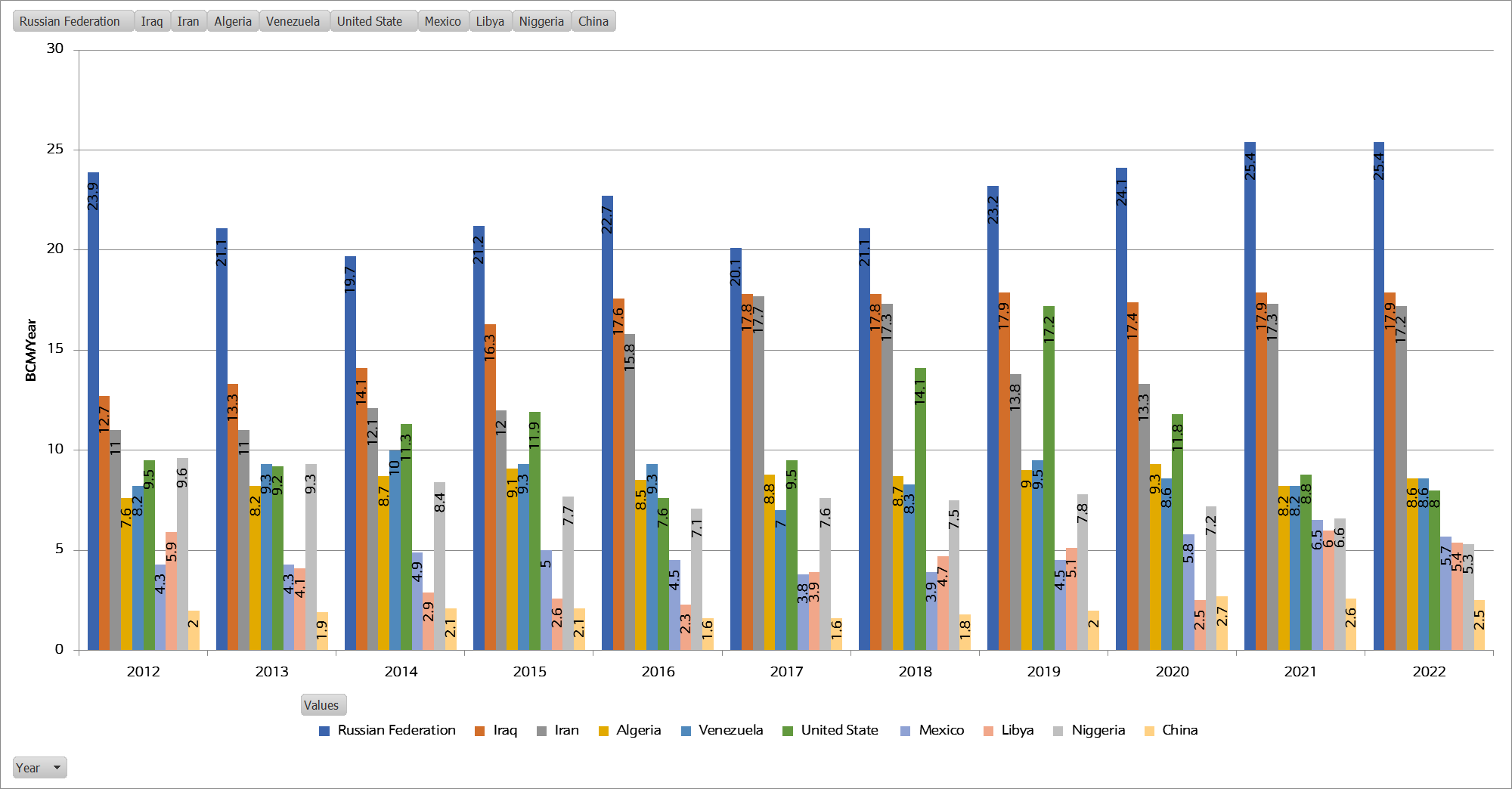

According to the World Bank's Joint Global Gas Flaring Reductions Tracker (GGFR), Iraq holds the second position globally, trailing only behind Russia, with gas flaring reaching 17.94 billion cubic meters in 2022. This marks a significant rise from 12.7 billion cubic meters in 2012, indicating a notable increase of 5.24 billion cubic meters in gas flaring over the past decade.

Graph 1: Max gas flaring annually in 10 countries (2012-2022).

Source: The World Bank, GGFR Tracker 12-11-2022

Per the World Bank tracker, Lukoil's West Qurna-2 oil field leads in annual gas flaring, combusting 1.18 billion cubic meters of associated gas. The second spot goes to a Venezuela Santa Barbara field well, burning 1.07 billion cubic meters yearly. Among the top 50 global gas-flaring sites, 13 are located in Iraq.

When considering oil production in the central and southern Iraqi regions and comparing it to the Kurdistan Region separately, there is notably minimal gas flaring observed in the oil and gas fields and wells of the Kurdistan Region.

In Iraq, the Rumaila oil field leads in annual gas flaring at 2.7 billion cubic meters, followed by the Zubair oil field with 2.5 billion cubic meters, and the West Qurna-2 oil field with 1.5 billion cubic meters. Collectively, these three fields waste 6.7 billion cubic meters of gas each year, surpassing half of the annual gas imports from Iran and anticipated future imports from Turkmenistan.

In the Kurdistan Region, the Khurmala oil field stands out for the highest annual gas flaring at 0.655 billion cubic meters, whereas the Khor Mor gas field records the lowest level at 0.9 million cubic meters, as depicted in the second graph.

Graph 2: Gas Flaring in Oil and Gas Fields in Iraq and the Kurdistan Region (2022).

Source: The World Bank, GGFR Tracker 12-11-2022

Conclusion

The prospective enforcement of the Iraq-Turkmenistan natural gas agreement later this year will undoubtedly prompt reflections on Iraq's natural gas investment initiatives and its capacity to bolster gas production while minimizing gas flaring in oil fields. However, the prior agreement inked between Total Energy and the Iraqi Oil Ministry appears to be more symbolic than substantive, as evidenced by Iraq's progression to a preliminary agreement and protocol signing with Turkmenistan to import 9 billion cubic meters of gas over a five-year period.

Iraq's renewed reliance on indirect gas imports from Iran reflects a shift in dynamics, as now the Iraqi funds flow to Turkmenistan. Despite this, it's worth noting that Iran encountered payment challenges in its past dealings with Turkmenistan for gas imports.

The Turkmen Foreign Ministry asserts that the five-year agreement is in place, yet doubts arise about fulfilling the cabinet's commitment to cease the gas flaring of 1.2 billion barrels, particularly Mohammed Shia Sudani's pledge to end money burning. Implementation of these promises appears uncertain.

The fate of the sixth round of oil and gas contracts remains uncertain, given that many conditions deterred foreign investment in most gas fields during the fifth round. Consequently, a reevaluation is anticipated in the upcoming sixth round.

Despite the attainment of a preliminary agreement, a joint memorandum of understanding, and a protocol outlining trade terms, uncertainties linger regarding the ultimate realization and execution of a final agreement. The question arises as to whether the Ministry of Electricity or the Ministry of Oil will take the lead in dealing with Turkmenistan Gas. Given the potential lack of awareness between the two ministries, the Ministry of Oil aims to boost domestic gas production, decrease gas flaring, and foster the purchase and development of gas fields. In contrast, the Ministry of Electricity is focused on ensuring a stable supply of gas for electricity generation! Coordination between these ministries may be crucial for a cohesive strategy.