Introduction

In late June and early July, the Iraqi parliament convened to review and approve the 2023 budget and the following two years' financial plans. The parliamentary debates were characterized by their intensity and extended duration, often lasting into the early hours of the morning. However, it is worth noting that these discussions, depending on the law, often leaned towards political considerations rather than purely economic ones.

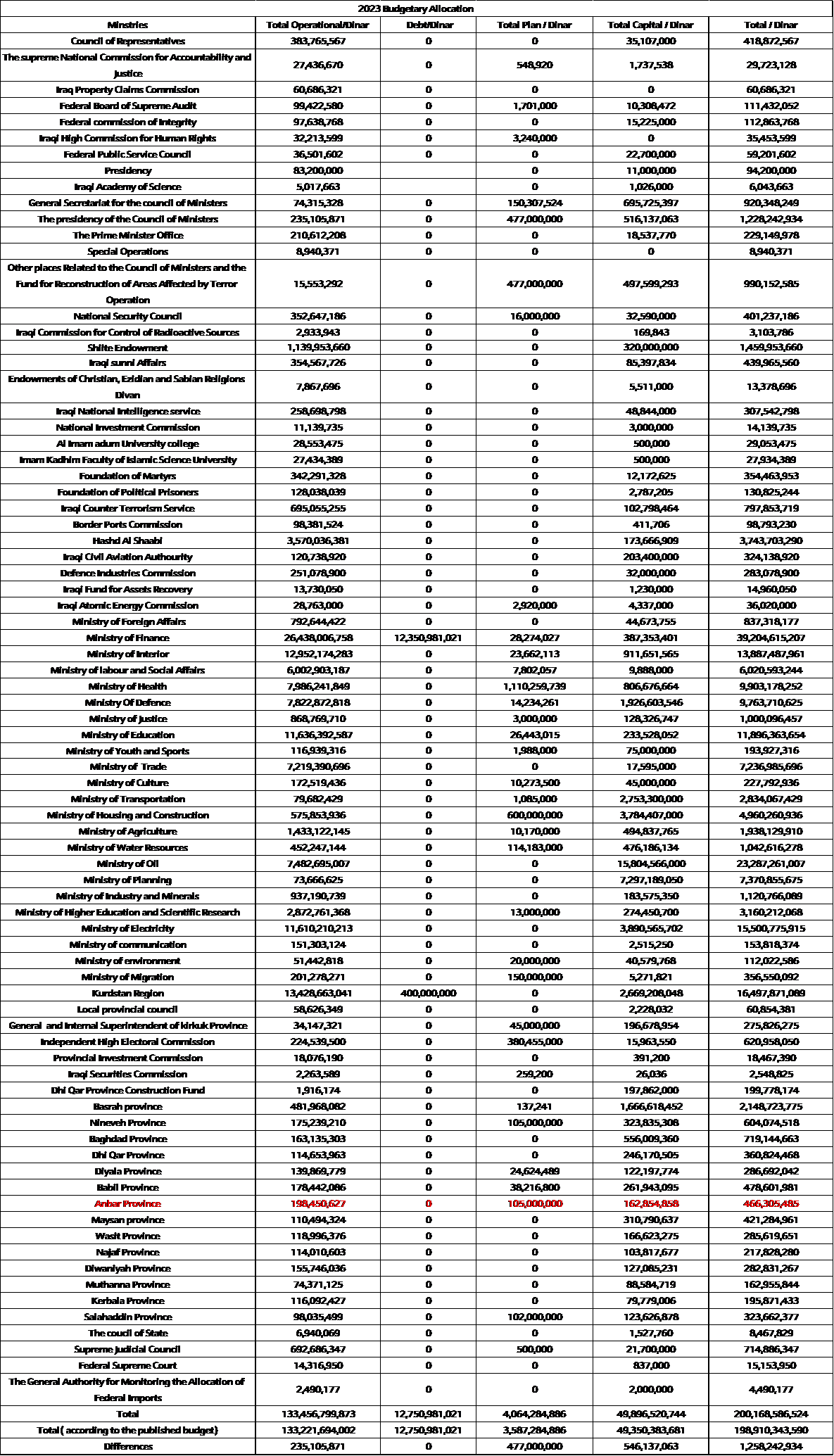

For instance, a substantial gap of 1 trillion 258 billion dinars is evident in the total expenditures alone. This discrepancy has been identified by multiple entities, including the Ministry of Finance, the Parliamentary Finance Committee, the Iraqi High Economic Council, and 327 Members of Parliament (pp. 60-63). What adds an intriguing dimension to this issue is the variance in expenditures for Anbar province, a matter that should have garnered the attention of the speaker and Sunni members within the finance committee. While the allocated budget for Anbar province was originally set at 466 billion dinars, the actual sum tallies up to just 436 billion dinars. Thus, this stark contrast amounts to a substantial 30 billion dinars in the collection of the allocated budget for this province!

As per the three-year budget, Iraq's projected expenditures for 2023 amount to 198 trillion dinars, with an initial allocation of 99 trillion dinars for the first half of the year. However, it's worth noting that during the preceding six months, only half of this allocation has been utilized. Furthermore, the anticipated deficit specified in the legislation might not materialize, as Ministry of Finance reports on both expenditures and revenues indicate that by the end of June 2023, total operating and investment expenditures stood at 47 trillion dinars, while oil and non-oil revenues exceeded 54 trillion dinars. To put this into perspective, in the first month of this year alone, Iraq experienced a gap of 7 trillion dinars between its revenue and expenditure.

As per the ratified 2023 budget, the expected breakdown of revenues was 87% from oil and 13% from non-oil sources. However, reports from the Ministry of Finance indicate a stark contrast for the first half of the year. Oil revenues have dominated, comprising a staggering 99.2% of total revenues, while non-oil revenues have contributed merely 0.8% to the overall revenue.

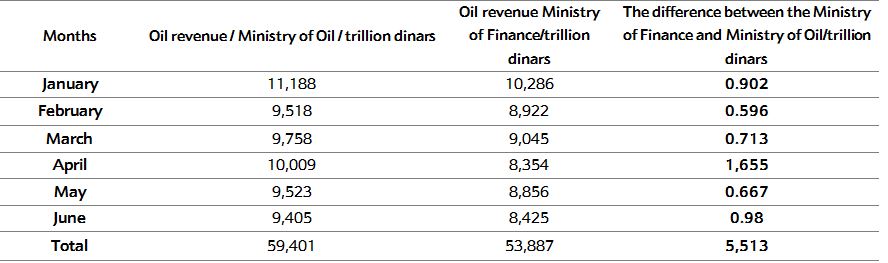

Another notable aspect concerning oil revenues is the disparity between the reports and publications of the Ministry of Oil and the Ministry of Finance regarding this income. During the initial half of this year, the Ministry of Oil reported oil revenues of $44.4 billion, equivalent to 59.4 trillion dinars. Conversely, the Ministry of Finance recorded a lower figure, amounting to 53.8 trillion dinars. This variance implies that the remuneration for producing companies operating in Iraqi oil fields exceeded 5.5 trillion dinars, not accounting for the Oil Ministry's expenses, which stood at 728 billion dinars over the same six-month period.

As per the budget law, oil revenues were initially projected to reach 57.6 trillion dinars. However, there is a noticeable deficit of 3.8 trillion dinars when compared to the actual revenue generated during this period, despite selling at an average price of $74.6 per barrel, which exceeded the budgeted amount by $4.6. The absence of oil exports from the Kurdistan Region and its failure to meet the budgeted contribution have resulted in an average daily export of 3.29 million barrels, falling short of the budgeted target of 3.5 million barrels.

In this analysis, we examine the disparities in revenues and expenditures by scrutinizing the data presented in the 2023 budget, along with the financial reports from both the Ministry of Finance and the Ministry of Oil.

Expenditures in the initial half of 2023, in accordance with both the budget and the Ministry of Finance.

On June 12, 2023, the Iraqi parliament granted approval to the three-year budget law, as stipulated by the 2023 budget law, amounting to 198.9 trillion dinars. Remarkably, this budget bears a deficit of roughly 64 trillion dinars, which is intended to be covered through debt financing. The law was officially published in the Iraq Official Gazette on June 26, from which the data presented here has been sourced.

Pages 60-63 provide a detailed breakdown of expenditures for the year 2023 across 65 institutions, ministries, and provinces. Notably, there is a notable variance of 1 trillion and 258 billion dinars in the total budget expenditure. The most significant difference is observed in the budget allocation for special programs, amounting to 477 billion dinars.

Discrepancies extend beyond the overall budget; they also affect the allocations designated for Anbar province. For instance, the operating budget is set at 198.4 billion dinars, the special program budget at 105 billion dinars, and the capital budget at 162 billion dinars, totaling 466.3 billion dinars. However, the published budget on page 63 reports only 436 billion dinars, reflecting a notable variance.

The disparities within the figures presented in the law raise a critical inquiry regarding its effective implementation in Iraq. If indeed it is being executed, it prompts a deeper examination of the criteria and numerical values being used. Not only do variations persist in the provision of resources and the allocation methodologies to institutions and ministries, but the numerical values themselves do not align as indicated in Table 1 below.

Regarding expenditures in 2023, there are noteworthy figures outlined in the law. For instance, within the presidential budget, the Iraqi Scientific Association total expenditure is an annual budget of 6 billion dinars. Furthermore, significant allocations have been made for entities like the Federal Board of Supreme Audit and the Commission of Integrity, with a combined budget of 223 billion dinars. Additionally, 15 billion dinars has been earmarked for the Federal Supreme Court. Interestingly, recent reports indicate that one-third of this allocation, which amounts to 5 billion dinars, is designated for the purchase of vehicles in 2023.

As per the law, Iraq is slated to allocate 198.9 trillion dinars for expenditures this year. However, there's a concern that if spending doesn't pick up pace soon, almost half of the 198.9 trillion dinars allocated in the budget may remain unspent. This is especially pressing because we are now in the final season of the year, with only one season remaining. It's worth noting that the Council of Ministers approved the budget guidelines on July 11 and published them in the Official Gazette on August 7, 2023.

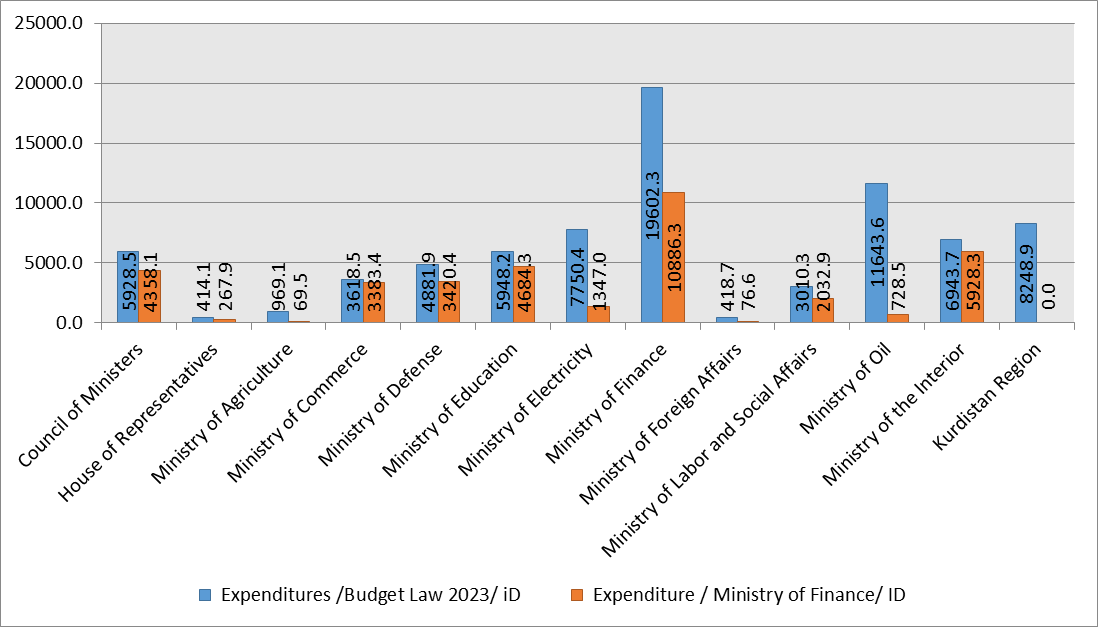

There is a significant variance between the expenditures outlined in the law and the actual spending reported by the Ministry of Finance for institutions, ministries, and provinces. While some entities have closely followed their budget allocations, others have spent only a fraction or nothing at all. To illustrate, in the first six months of this year, where 99 trillion dinars were earmarked for spending, only 47 trillion dinars have been disbursed so far. Consequently, to meet the budgetary targets, expenditures would need to triple in the second half of this year.

Table 1: Expenditures according to the 2023 budget law for institutions, ministries and provinces / thousand dinars

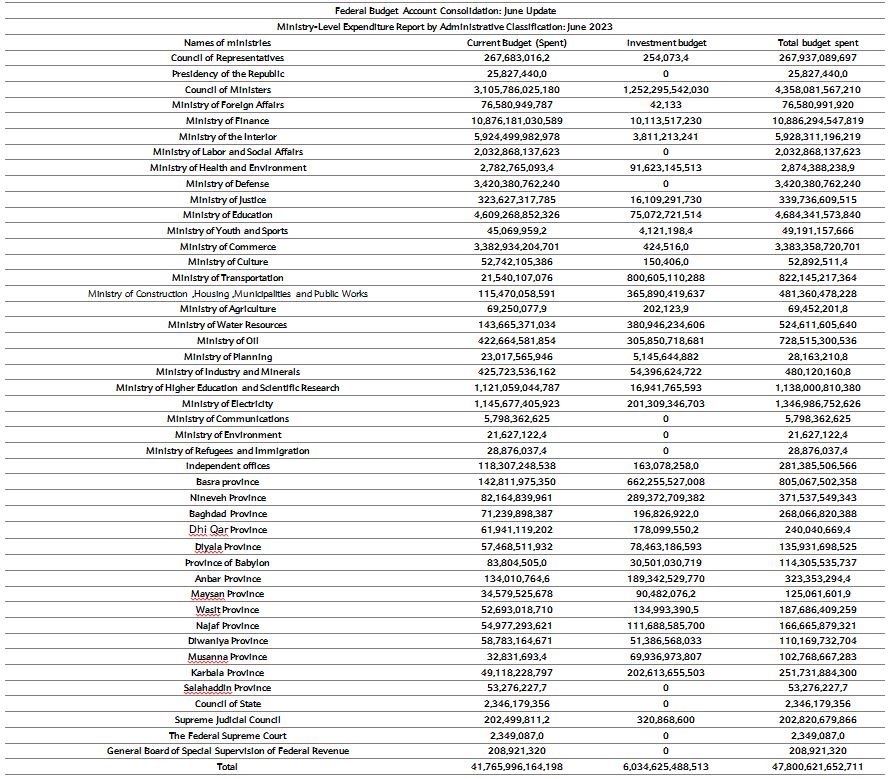

According to the Ministry of Finance's latest report, by the end of June 2023, total expenditures had reached 47.8 trillion dinars. Within this sum, 41 trillion dinars were allocated to operating budgets, while 6 trillion dinars were designated for investment budgets, as presented in the accompanying table. Notably, in the preceding six months, the Ministry of Finance received the largest allocation in the operating budget, totaling 10.8 trillion dinars. Following closely behind were the Ministry of Interior with 5.9 trillion dinars and the Ministry of Education with 4.6 trillion dinars.

Table 2: Expenditure Figures in Dinar, as Reported by the Ministry of Finance up to June 2023.

In the most recent six months, the Council of Ministers emerged as the highest spender, disbursing a significant sum of 1.2 trillion dinars. This stands in contrast to the allocation stipulated in the 2023 budget law, which designated 7.9 trillion dinars for 20 other entities, including the Prime Minister's office with 229 billion dinars, the Office of the Council of Ministers with 920 billion dinars, and the Presidency of the Council of Ministers with 1.2 trillion dinars.

As a result, among the 45 entities for which the Ministry of Finance disclosed expenditures in the past six months, the Council of Ministers stands out as the only entity to have utilized a substantial portion, managing to spend 4.3 trillion dinars out of its allocated 5.9 trillion dinars in the first half of this year, accounting for 72% of its total budget, as indicated in the first graph.

Another intriguing observation pertains to the alignment of expenditures between the budget law and the Ministry of Finance reports, specifically concerning the Kurdistan Region. Out of the 45 entities considered, the Ministry of Finance's allocation for the Kurdistan Region remained at zero or showed no expenditure for the first six months of this year. It's worth noting that during these six months, there was an expectation that at least half of the operating budget would have been expended, particularly in the second quarter or the months of 4-5-6 when oil exports were suspended.

Graph 1: Expenditure Variances in First Six Months - Budget vs. Ministry of Finance.

The revenues reported by the Ministry of Finance and the Ministry of Oil during the first half of 2023.

The Ministry of Finance's budget and reports outline seven potential sources of revenue, but in practice, the vast majority of Iraq's income, as reported by the Ministry, comes exclusively from oil-related activities. Remarkably, a striking 99% of the total revenue in the first six months of the fiscal year is derived from oil production, oil exports, and dollar recovery. These activities dominate Iraq's income stream, especially after accounting for company wages and currency exchange transactions at the central bank.

As per the Ministry of Finance's report, oil revenues in the first half of this year amounted to 53.8 trillion dinars, with an anticipated projection of 58.6 trillion dinars. This projects a deficit of 4.7 trillion dinars. The impact of this deficit would have been even more significant if oil prices weren't as high. The primary reason for this discrepancy is the suspension of oil exports from the Kurdistan Region, which was initially expected to contribute 400,000 barrels of oil per day but has remained suspended since March, 25th, 2023.

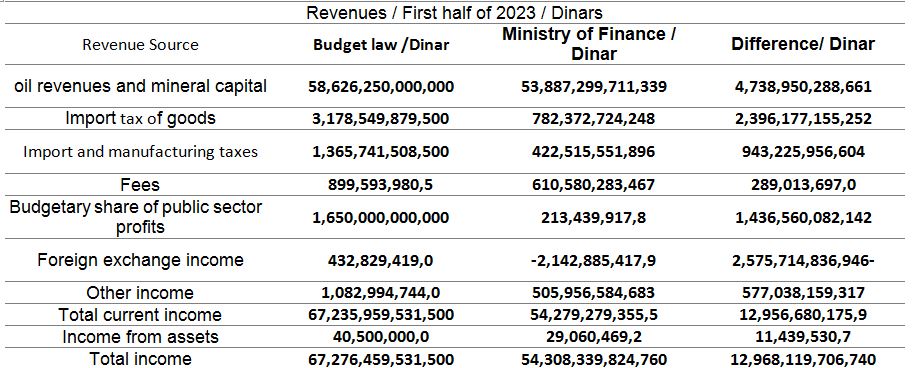

Regarding non-oil revenues in the past six months, the budget had initially anticipated Iraq's non-oil revenues to reach 8.6 trillion dinars. However, during this period, Iraq's non-oil revenues plummeted below zero due to currency exchange losses. The total non-oil revenue actually amounted to just 1.9 trillion dinars. Interestingly, the Ministry of Finance reported a decrease in foreign exchange revenue, which amounted to 2.14 trillion dinars, in contrast to the budget's projection of 413 billion dinars from non-oil revenue, as depicted in the provided table.

Table 3: Oil and non-oil revenues in the first half of 2023 according to the Ministry of Finance and 2023 budget

Indeed, as per the Oil Ministry's report, Iraq's total oil revenue in the first half of 2023 surged to 59 trillion dinars, surpassing the budgeted amount. However, it's essential to note that this figure is calculated before factoring in production costs, utilities expenses, and other associated production and export costs.

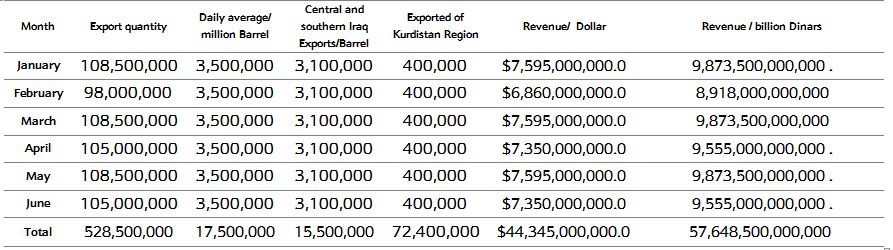

In the first half of 2023, the total oil revenue returned to the Ministry of Finance was only 53.8 trillion dinars, while according to the Ministry of Oil, the total revenue during the period was $ 44.4 billion, or 59.4 trillion dinars. Iraq exported 595 million barrels of oil during the six months, at an average of 3.29 million barrels per day at $74.66 per barrel, according to Table 4.

Table 4: Details of oil revenues according to Ministry of Oil publications in the first half of 2023

In the monthly publication from the Iraqi Oil Ministry detailing oil exports, revenues, and prices, it's noted that the exchange rate between the US dollar and the Iraqi Dinar stood at 1450 Dinars from February 1 to 7, after which it shifted to 1310 Dinars.

The Ministry of Finance and the Ministry of Oil have reported a variance of approximately 5.5 trillion dinars in their accounts for the first half of 2023. Notably, this difference reached its peak in April 2023, amounting to 1.6 trillion dinars, while the lowest variance was observed in February, standing at 596 billion dinars.

Table 5: Differences in oil revenues between the reports of the Ministry of Finance and the Ministry of Oil in the first half of 2023

If we include the difference between the Ministry of Oil and the Ministry of Finance in the wages of utilities and the cost of a barrel of oil, the cost of oil in Iraq in the past six months was $ 7.1 to $ 7.8 a barrel The amount is 23.2 trillion dinars and 7.4 trillion dinars have been allocated in the operating budget alone!

In addition to the previously mentioned sum, the Ministry of Finance disclosed that the Ministry of Oil allocated an additional 728 billion dinars, with 422 billion designated for operational expenses and 305 billion earmarked for investment purposes.

The 2023 budget, covering the next two years, outlines Iraq's projected oil revenue, inclusive of the Kurdistan Region, at 117.2 trillion dinars. The plan anticipated exporting 3.5 million barrels per day, with 3.1 million barrels originating from Baghdad and 400,000 barrels from Erbil. However, due to the suspension of exports and the unresolved Ankara-Baghdad agreement, it's improbable that these 400,000 barrels will contribute to exports, as indicated in the budget. Over the past six months, oil exports amounted to 72.4 million barrels, with approximately 36.4 million barrels exported during months 4, 5, and 6.

In summary, based on the budget and the average oil export prices, the Iraqi budget has incurred a loss of $5.4 billion. If we consider the budgeted oil price, the loss would be $5.04 billion. It's worth noting that as of now, approximately two months and ten days passed into the second half of the year, and the resumption of oil exports from the Kurdistan Region remains uncertain. For detailed oil revenue figures according to the 2023 Iraqi budget, please refer to Table 6.

Table 6: Iraqi oil revenues according to the budget law in the first half of 2023.

Conclusion

There are notable disparities between the projected expenditures and revenues outlined in Iraq's budget and the actual implementation. A clear example is the daily oil export target of 3.5 million barrels, while the average was 3.29 million barrels. In terms of revenue, particularly non-oil revenue, not only failed to increase, but it has also incurred a deficit. While the law anticipated collecting 13 percent of non-oil revenue, the first six months of this year saw less than 1 percent of non-oil revenue being generated, with 99 percent coming from oil revenue.

The disparities between the budgeted revenues and expenditures, as reported by the Ministry of Finance, and the variations from the figures stipulated by the law are striking. This difference is notably substantial, exceeding 1 trillion dinars, and in the case of Anbar province alone, it amounts to 30 billion dinars. Undoubtedly, if we delve into the details of the 65 institutions, ministries, and provinces, we are likely to uncover additional insights and discrepancies.

In recent developments, there's been talk that Baghdad is setting a rate of $6 per barrel for oil produced in the Kurdistan Region. This stands in contrast to the annual allocation for investment in the broader Iraqi oil sector, which amounts to 15 trillion dinars, equating to a cost of $7 to $8 per barrel for oil production in Iraq. It's important to note that the composition and cost of a barrel of oil in the Kurdistan Region differ significantly from the rest of Iraq. These differences aren't solely attributed to the involvement of international oil companies in the Kurdistan Region but are rooted in the distinct geological characteristics of the oil wells and the unique environmental conditions of oil fields in the Kurdistan Region. Consequently, the production cost is notably lower and doesn't align with the figures associated with Iraq's oil barrel production.