| RRC

By Omer Ahmed|

Only 10 days left to for the historic OPEC+deal comes into effect on May 1, which earlier this month big oil producers agreed to record about 20 mbpd output cut in the global crude markets.

OPEC members from next month will cut production by a record 6.1 mbpd. And also members of OPE+ made of oil producers and allies including Russia announced plan for the deal and agreed to cut production by 3.6 mbpd. These two groups of oil producers have been collaborating for three years and there is a deal between them to stabilize oil market, both agreed to cut production by 9.7 mbpd.

Other global producers such US, Canada, Brazil and Norway which are known as OPEC++ as part of the historic deal they set to cut production by 5.25 mbpd.

All above mentioned oil producers would bring the overall cut in oil output to 15 mbpd .

And many large oil consumers such China, South Korea, India and Japan are set to buy 3 mbpd of oil for storage.

Saudi Arabia, Kuwait and UAE announced that they will make more cuts in production by 2 mbpd beyond the deal. Worldwide oil producers agreed on a record global production cut of up to 20 million barrels per day.

Despite huge output cuts, oil prices dropped more. A day before announcing this big deal on April 12, Brent oil was traded for $32, but towards end of last week dropped to $27.

We forecast a drop in demand in April of as much as 29 mb/d year-on-year, followed by another significant year-onyear fall of 26 mb/d in May. In June, the gradual recovery likely begins to gain traction, although demand will still be 15 mb/d lower than a year ago

According to the International Energy Agency (IEA) forecasts, demand in April of as much as 29mb/d year-on-year. So still size of demand and supplies is different by 10 mbpd that’s why the global oil market has collapsed.

Amid this crisis it’s important to see that Iraq as the second largest oil producer in OPEC decided to cut production by between 1 mbpd to 1.1 mbpd and KRG committed to its share of an OPEC+deal to reduce oil output.

After October events of 2017, Kurdistan region lost 280k bpd of oil from Kirkuk oilfields, then oil production in KRI in short term reduced for 320k bpd. Therefore KRI had to export most of its produced oil and not sell it to domestic market and stopped its petroleum support. And to fill domestic needs allowed businessmen to start petroleum imports.

Despite that KRG in the past years allocated about 20 to 50k of oil to local refineries, but the refineries managed to survive. Iraqi government as had less capacity to refine oil and was in high demand for petroleum products, agreed to provide crude oil for KRI refineries, and then Iraqi government started to provide petroleum products for the liberated areas from ISIS and is still doing so.

There are two refineries in KRI, Kalak refinery with capacity of 160k barrels and Bazian with 40k barrels so together can refine 200k b/d and provide it for domestic market and even export it to other areas in Iraq.

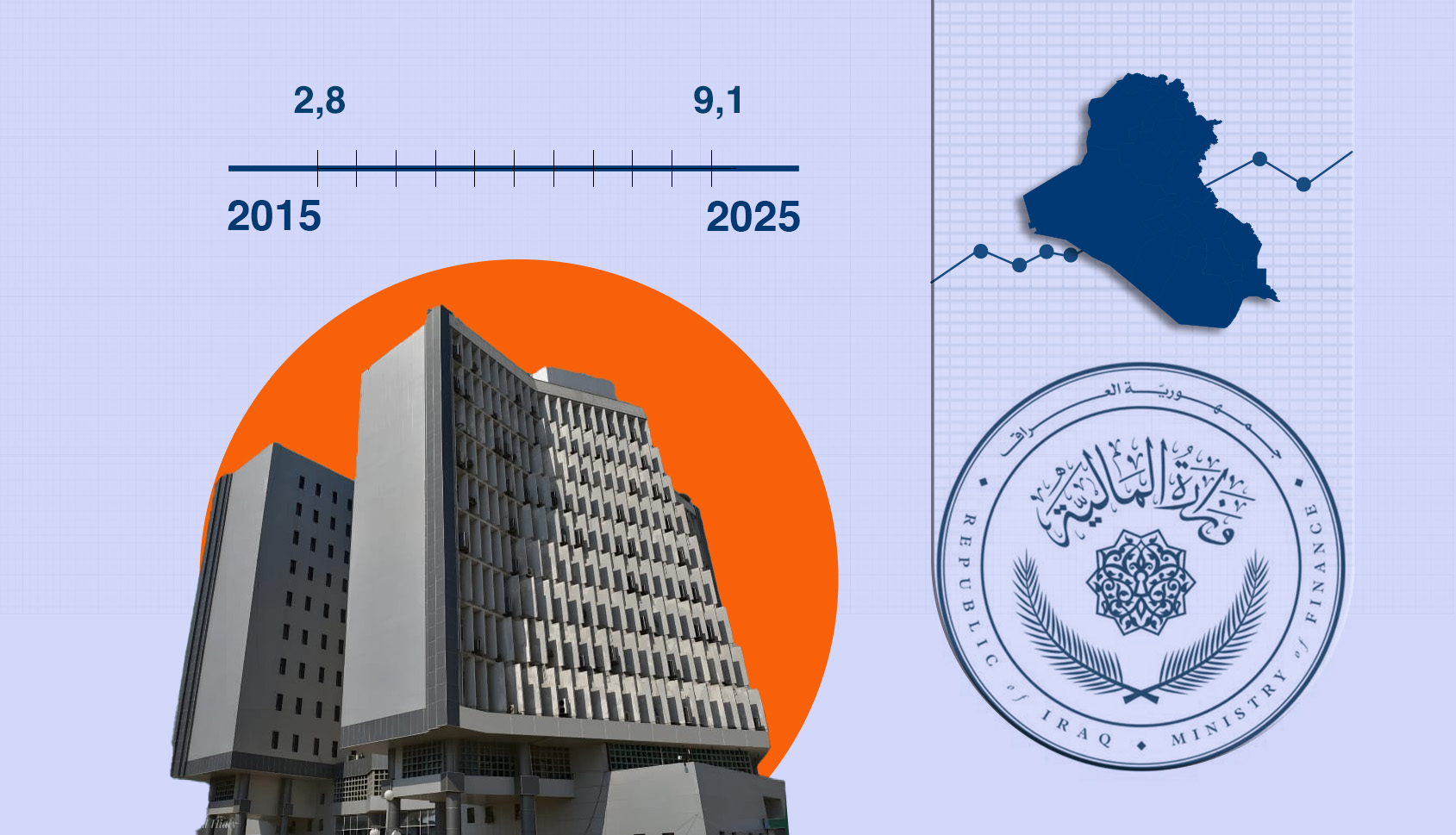

Level of KRI oil production in October 2018 (when OPEC+ made a deal to cut outputs and became a base for the new deal) was 417k bpd and now is 490k bpd. And now KRG’s commitment to OPEC+ deal will cut output by nearly 111k bpd.

One of the KRG’s options amid this deal is that instead of exporting 100-150k bpd via Ceyhan port can provide that for the local refineries. And in this case KRG does not need Baghdad to provide crude oil for its refineries. The current capacity of KRI refineries are 200k b/d but now daily they refine 150k b/d, the products from these refineries can meet domestic needs and send to other governorates such Mosul which is close to Kurdistan region.

In the sake of this policy KRG can also impose tax on the imported petroleum, especially those products can be produced locally in order to increase internal revenues and encourage use of domestically produced petroleum.

If KRG take this step, it will have positive impact and will strengthen downstream sector in KRI. Both KRI and Iraq are depending more on importing petroleum products to meet domestic demands in diesel and gasoline to kerosene and other petroleum products.

Is expected that in the upcoming years Iraq’s demand for petroleum will increase and Kurdistan region despite that can meet its domestic needs also can become good petroleum provider for other parts of Iraq.

And providing crude oil for the local refineries can encourage these refineries to be developed more and work to upgrade quality of their products. For example if they produce high quality of diesel and gasoline, then won’t be need to import such petroleum products.

Some of the oil products of refineries such Naphtha and others, can feed other important industries, such petrochemical industry which KRI and Iraq deprived from, as the primary resources are exist in the country such industry also can be developed which after coronavirus outbreak these industries will be more valuable.

In other side, Kurdistan region lacks of proper gasoline therefore is cannot provide full electricity for its citizens. If KRG after providing oil for the refineries decide to give gasoline for power stations, then those stations can provide electricity for 24 hours. Power stations in KRI are working with natural gas and size of the gas is not enough to provide 24 hours electricity in all seasons. Therefore along with natural gas some of the stations can fill their units with gasoline then producing electricity will increase for twice. KRI has lots of capacity to produce electricity but not enough fuel is available to generate.

Also KRG agreed with the oil production companies that operating in KRI to delay their belated payments (from previous years) for 9 months until oil prices back to around $50, but promised to pay their payments monthly from March 2020, this according to a one of the oil companies statement. This way KRG can ensure that will continue in providing financial support for the oil companies in order that KRI oil production won’t reduce during these difficult times of falling oil prices. Even though fall of oil prices stopped exploration and developments of oilfields in KRI, but is important that these companies continue in oil production at this stage.